Mara Pool And Bitcoin Mining Censorship

The hosts of “The Van Wirdum Sjorsnado” discussed Mara Pool, bitcoin mining pools that censor blocks and what Bitcoiners could do about this.

Watch This Episode On YouTube

Listen To This Episode:

- Apple

- Spotify

- Libsyn

- Overcast

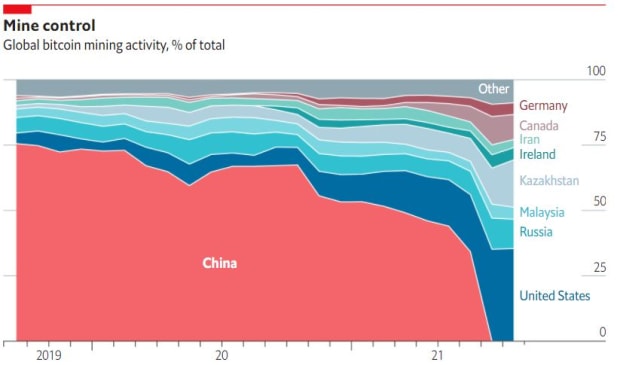

In this episode of “The Van Wirdum Sjorsnado,” hosts Aaron van Wirdum and Sjors Provoost discussed the emergence of Mara Pool, the American Bitcoin mining pool operated by Marathon Digital Holdings, which claims to be fully compliant with U.S. regulations. More generally, van Wirdum and Provoost discussed the prospects of mining censorship, what that would mean for Bitcoin and what can be done about it.

Mara Pool claims to be fully compliant with U.S. regulations, which means it applies anti-money laundering (AML) checks and adheres to the sanction list of the Office of Foreign Asset Control (OFAC). While details have not been made explicit, this presumably means that this pool will not include transactions in its blocks if these transactions send coins to or from Bitcoin addresses that have been included on an OFAC blacklist.

Van Wirdum and Provoost discussed what it means that a mining pool is now censoring certain transactions, and they went on to expand on what it could look like if this practice gets adopted more widely. They considered what censoring mining pools could accomplish if they ever get close to controlling a majority of hash power, and what Bitcoin users could potentially do in such a scenario (if anything).