Market Watch: BTC Reclaims $37K As ETH Approaches All-Time High Levels at $1400

Bitcoin has continued to consolidate in the past 24 hours around the $37,000 price mark. In contrast, some alternative coins have charted serious gains, including ETH breaking above $1,350, and have reduced BTC’s dominance over the market to below 66%.

ETH To A New 3-year Record, BCH Reclaims $500

While most alternative coins mimicked BTC’s performance last week, it seems that most have started outperforming the largest cryptocurrency. Ethereum leads the charge with 50% gains against BTC in a relatively short period.

On a 24-hour scale, ETH has added 12% against the dollar to a new 3-year high of $1,385 (on Bitstamp). Thus, the second-largest digital asset came less than $100 away from breaking its ATH of $1,450 painted in January 2018.

Ripple has also increased by a significant percentage. XRP is up by 10% in a day to over $0.30. A 9% increase for Bitcoin Cash has helped BCH overcome the $500 mark and currently trades just shy $530. Litecoin is the most significant gainer from the top ten with a 14% surge to $165.

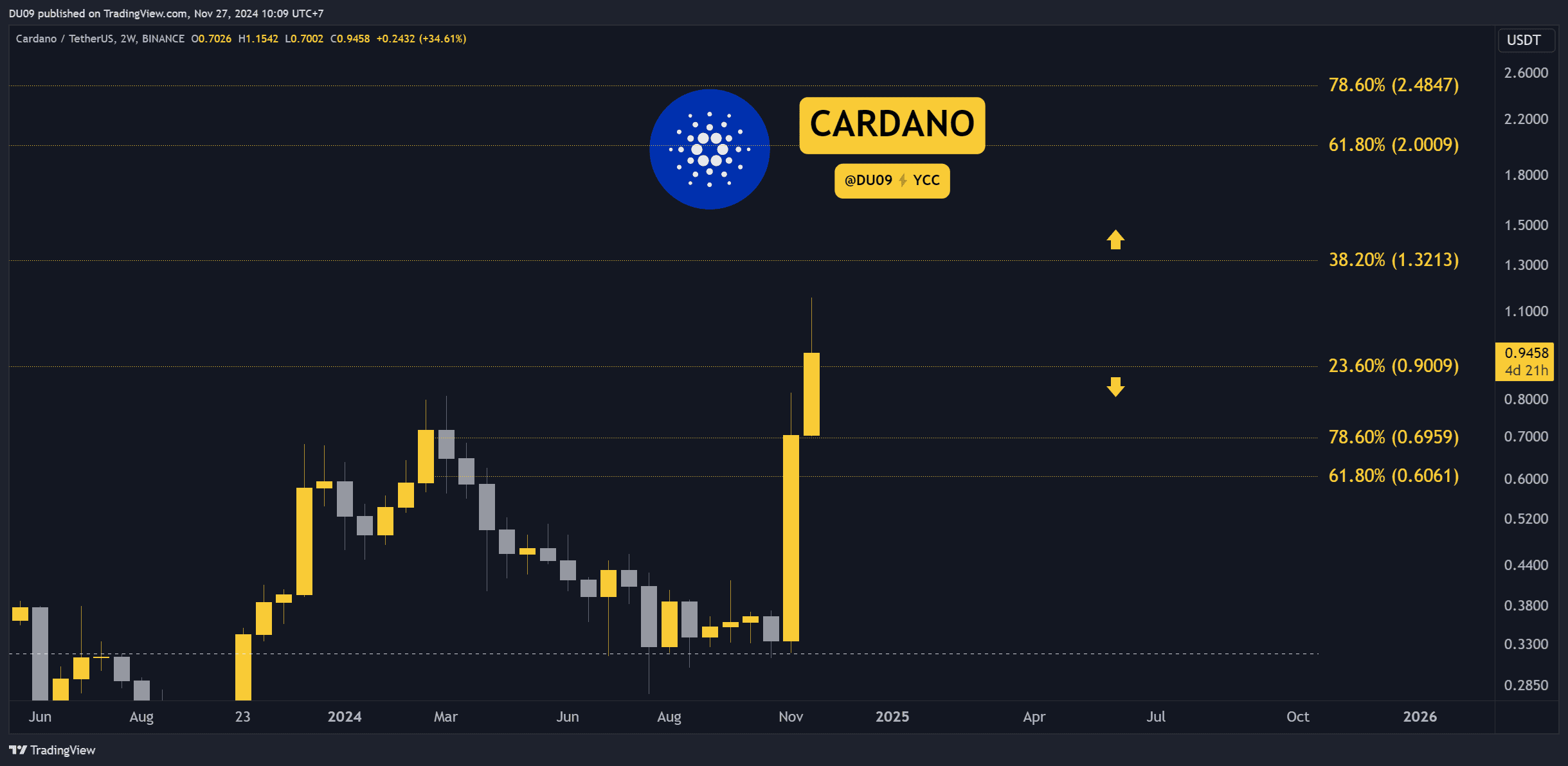

In contrast, Binance Coin (-1%), Chainlink (-3%), Polkadot (-3%), and Cardano (-3%) have lost some value since yesterday.

Enjin Coin is the best performer from the top 100 coins with a 27% surge. Ampleforth (25%), UMA (17%), THORChain (15%), Reserve Rights (13%), Neo (13%), Huobi Token (13%), Siacoin (12%), and VeChain (11%) are also representatives of the double-digit price increase club.

In total, the crypto market cap has remained above the coveted $1 trillion mark.

Bitcoin’s Dominance Drops As BTC Consolidates

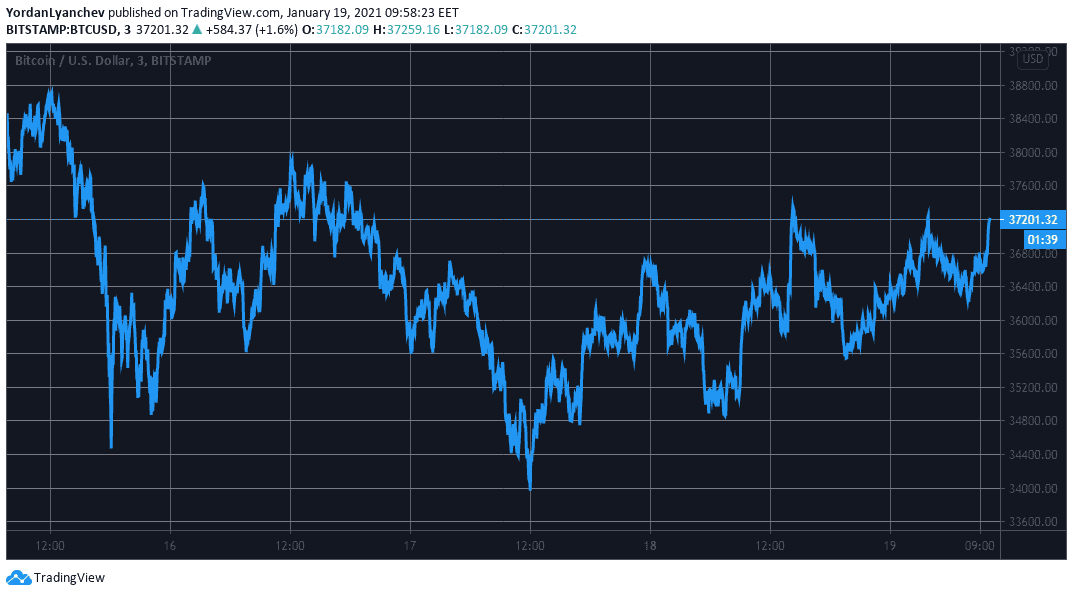

While some alternative coins have charted double-digit gains, BTC seems stuck in a range in the past 24 hours. The asset dipped beneath $34,000 as reported yesterday but bounced off immediately to a high of $37,500.

However, the cryptocurrency has failed to breach above that level and, after some sideways trading, has returned to about $37,000.

The technical indicators suggest that bitcoin has to overcome the resistance levels at $38,000, $39,700, and $40,000 to resume its bull run. Alternatively, $36,000, $34,800, and $34,000 are the first support lines in case of another price breakdown.

As a result of the aforementioned developments with BTC and the altcoins, bitcoin’s dominance over the market has dropped to 65.5%. The metric comparing the market cap of BTC and all other digital assets has declined by nearly 5% in ten days.