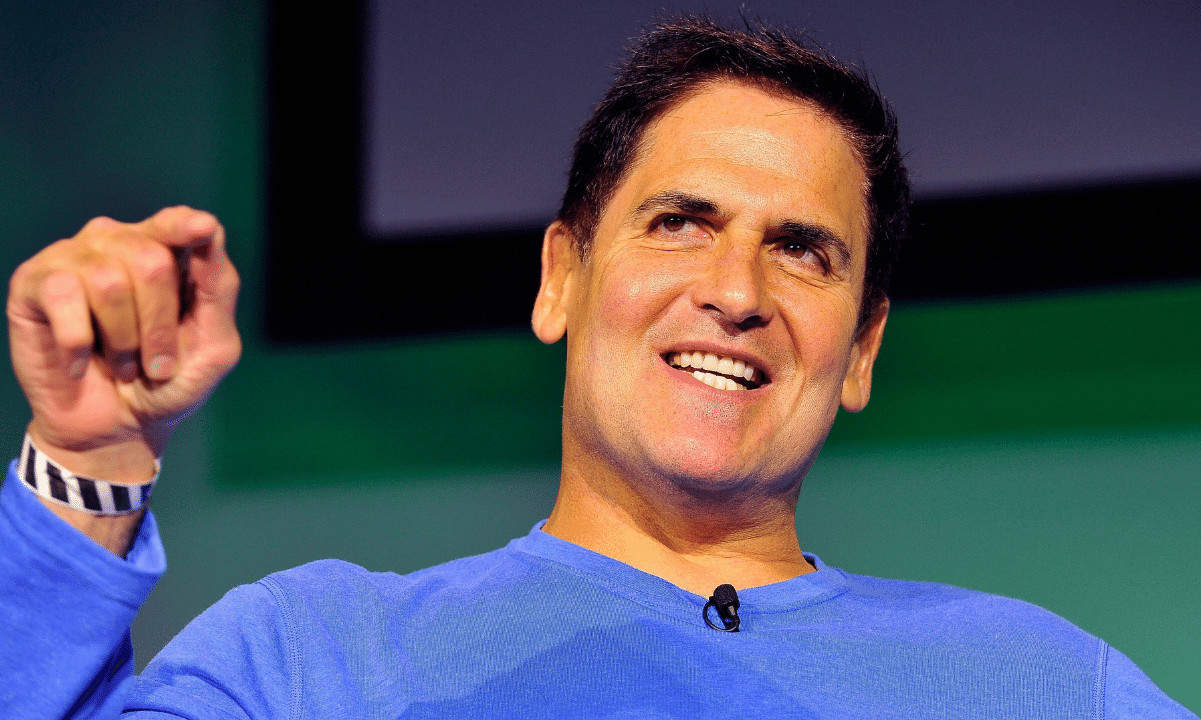

Mark Cuban Explains Which Crypto Businesses Will Dissappear During the Bear Market

Investors are increasingly concerned about the spillover effect in case of a potential collapse of the lending platform, Celsius. Weighing on the struggling ecosystem, the “Shark Tank” star argued that more companies built on hype and lack of valid prospects will disappear.

More Losses Incoming

In an interview with Fortune, Cuban predicted another possible shake-out in not just stocks but also the crypto market. The Dallas Mavericks owner believes many companies would not survive this crash.

“In stocks and crypto, you will see companies that were sustained by cheap, easy money—but didn’t have valid business prospects – will disappear. Like [Warren] Buffett says, ‘When the tide goes out, you get to see who is swimming naked.’”

The cryptocurrency market increasingly moving in sync with tech stocks proved costly for investors. The subsequent Terra implosion further fueled the prevailing fears in the crypto space.

A liquidity crisis at Celsius has investors worried about a broader contagion. Rumors about financial stress about Singapore-based hedge fund Three Arrows Capital, facing possible insolvency, have further dented the sentiment.

Hope?

Despite the extreme pessimism in the industry brought about the two high-flying companies on the brink of a crash in the bear market, the tech billionaire believes that disruptive applications and innovations released during this time will always find a market and succeed.

This year, Bitcoin acted less as an inflation hedge as the correlation between the Nasdaq 100 and the crypto reached near all-time highs. Cuban said tech stocks and crypto continue to face pressure until the current rush of rate hikes is priced in but asserted that “game-changing applications” would flee that stress.

“If rates go up, it will struggle till it’s priced in. The exception, as with stocks, is for new, game-changing applications.”

The crypto industry saw massive job cuts in recent times. Coinbase, Crypto.com, and BlockFi shook things up after announcing lay-offs. On the brighter side, exchanges such as Binance, Kraken, and layer 2 sidechain Polygon are looking to increase their headcount with new hires.