Looking at Some Unanswered Signature and Silvergate Bank Questions

I think it’s safe to assume people want certainty. Companies want to know they’ll be able to tap banking services. For that to happen, banks need to be comfortable serving crypto companies. And for that to happen, they probably need to know what factors led to Signature becoming a failed bank – was it, as so much of the industry keeps saying, the mere fact it served crypto clients? Or was it because the bank itself had some deeper issues?

Related Posts

Newly Issued Gaming Token Exploited on Blast With $4.6M Drained

A total of $4.6 million was lost, according to CertiK.The exploit was related to the smart contract's mint function.The token lost more than 99% of its value.00:59Running With Crypto: 5 Questions With TRM Labs' Ari Redbord09:43Hacks Involving North Korea Are 'Even Greater Problem': Legal Experts02:01Breaking Down the State of Hacking in 202400:59Crypto Hack Volumes Fell

Bitcoin’s Short Term Momentum Flips Bearish; Support Under $65K

Technical indicators suggest that bitcoin’s short-term momentum has flipped bearish.The 50-day simple moving average marks major support at $64,870.Technical indicators that gauge bitcoin's (BTC) price movement over the short term have flipped bearish, with crucial support positioned under $65,000.The cryptocurrency’s 10-day momentum, which compares the going market price with the price from 10 days ago

For Contact Tracing to Work, Americans Will Have to Trust Google and Apple

Apr 14, 2020 at 20:22 UTCUpdated Apr 14, 2020 at 20:36 UTCFor Contact Tracing to Work, Americans Will Have to Trust Google and AppleLast weekend, Google and Apple announced a partnership to enable Bluetooth contact tracing to fight coronavirus. Contact tracing is the process of identifying carriers of coronavirus, and whom they’ve come into contact…

FTC Issues Warning on Bitcoin Blackmail Scams

The U.S. Federal Trade Commission (FTC) is warning consumers warns about a new type of bitcoin scam aimed at blackmailing men.

BA-Backed Firm Raises $5 Million to Put Airline Security on a Blockchain

news Blockchain firm Zamna has raised $5 million in a seed funding round led by VC firms LocalGlobe and Oxford Capital for the continued development of its airport security system. Formerly known as VChain Technology, Zamna’s round was joined by International Airlines Group (IAG), the parent firm of British Airways. IAG is an existing investor…

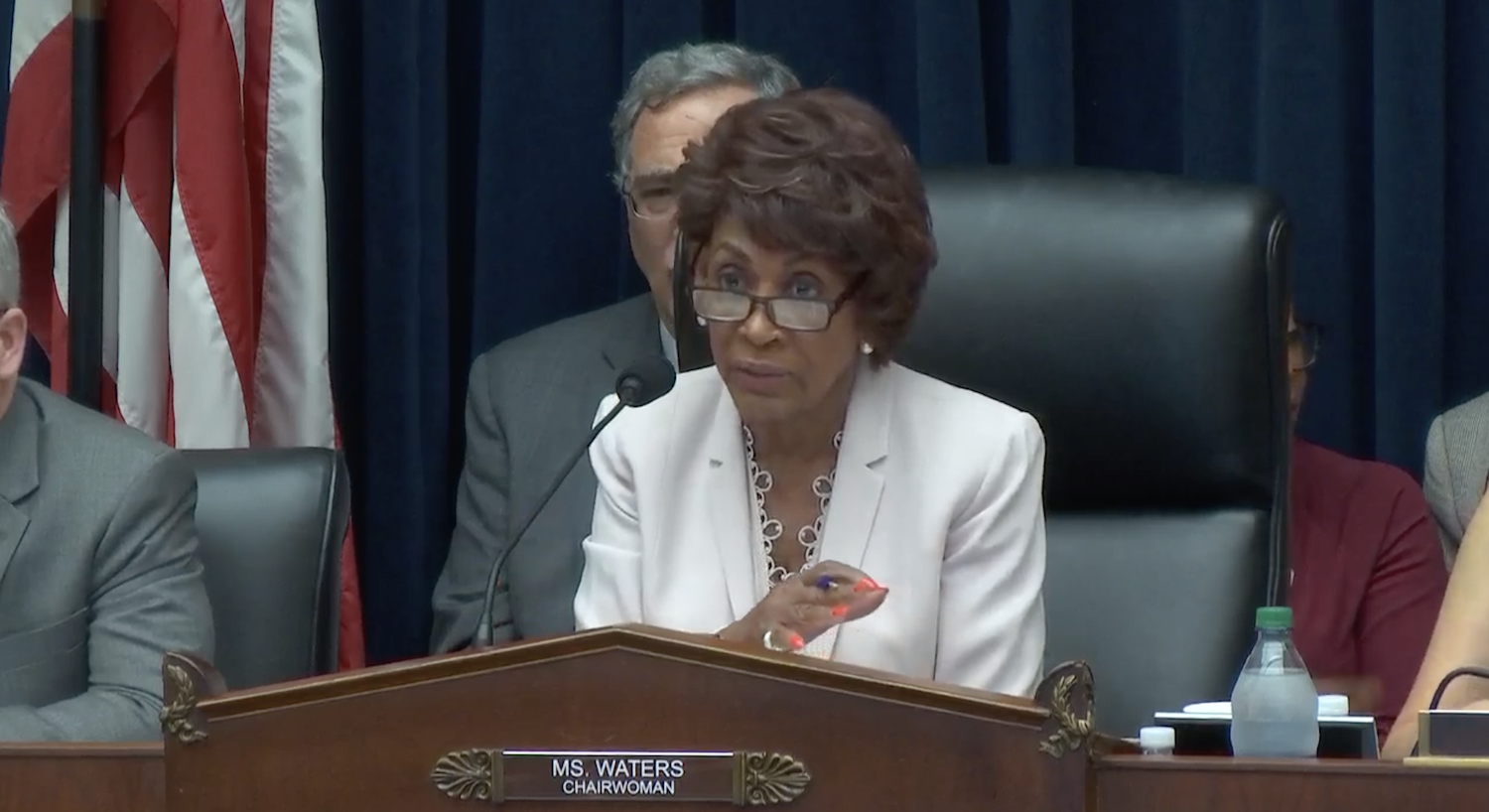

Lawmakers Amp Up Pressure on Facebook to Halt Libra Cryptocurrency Development

news U.S. lawmakers repeatedly pressed Facebook’s top blockchain executive to halt development of the Libra cryptocurrency during a contentious hearing on the project Wednesday. They didn’t get far. David Marcus, the CEO of Facebook’s subsidiary Calibra, reiterated his promise that Libra would not launch until regulators’ concerns were fully addressed. But he stopped short of…

ECB to Start Wholesale CBDC Settlement Trials in 2024

The European Central Bank will start exploratory work for financial market settlement based on distributed ledger technology (DLT) starting in 2024, according to minutes published Thursday.The central bank is looking at how it can innovate in settling transactions between financial institutions for securities or foreign exchange, while also developing plans for a retail central bank…

Democrats Pushing Harris Campaign for ‘Reset’ on Crypto Stance, House Rep Says

U.S. Vice President Kamala Harris “understands” crypto and may embrace it as an issue in her nascent campaign for the White House, Rep. Wiley Nickel (D-NC) said at the Bitcoin Nashville conference on Saturday. "We had a total reset of the presidential election," Nickel said, adding "we’ve been working hard to get a reset from