Market Watch: Bitcoin Topped at $39K, Crypto Markets Lost $100B Following Fed’s Meeting

Bitcoin’s run-up was halted at around $39,000 after the Federal Reserve announced it will increase the interest rates in March this year. The altcoins, which were also heading north, dropped in response similarly to BTC.

Bitcoin Rejected at $39K

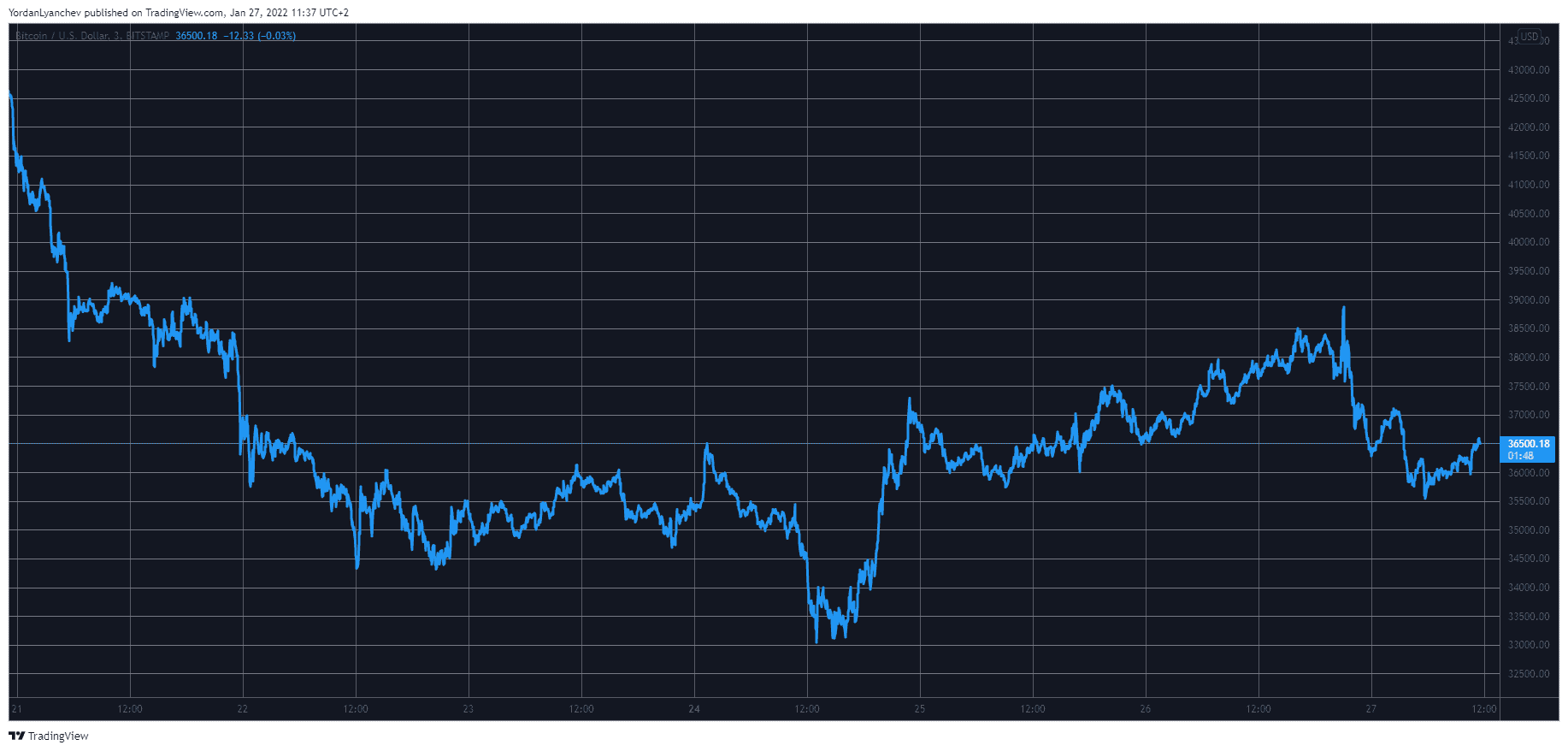

After last week’s massacre, in which the primary cryptocurrency dumped by over $10,000 in days to a six-month low beneath $33,000, the landscape seemed significantly more positive in the past 72 hours.

The asset recovered $4,000 in a day, as reported on Tuesday before another leg up drove it to around $37,000 yesterday. During the trading day, bitcoin kept climbing and tapped a six-day high at roughly $39,000.

As the situation seemed bullish, though, came the most recent meeting of the Federal Reserve. In it, the central bank said there will be no changes to the interest rates now, but they will be increased in March.

This caused enhanced volatility in the crypto and the stock markets, as BTC dumped by over $3,000 in hours. As of now, it has reclaimed $36,000, but it’s still about 3.5% down on the day. As such, its market capitalization is just slightly below $700 billion.

Altcoins in Red as Well

The alternative coins were flying high in the past 72 hours, with Ethereum surging past $2,600 just a few days after being close to dump below $2,000. However, the market-wide retracement has driven the second-largest crypto to just over $2,400.

Binance Coin (-4%), Ripple (-3%), Dogecoin (-2.5%), Shiba Inu (-4%), and MATIC (-2.5%) have declined by similar percentages. More serious losses come from Solana (-7%), Terra (-7%), Polkadot (-6%), and Avalanche (-7.5%).

Aside from Theta and Theta Fuel, which are well in the green, the remaining lower- and mid-cap alts are also in the red. Waves (-15%) leads the pack, followed by Quant (-14%), OKB (-11%), Celsius Network (-11%), Cosmos (-10%), and Kusama (-10%).

Ultimately, the crypto market cap declined by over $100 billion following the Federal Reserve’s statement.