Maker DAO Receives 2,500 BTC in 2 Days as Wrapped Bitcoin Lock-In Jumps 1,921%

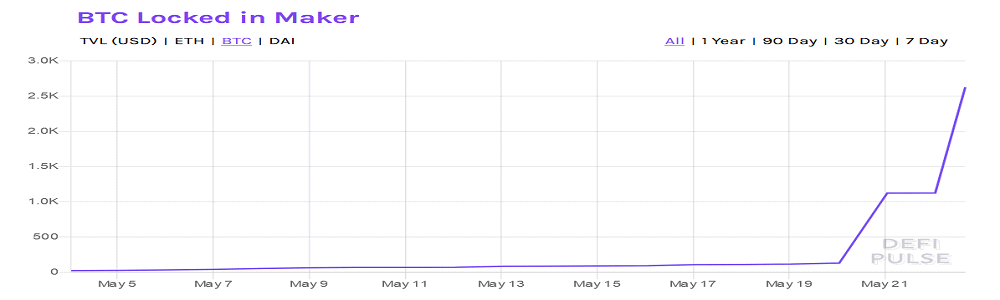

Maker DAO just received an influx of almost 2,500 Bitcoin in the past 48 hours, as the number of Wrapped Bitcoin (WBTC) locked in the decentralized finance app increased by 1,921%.

Maker DAO is a decentralized lending protocol on Ethereum, which issues the stablecoin Dai (DAI) in return for ETH-based collateral. Since BTC can be represented on Ethereum in the form of Wrapped Bitcoin, that means Bitcoin, too, can be used as ETH-based collateral on Maker DAO.

On May 20, just over 130 Bitcoin were locked in Maker DAO in the form of WBTC. Just two days later, on May 22, that number had jumped to 2,628.

The sudden influx coincides with a massive 1,500 BTC order that went into Maker DAO on May 21. The event was noted by DeFi developer Emiliano Bonassi at the time.

OMG mint request 1500 $WBTChttps://t.co/3vOXYhPmbRhttps://t.co/nFclGp3a3m@defipulse @ChazSchmidt @defiprime

Great job @CoinList and @WrappedBTC pic.twitter.com/OxRciib3bB

— Emiliano Bonassi | emiliano.defi-italy.eth (@emilianobonassi) May 21, 2020

The two sudden spikes on the graph above could be suggestive of the notion that only two individuals, or groups, were responsible for the influx. It could be equally likely that just one customer made two separate orders.

More Bitcoin in Maker than Lightning

Either way, the sudden entry of nearly 2,500 WBTC into Maker DAO means there’s now more BTC in the Maker protocol alone than on the entire Lightning Network. Data from BitcoinVisuals shows just over 900 BTC stored on the Lightning Network at the time of writing.

In dollar terms, that means there’s over $24 million Bitcoin being used on Maker DAO, versus just $8.2 million on the Lightning Network.

The Lightning Network was devised as a layer-two scaling solution for Bitcoin. It has drawn criticism from onlookers for its centralization and security concerns.

While the concept of Ethereum being a better home for BTC than Bitcoin is an interesting one, it also has its problems. As was reported by CryptoPotato previously, the average fees on the Ethereum network continue to climb, caused in part by a multi-level marketing scheme operating on the blockchain.

The post Maker DAO Receives 2,500 BTC in 2 Days as Wrapped Bitcoin Lock-In Jumps 1,921% appeared first on CryptoPotato.