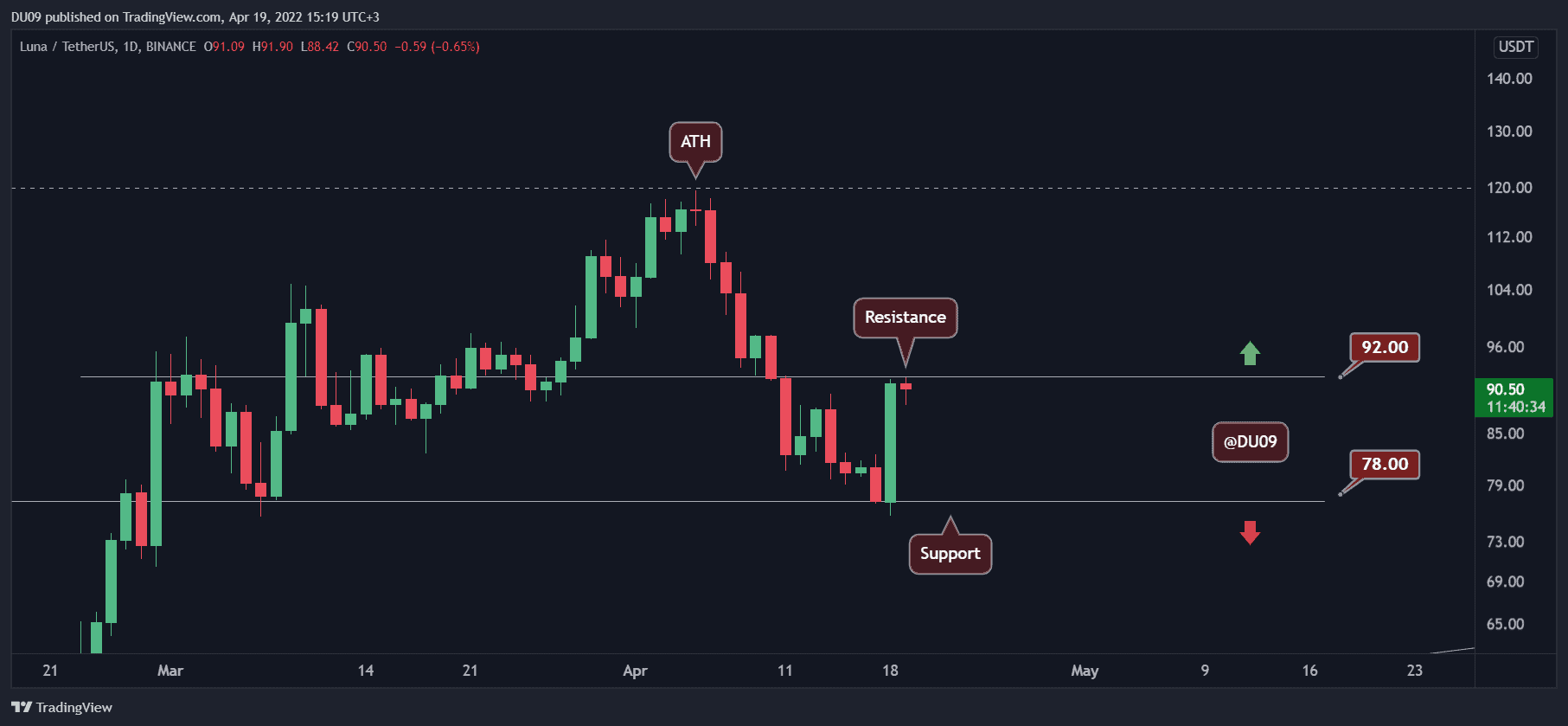

LUNA Price Analysis: After the 15% Spike, Was Local Bottom Found?

Terra’s native token price, LUNA, increased by 15% yesterday, shortly before BTC reclaimed the $40K mark.

Key Support level: $78

Key Resistance level: $92, $120 (ATH)

Luna’s downtrend since hitting a new all-time high at $120 came to a quick stop yesterday when the price rallied 15% in one day.

The biggest challenge now for Luna is to break the critical resistance at $92. If successful, this can put LUNA in a position to target a 3-digit price and maybe the ATH level.

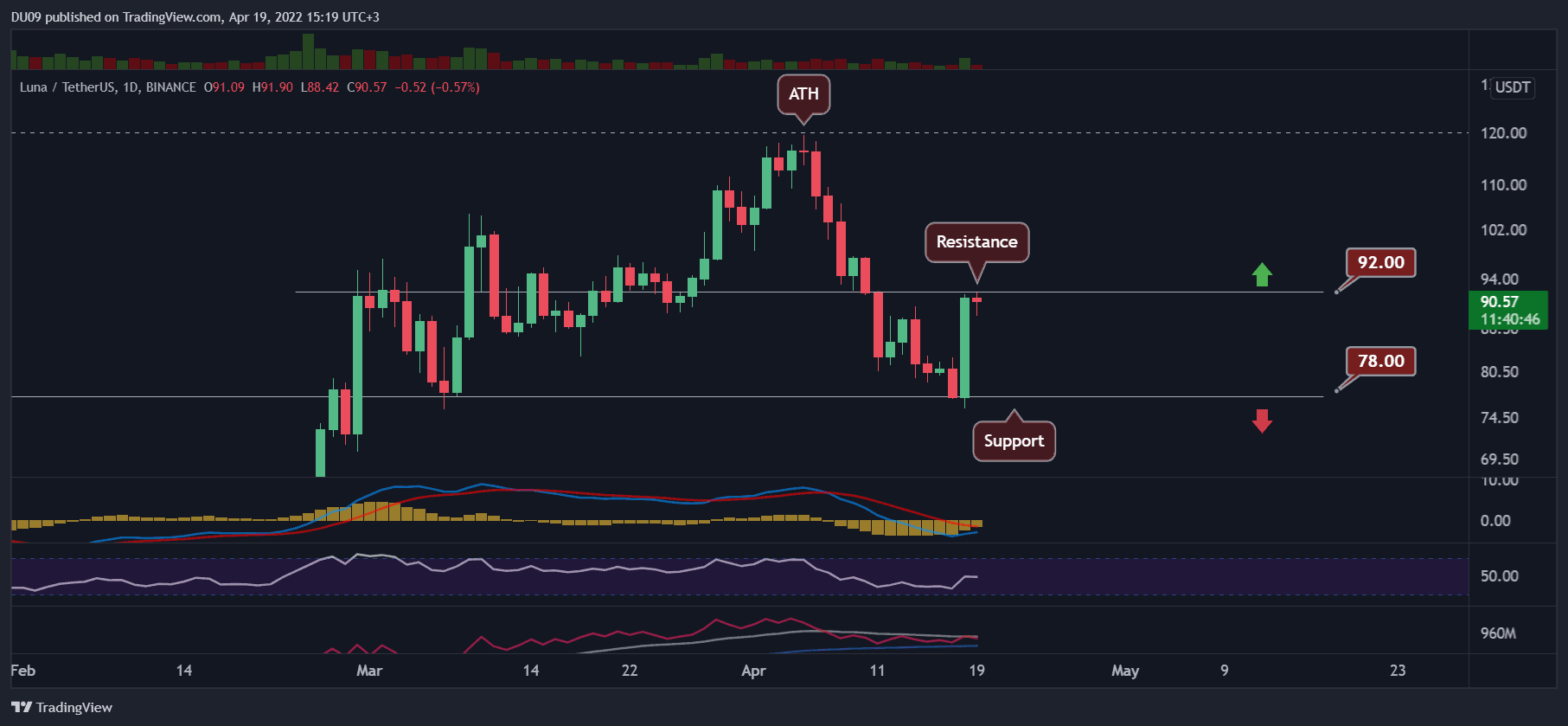

Technical Indicators

Trading Volume: The volume exploded yesterday following the price rally, but it seems LUNA failed to continue this momentum today.

RSI: The RSI spiked to 50 points on the daily timeframe and made a higher high. This is a positive sign and a renewed uptrend could be had if buyers break the key resistance.

MACD: The daily MACD is bearish, but the moving averages are curving up. Buyers need to show more strength to turn the momentum bullish.

Bias

The current bias on Luna is neutral. Buyers managed to stop the ongoing correction, but it’s too early to declare a price reversal.

Short-Term Prediction for Luna Price

LUNA has a great opportunity to hit a three-digit price again if buyers continue to push higher. The key resistance at $92 must be broken, otherwise, sellers may take over the price action and lead LUNA into a deeper correction.