Luxembourg Passes Bill to Give Blockchain Securities Legal Status

The European nation of Luxembourg has just passed a bill providing a legal framework for securities issued over blockchains.

According to a notice published Thursday, the country’s Chamber of Deputies, the county’s parliament, passed the bill on Feb. 14 with 58 members supporting the legislation and only two voting against.

Titled Bill 7363, the legislation is intended to provide financial market participants with legal certainty for issuing securities using blockchain technology.

“The bill should provide greater certainty for investors and make the transfer of securities more efficient by reducing the number of intermediaries,” the chamber said.

Luxembourg, an EU member nation, passed a bill making it possible to legally issue “dematerialized securities” in April 2013 via an amendment of a securities law passed in 2001.

Taking into account technological developments in recent years, the chamber said the new bill further amends the 2001 law to also include the registration and distribution of securities using secure electronic registration, “such as distributed ledger technology and in particular blockchain technology.”

Specifically, the amendment adds Article 18a to the law, which states:

“Account-keeper may hold securities accounts and make registrations of securities in securities accounts within or through secure electronic registration devices, including distributed electronic registers or databases. Successive transfers recorded in such a secure electronic registration device are considered like transfers between securities accounts. Holding of securities accounts within such a device secure electronic registration or registration of securities in securities accounts through such a secure electronic recording device do not affect the fungible nature of the securities concerned.”

A document proposing the bill prior to its passing indicates that blockchain securities have the same status as traditional securities under the bill. It say that, for securities issued over blockchain, “the easiest way today is to use the token concept… This is from the technological point of view a new type of dematerialized security, but to which are attached from a legal point of view the same rights as classic dematerialized securities.”

Editor’s note: Some statements were informally translated from French.

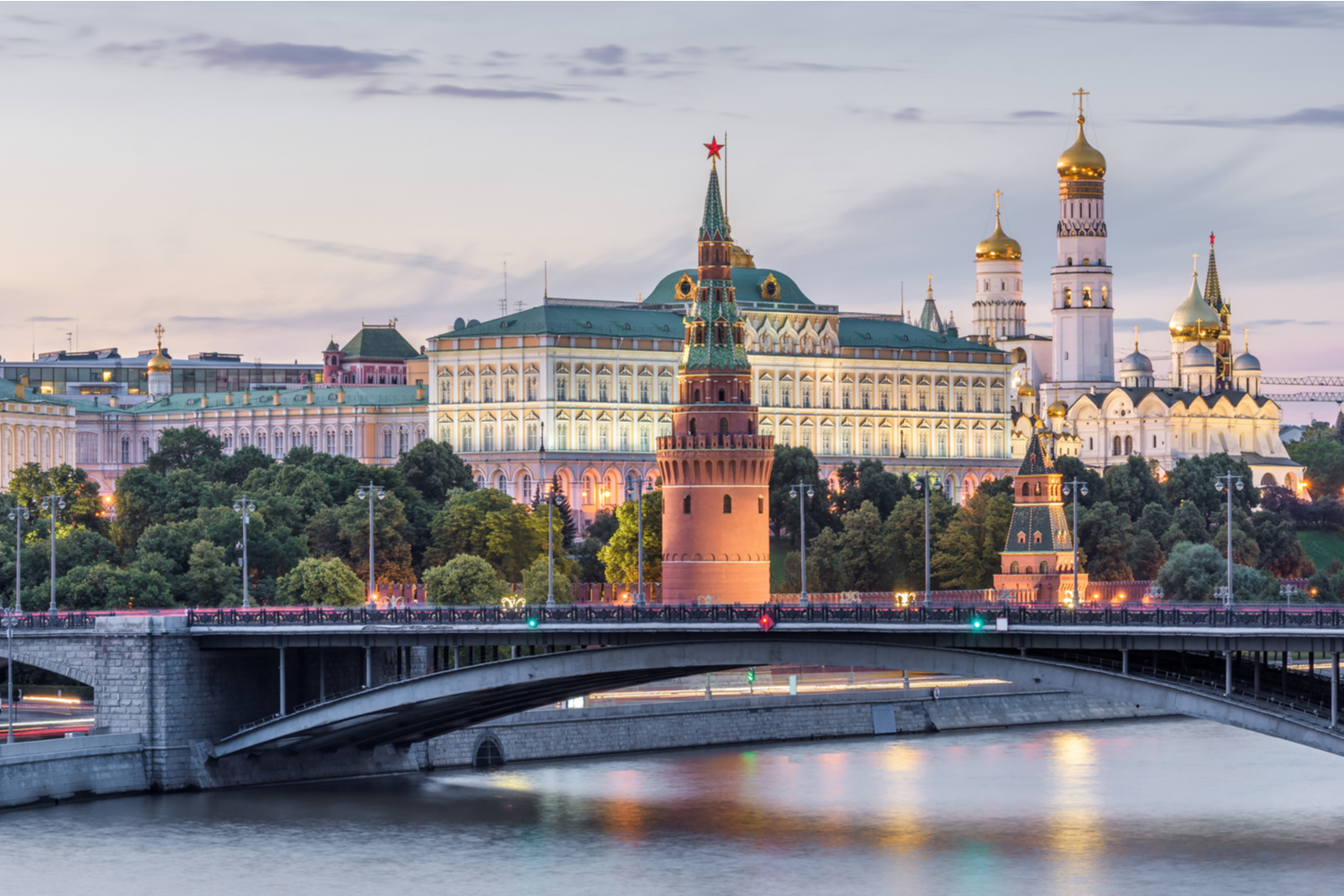

Luxembourg Chamber of Deputies image via Shutterstock