Market Watch: Fantom and Near Skyrocket 20%, Bitcoin Continues Consolidation

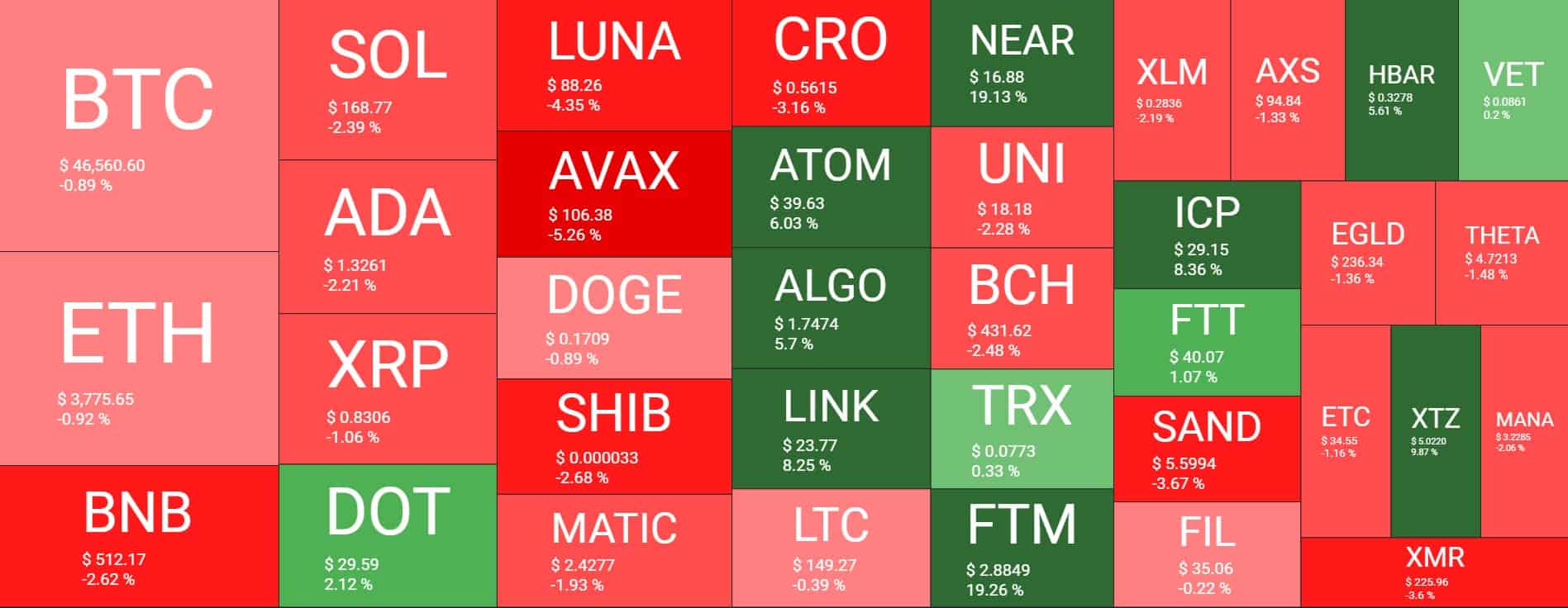

Bitcoin’s adverse price movements continued in the past 24 hours, with the asset dipping below $46,000 briefly. While most larger-cap alts are also slightly in the red, NEAR Protocol and Fantom went on a tear with substantial double-digit pumps.

NEAR and FTM on a Roll

Most larger-cap alts have failed to produce any significant price gains lately. Ethereum is a prime example as it traded above $4,000 roughly a week ago. However, it started to decline in value gradually and now stands below $3,800 after another 1% drop since yesterday.

Binance Coin (-2.5%), Solana (-2.5%), Cardano (-2.2%), Ripple (-1%), Luna (-4.5%), Avalanche (-5.5%), Dogecoin (-1%), Shiba Inu (-2.5%), and MATIC (-2%) are also all in the red.

Polkadot is the only exception from the top ten with a 2% increase.

The situation with the lower- and mid-cap altcoins is somewhat different. Fantom and NEAR Protocol have stolen the show in the past 24 hours with similar 20% price increases. Consequently, NEAR stands at $17, while FTM is close to $3.

More daily increases come from Ravencoin (17%), Velas (14%), Secret (12%), Tezos (11%), Curve DAO Token (11%), and others.

The cryptocurrency market capitalization has remained above $2.2 trillion but is down by $30 billion in a day.

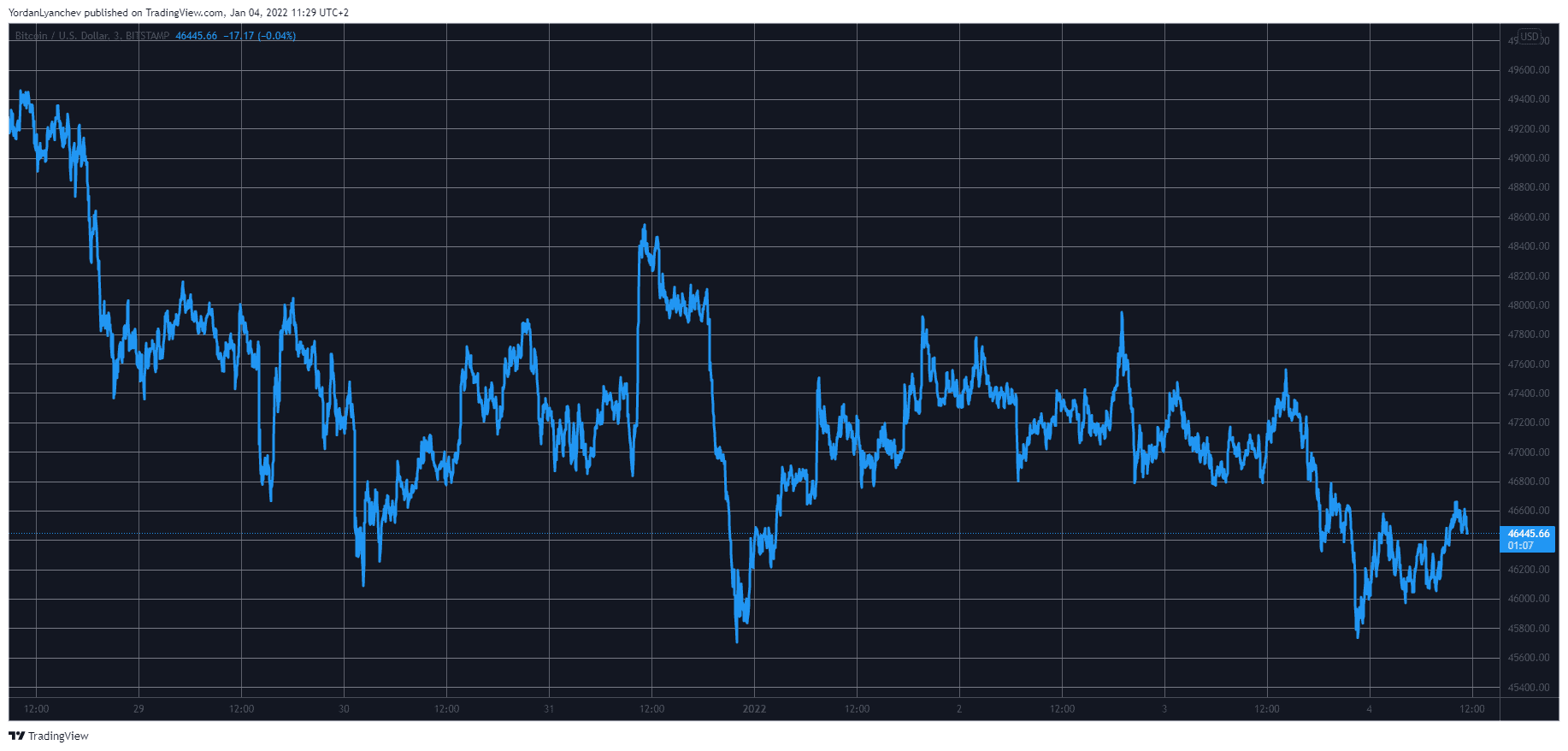

Bitcoin Drops Below $47K

The primary cryptocurrency has had its fair share of adverse price developments in the past several days. It shot up somewhat suddenly on December 31st before it plunged more vigorously by $3,000 in hours to below $46,000.

It started the New Year on a more positive note and neared $48,000 on two separate occasions. However, it failed to breach that line, and the subsequent rejection drove it south to $47,000, where it stood for a while, as reported yesterday.

Since then, though, the bears have been in control as they pushed BTC down again to an intraday low of $45,800. As of now, bitcoin has bounced off and reclaimed $46,000, but it’s still in the red on a daily scale.

As a result, the asset’s market capitalization has remained well beneath $900 billion.