Market Watch: Polkadot (DOT) Replaced Ripple on The Top 4, Chainlink (LINK) New All-Time High

Following an unsuccessful attempt to overcome the $40,000 price tag over the past two days, BTC headed south once again to an intraday low of about $34,500. Simultaneously, while most alternative coins were in the red, the two large-caps – Chainlink and Polkadot – have both exploded to new all-time highs.

Bitcoin Dips To $34.5K But Quickly Recovers

The primary cryptocurrency managed to recover the losses following a “Black Monday” style crash that drove it back to the $30K price area in a matter of a day. On Thursday, only three days later, BTC took a swing at $40,000.

There, the bears took charge and drove it south once more. In the following hours, bitcoin started gradually decreasing in value before a sharp dump to an intraday low of below $34,500 (on Bitstamp), while U.S. stock markets’ leading indices were also in the red.

Nevertheless, the cryptocurrency bounced off and currently trades around $37K.

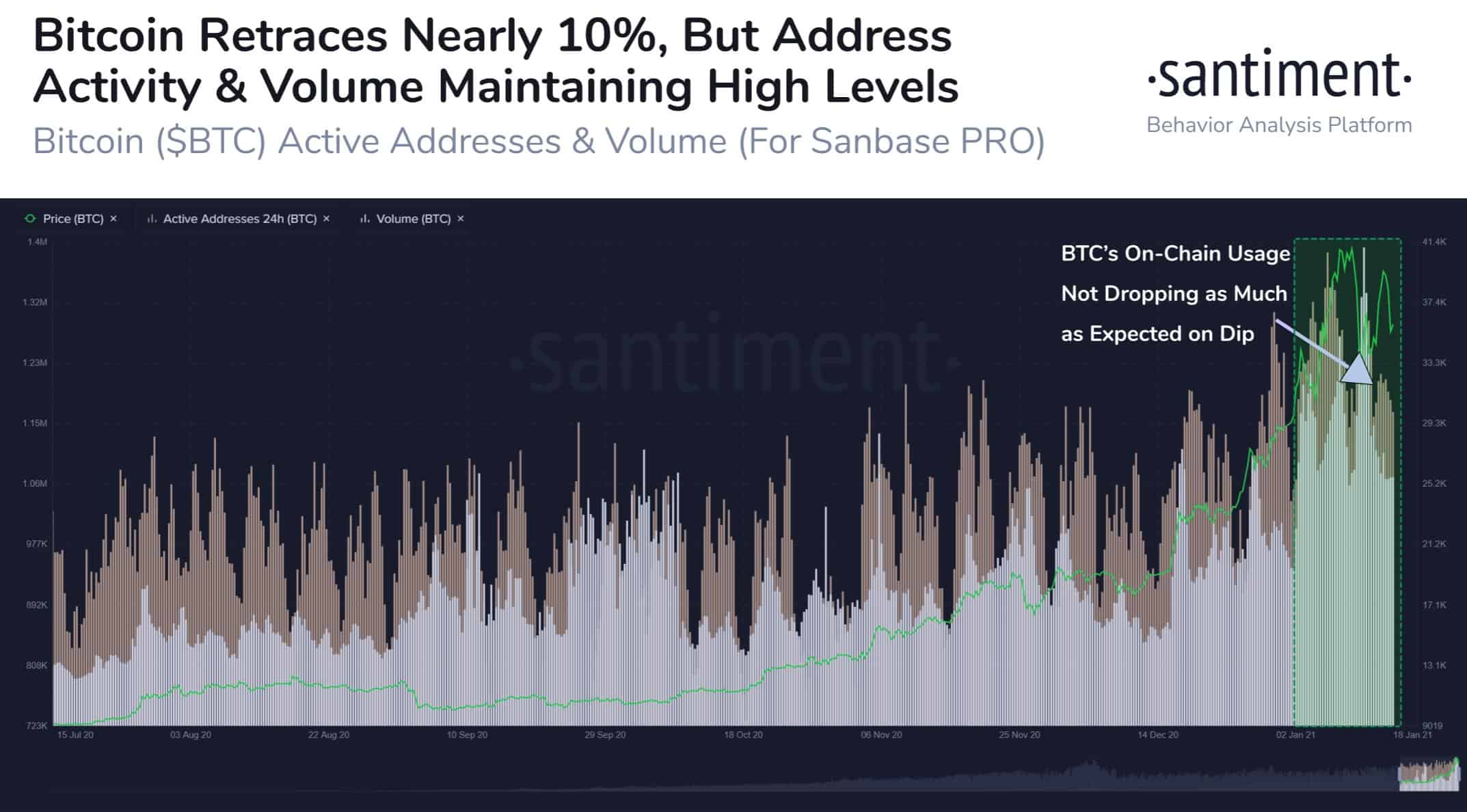

Despite the correction to $34,500, and in light of the recovery, the crypto analytics company Santiment noticed that the daily active addresses and the trading volumes had sustained high levels, thus “creating a bullish divergence.”

DOT Replaced Ripple: Chainlink Breaks ATH

Most alternative coins mimicked BTC’s highly-volatile week, including the retracement in the past 24 hours. Ethereum has dropped by 3%, trading slightly above $1,200, while XRP is down to $0.28 after a 3% decrease.

Bitcoin Cash (-3%), Litecoin (-3%), and Stellar (-2%) are also in the red.

In contrast, Polkadot has doubled-down on its recent impressive performance with another all-time high. DOT neared $15 yesterday but has surpassed that level for its newest record of over $15.7, as of writing these lines.

DOT is now the 4th largest crypto by market cap, surpassing Ripple (XRP). DOT’s market cap is $14.8 billion, according to CoinGecko.

Chainlink had also exploded in value: its native token, LINK, had increased by 50% in just a week. On a 24-hour scale, LINK has gained 20% and reached a new ATH of over $22.5.

More gains are evident from mid and low-caps: IOST (50%), The Graph (30%), Curve Dao Token (28%), Ocean Protocol (27%), Aave (25%), Energy Web Token (24%), Band Protocol (22%), Hedera Hashgraph (17%), Basic Attention Token (14%) and more.

Hence, despite the losses marked by BTC and other large-cap altcoins, the total market cap has remained above the coveted $1 trillion mark.