Market Watch: ETH Came Inches Away From New ATH as Bitcoin Dips To $52.5K

Bitcoin’s price continues to suffer as the asset dipped by almost $5,000 in the past 24 hours. Despite recovering some ground, its dominance is agonizingly close to breaking below 50% as some altcoins, including Ethereum and Uniswap, have charted notable gains against the dollar and BTC.

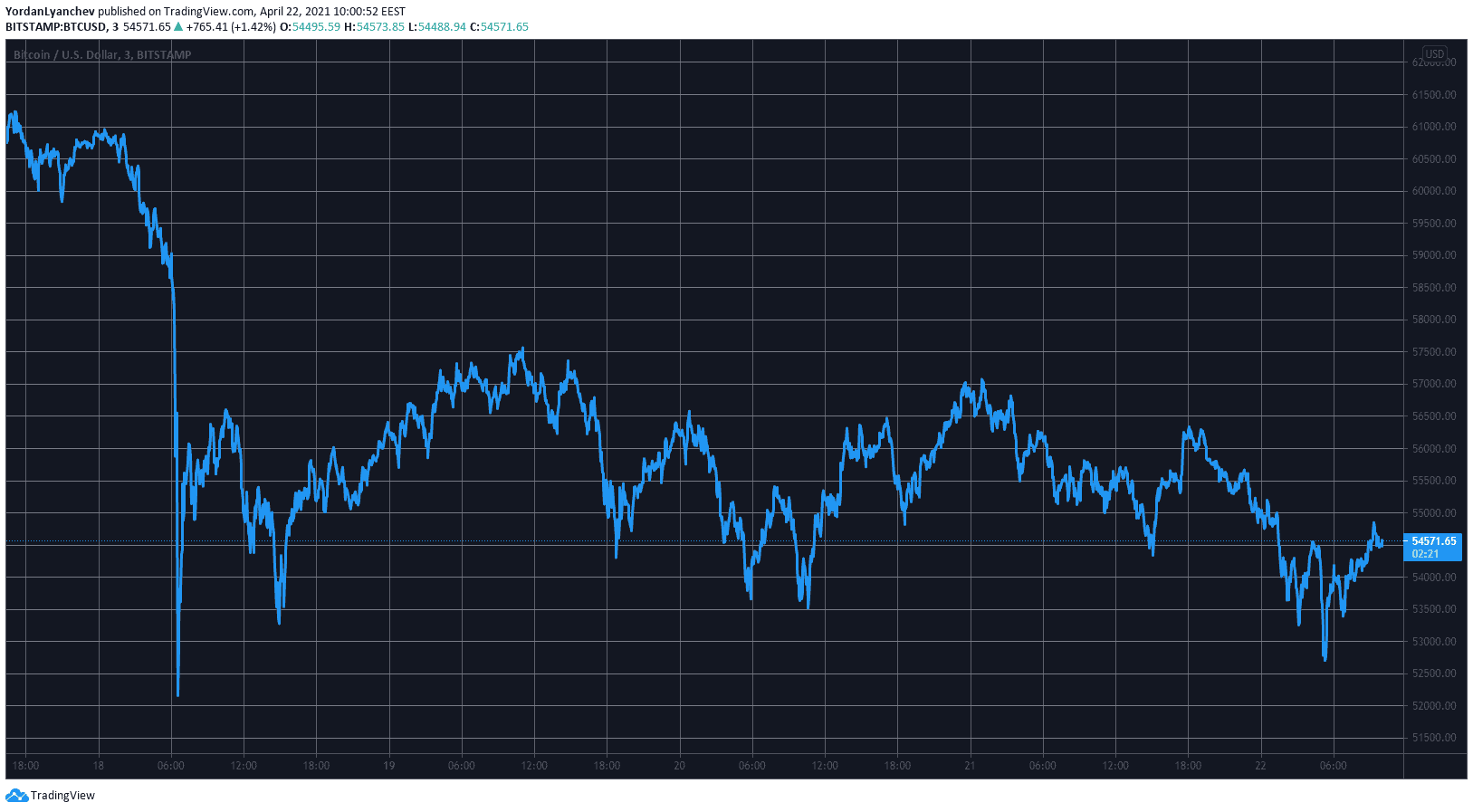

Bitcoin Slumps to $52,500

The primary cryptocurrency is still unable to shake off the losses registered during the weekend when it plummeted to a 3-week low of $51,500. In the next few days, BTC attempted to surge higher but failed at $57,500 on Monday and $57,000 yesterday.

The latest rejection that came less than 24 hours ago pushed bitcoin further south. Since then, the cryptocurrency dumped by about $4,500, leading to a low of $52,500 (on Bitstamp).

So far, bitcoin has bounced off and has regained $2,000 of value, and its market capitalization is back above $1 trillion. However, JPMorgan analysts outlined concerns indicating that the asset risks falling even harder if it fails to overcome $60,000 anytime soon.

The latest adverse price developments have harmed bitcoin’s dominance over the market again. The metric comparing BTC’s market capitalization with all other crypto assets is down to just north of 50% – a new 2-year low.

Alts Retrace but Not ETH

Most alternative coins have followed their leader with steep retracements in the past 24 hours. Binance Coin, which surged above $600 yesterday, has slumped by more than 8% and is down to $560.

Ripple (-7%), Cardano (-3.5%), Chainlink (-2%), Dogecoin (-14%), and Bitcoin Cash (-4%) are also well in the red from the largest-cap altcoins.

In contrast, comes Ethereum’s jump to $2,500 earlier today. Although ETH failed to breach its ATH record and has retraced with about $30, the second-largest cryptocurrency is still more than 6% up on a 24-hour scale.

Uniswap has also pumped hard since yesterday. A 15% surge has driven UNI to north of $36.

Somewhat expectedly, more fluctuations are evident from the lower- and mid-cap altcoins. Celo (-15%), Bitcoin Gold (-12%), Ontology (-11%), Siacoin (-10%), Vechain (-10%), Qtum (-9%), and IOST (-8%) have lost the most.

On the other hand, Maker (32%), DigiByte (27%), Polygon (18%), Solana (17%), Compound (13%), and Aave (10%) have gained the most.