Making The Decision To Mine Or Purchase Bitcoin

While mining is surely one of the most interesting ways to obtain bitcoin, the actual profit and benefit of doing so must be taken into account.

For mining insight, others such as @Diverter and @Econoalchemist have published detailed reports on their experiences and lessons, helping others through the experience and avoiding pitfalls in the mining space. I would like to add to this compendium and address economic aspects, specifically, the question of mining versus outright purchases of bitcoin.

There are many benefits to mining bitcoin, such as acquiring non-KYC bitcoin, enhanced privacy and contributing to the bitcoin ecosystem. Outside of these benefits lies a more objective benefit: The quantity of bitcoin one can obtain with fiat. By solving how much bitcoin one can acquire, it clears some of the uncertainty of the decision to be made and reveals an interesting side benefit: By focusing on the quantity of bitcoin, one can disregard exchange rates back to fiat.

Thinking in bitcoin terms makes fiat noise fall away and you can focus on the hard-money signal bitcoin provides, identifying the path that provides more bitcoin. I am not suggesting other benefits are to be disregarded, but determining which aspect delivers more bitcoin improves your overall analysis and decision-making. When one considers economic outcomes in bitcoin terms — the purest form of currency on the planet — one divests baggage associated with traditional finance and agenda-pushing rent-seekers. By first understanding how much bitcoin each alternative will provide you, you can decide for yourself if the subjective benefits are worth the difference in the amount of bitcoin.

Miner market prices are driven by buyers with low operational costs. Buyers with low operational costs are able to spend more on a miner for a given return and outbid setups with higher operational costs, resulting in a higher market price. Whether the market price is the “right” price for your own situation depends on how inexpensively you are able to install and run a miner, and what amount of future global hashrate growth you are comfortable with, implied by the miner’s cost.

Putting these concepts into practice, some basic rules of thumb that might help anyone facing the same questions.

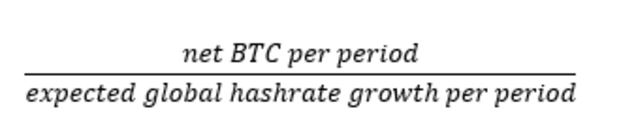

Bitcoin Miner Annuity

A simple formula for calculating a miner’s break-even price versus the actual cost is to measure the net bitcoin received over a short interval divided by the estimated hash rate growth over the same interval. The result is the estimated amount of bitcoin received by mining into the foreseeable future. This formula is comparative to valuing a shrinking bitcoin annuity. If the result of the calculation is equal or greater than the miner’s cost in bitcoin, it indicates mining bitcoin will bring the miner’s owner more bitcoin over time compared to purchasing bitcoin today. Exceptions for this formula exist around timing until halving and rate of global hashrate growth, estimates used, how to incorporate the reduction of bitcoin revenues after the next halving, etc., but that is what spreadsheets and online mining calculators are for, and there are a number of good resources available should you want a more detailed analysis.

Inputs Matter

Of the many inputs for determining miner profitability, pay attention to three inputs that have the most impact on the analysis: Your estimate of the global hashrate growth, upfront cost of your miner and electricity costs. Of course, there are many more variables that impact the net bitcoin generated by a miner; you need to analyze this for your own situation. When it comes to these three aforementioned inputs, pay particular attention to the cost of the miner, and even closer attention to the estimated hash rate growth. A miner’s market price implies a global hash rate growth rate for a given set of costs: Low electricity costs are important, but one can potentially generate more net bitcoin than the cost of the miner with high electricity costs as long as the cost of the miner was sufficiently low. However, it is possible to not recoup the upfront costs when one has underestimated global hash rate growth and overpaid for the miner.

No Discounts

The risk-free rate of bitcoin is zero. This is heresy to some financial wizards, but there it is. Bitcoin’s issuance code could be effectively considered an inflation rate; it can be incorporated into the analysis should one feel it better represents the “time value” of bitcoin when looking at real rates across different currencies, but remember, we are measuring our performance in bitcoin terms where delivery of future bitcoin is governed by the math of bitcoin, letting us simplify our analysis with a discount rate of zero. Outside of the discount rate, one must consider the expected global hash rate increase, or said differently, the rate a miner’s revenues will shrink in each period.

Pulling these concepts together, this is the simplified formula for the miner break-even value:

The impact of the next halving on the annuity may be incorporated by subtracting lost bitcoin revenues:

One could repeatedly add additional reductions for subsequent halvings, but for this simple analysis, it might be overkill. It is important to note that the net BTC per period, post–net halving, will be at the forecasted forward global hash rate, and given recent history of hash rate growth and the time to the next halving, the value in (and beyond) the next halving cycle will have low impact on your analysis as of the time of this writing, but make sure to check for yourself and your own situation.

Coming full circle, bitcoin as a non-sovereign money creates a zero, risk-free rate currency allowing for a simple comparison for the mine-or-purchase decision. In a hypothetical world, the value provided by a bitcoin miner would be the price where the purchaser deciding between mining versus buying would be indifferent to the choice made, but there are many drivers of mining’s value. Mining inputs and the many benefits from mining vary across the globe, and given a relatively free market, a miner’s price will not likely be close to any one individual’s hypothetical value. All is not lost for the prospective miner, as this implies a diverse market where low-cost inputs exist and where value is ascribed to bitcoin’s various aspects, tangibly demonstrating in another way that mining contributes value above and beyond the bitcoin generated.

This is a guest post by DP. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.