Lossless Lottery PoolTogether Opens Up to More Coins, More Prizes

Lossless Lottery PoolTogether Opens Up to More Coins, More Prizes

More games with no losers are coming to Ethereum (kind of).

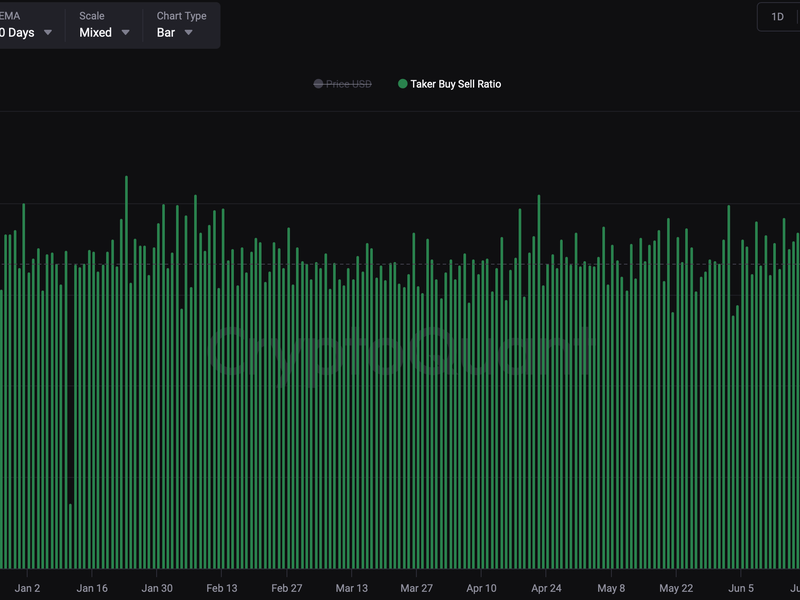

PoolTogether, the lossless lottery on Ethereum that’s meant to gamify savings, is releasing its v3 today at 16:00 UTC. The site, first launched in June 2019, makes it so one player wins all the yield earned on many people’s deposits in a pool, but everyone keeps their initial deposits. That’s why it is called “lossless.” So far there have only been two pools, though, one using MakerDAO’s dai stablecoin, and the other using CENTRE’s USDC.

That’s all set to change with v3, which will enable lots more ERC-20 tokens, more yield sources and more prize distribution schemes.

“The thing they all have in common is they are no-loss, you can withdraw your money any time and they have prizes. That’s the commonality, but they have all sorts of variations,” PoolTogether founder Leighton Cusack told CoinDesk in a phone call.

Perhaps v3’s most important feature, however, is that it will enable outsiders to create new pools with their own rules.

New funding

In order to complete its third version, PoolTogether raised a little over $1 million in a seed extension round led by ParaFi Capital, with additional participation from Robot Ventures, OpenLaw’s The LAO, the MetaCartel DAO and a few angels, including Synthetix’s Kain Warwick and Aave’s Stani Kulechov.

Ben Forman of ParaFi Capital told CoinDesk in an email:

“No-loss lotteries are an underexplored and compelling alternative to high yield savings accounts. It’s a prime example of a use case that functions more elegantly on a blockchain vs. traditional financial infrastructure.”

In that way, PoolTogether makes for a good entry point into decentralized finance (DeFi) and crypto.

“Everyone is familiar with the concept of a lottery,” Dan Elitzer, an investor at a new venture firm called Nascent and one of the instigators of Yam Finance, told CoinDesk via direct message. He described PoolTogether as “a product that gives a thrill like playing a lottery, while encouraging savings and making sure users don’t lose money.”

New version

As of Thursday, there will only be one pool on the PoolTogether website, a dai pool. Once the prize for the dai pool has enough deposits for supporting a $10,000 prize (Cusack estimates this at about $8 million), there will be a community vote on what pools to add first.

But that’s only what’s on the PoolTogether website. Also launched today is PoolToether Build, a way that anyone can construct additional pools with their own unique prize strategies.

Also with v3, the pools move toward decentralization. New pools will no longer be controllable by the PoolTogether team. No one who creates a pool will be able to touch users’ deposits in those pools. This is all part of the process for PoolTogether to get to full decentralization.

Coming out of DeFi Summer, Cusack saw outsize returns going to lots of other projects and it was hard to drive as much excitement toward PoolTogether’s model. On the other hand, because the team has been conservative and careful the project also hasn’t had any adverse events, such as users losing funds.

“There’s some jealousy when you see a protocol launch and see $100 million in it in two days,” Cusack said. “At the end of the day, I think a lot of that buzz is dying off.”

So now that the degen spirit has died down, Cusack believes the reputation PoolTogether has built since launch will pay off.

“Products that are going to stick around are going to prioritize security and safety and more sustainable methods,” Cusack said.

Pool builders

PoolTogether the company will retain control over the PoolTogether website for now and it’s not going to post any other prize pools until the one it has reaches that $10,000 payout.

But others will be able to build new pools right away; they will just also need to create front-ends for them at another URL.

PoolTogether Build is more like the developer tools of PoolTogether. Build will support making prize pools for any ERC-20 token that can be deposited on DeFi platforms Compound or Yearn.Finance (for now, more sources of yield to come).

Build will also support other prize strategies. So, for example, the pool could say, for example, that half of its yield goes to depositors and half to some charity. Or it could award its pool to 10 winners, rather than only one.

PoolTogether also will have new features such as referral rewards and HODLer rewards. So depositors can earn extra tickets if they recruit others into a pool or they can get extra tickets if they leave their funds in a pool over multiple cycles.

Lastly, PoolTogether is now designed to deal with liquidity mining (when deposits in a smart contract earn some kind of new token, on top of their normal yield), which is not something the team anticipated going into v2.

At its core, every PoolTogether prize pool will be two smart contracts. The first contract holds the deposits and that pool can never be changed once created, so that only depositors can withdraw the liquidity. The second smart contract collects the yield in order to distribute the prize. That smart contract can be changed by its creator, but the only thing that could ever be at risk then is the prize, not the deposits.

To deal with liquidity mining, any token sent to the wallet of the deposit smart contract will just be bounced to the corresponding prize smart contract, which should solve for any surprising new tokens that come along in the future.

PoolTogether has accumulated quite a bit of COMP over DeFi Summer. It plans to trade it all for dai that it can use to bolster returns in this first pool.

Business model

When PoolTogether first launched, it initially planned to shave off a tiny bit of the yield earned on its pools to keep the lights on.

But the team has since joined other early DeFi pioneers in turning all of its returns over to liquidity providers. For PoolTogether, that has meant continuing to shave off a little bit of the yield and putting it into what it calls the “reserve.”

As we previously reported, Coinbase Ventures had supplied PoolTogether with funds for the reserve that bolstered returns on its USDC prize pool.

PoolTogether is looking down the road toward full decentralization, one where all its users will have a say in how the protocol works, what pools are created and what prize strategies are deployed.

This will probably mean a token at some point, but Cusack is not settled on what strategy to follow there.

“We want to fully decentralize the protocol and we want to figure out the best way to do that,” he said.

He gave Compound and the automated market maker Uniswap as examples, and said:

“From my perspective, what’s worked well is when protocols that have a really high degree of traction already launch a token.”