Luna’s BTC Reserves Gone as Exchanges Halt UST Withdrawals Amid Turbulent 24 Hours

The latest move by the cryptocurrency exchange comes after LFG decided to lend $1.5 billion in BTC and UST to defend the latter’s peg.

Binance has announced temporarily suspending LUNA and UST tokens on Tuesday, citing a high volume of pending withdrawal transactions as a result of “network slowness and congestion.”

- The cryptocurrency exchange also said that it would resume withdrawals for the two tokens once it deems the network to be stable and the volume of pending withdrawals has reduced.

- In a statement, Terra’s official Twitter account asked users to be mindful while using public infrastructure usage. It said,

“If you are using the public infra, please do not spam it at this time as we are experiencing naturally high levels of transaction volume. Please be mindful of our public infra usage. More updates on today’s events and future plans to follow.”

- Other prominent platforms such as Kraken and CoinList have also halted withdrawals. FTX, on the other hand, is still processing UST withdrawals.

- As reported earlier by CryptoPotato, TerraUSD (UST) lost its peg with the dollar over the weekend. The third-largest stablecoin by total issuance fell as low as $0.68 before recovering to $0.91, according to data from CoinMarketCap.

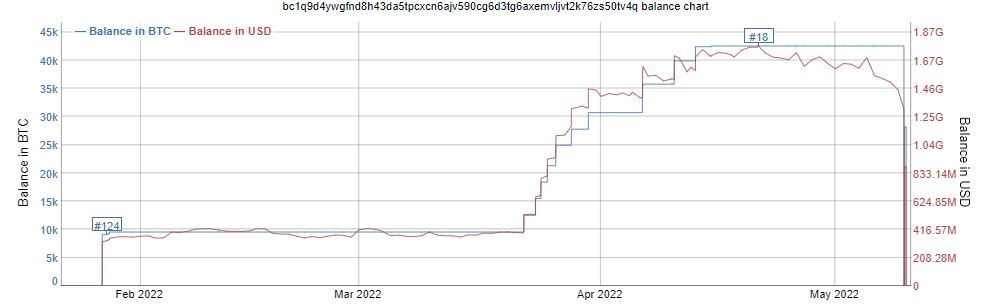

- In a bid to defend its peg, the Luna Foundation Guard said that it will loan $1.5 billion in Bitcoin and UST to third-party platforms that plan to provide support for the algorithmic stablecoin’s peg.

- The address that previously contained over 70,000 BTC is currently completely depleted.

- Many critics believe that the move may have exacerbated a sell-off in the Bitcoin market that drove it to the lowest price since July 2021.

- Along with UST, LUNA lost a whopping 50% of its value in the past day alone and crashed to lows not seen since last October amidst macro volatile conditions in the wider cryptocurrency market.

- Several experts in the crypto sector were not happy about TFL Founder Do Kwon’s move to entwine the project with Bitcoin, which happens to be the very core of the digital asset market.

- The argument behind it is the fact that algorithmic stablecoins, unlike traditional stablecoins, the price stability orginates from the use of specialized algorithms and active treasury management. that manage the supply of tokens in circulation.