Market Watch: Binance Coin Surging Following BNB Burn and IEO Rumors, Bitcoin Celebrates In Place

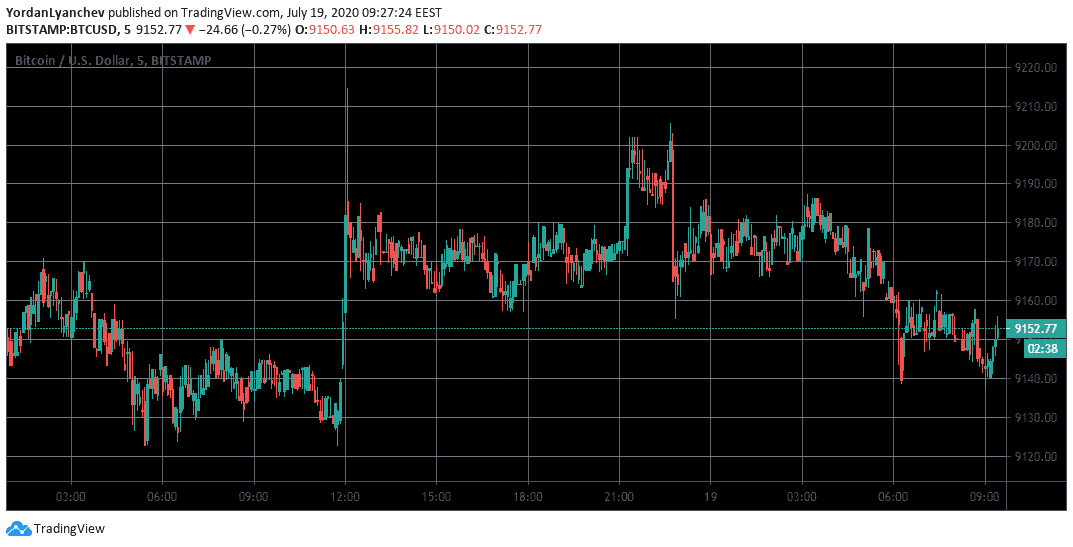

The weekend turns out to be a rather boring one again for Bitcoin’s price as the asset continues hovering at about $9,150.

However, the fluctuations within the altcoin market attract attention, with numerous double-digit gainers, led by Binance’s most recent acquisition – Swipe.

Twitter Hack And Bitcoin

After the blatant Twitter hack earlier this week, the situation around the social media giant continues to unfold daily. The FBI initiated an extensive investigation, and now recent reports indicated that India’s cybersecurity agency Computer Emergency Response Team (CERT-In) had sent an official notice to Twitter to request full details for the hack.

The social network recently revealed that eight people had their personal access data stolen but failed to disclose their names. And while Twitter received a massive image blow, Bitcoin’s involvement in these attacks, namely that the perpetrators initiating a “BTC giveaway scam,” has no impact on the primary cryptocurrency.

The asset price continues trading in its familiar price territory. Apart from one sharp increase from $9,120 to $9,220 yesterday, the rest of the weekend remains quiet on the BTC front, which can add the number 9,200 to its last name.

It appears that the $9,100 support line endures the pressure from the bears so far. If broken, BTC can rely on the psychological level of $9,000. In contrast, should another upward tick come, Bitcoin has to take down the $9,300 line, which has been a major thorn in its side for weeks.

Altcoins Ongoing Party

And perhaps to exemplify the current differences between the performances of Bitcoin and the altcoin market, most alternative coins record massive price fluctuations. Today’s leader of the trend heading upwards is Swipe.

The Visa debit card platform, recently acquired by the leading cryptocurrency exchange Binance, continues its weekend surge by another 32% today to $1,30.

SXP’s market cap growth to $80 million places it inside the top 100 projects by market cap, according to CoinGecko.

The 25% surge from Nimiq is next in line, while Kava, Reserve rights, and Aave (LEND) follow by similar increases of approximately 20%. The LEND token completes a fabulous 100X in just a few months.

After yesterday’s price jump, ABBC Coin retraces today by 11%. Aurora, which has performed quite impressively lately, is also in the red after an 8% decline.

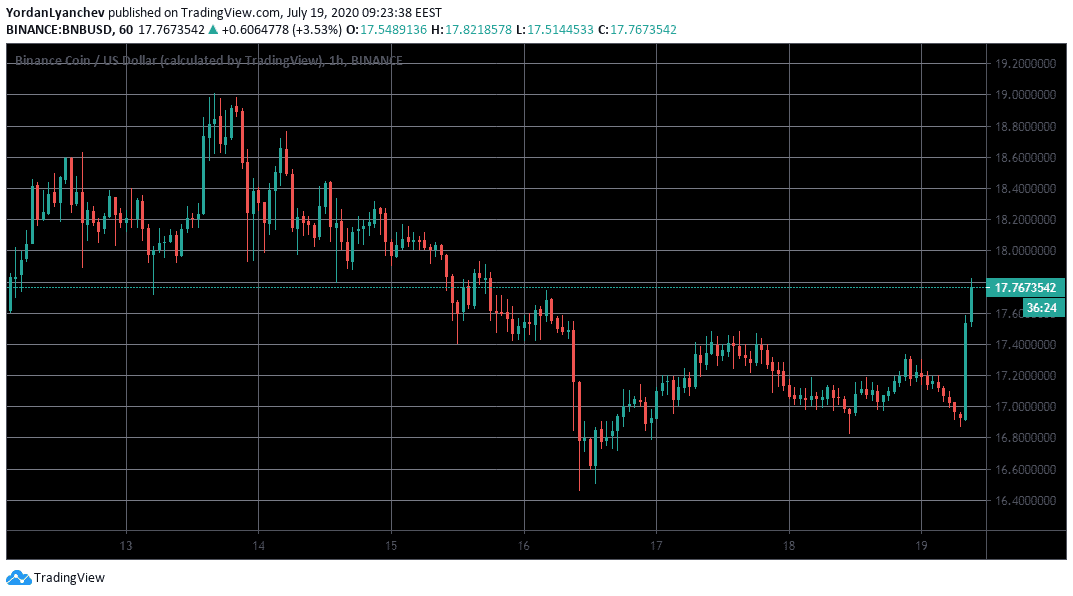

Binance executed the 12th Binance Coin (BNB) burn yesterday, which the company classified as the “biggest ever recorded.” 3,477,388 BNB is now “gone forever.” In terms of USD value, this significant amount exceeds $60 million.

BNB’s price didn’t react immediately to the events yesterday, but it did today. In just two-hourly candles, BNB went from below $17 to $17.8. Another reason for BNB’s price spike could be related to an upcoming Binance IEO, on the platform’s Launchpad.

Most other large-cap altcoins follow Bitcoin’s example with a lack of sharp moves. Litecoin, Ripple, and Chainlink are up by about 1%, while Ethereum and Bitcoin Cash are just slightly in the green with 0.5%. Cardano’s 2.5% increase makes ADA the most impressive gainer in the top 10 after BNB.

The post Market Watch: Binance Coin Surging Following BNB Burn and IEO Rumors, Bitcoin Celebrates In Place appeared first on CryptoPotato.