Long-Term HODLer Supply Hits All-Time High

Today, long-term bitcoin holders control 12,711,385 BTC and have accumulated 460,078 BTC on a net basis over the last 30 days.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

The long-term bitcoin holder supply has hit a new all-time high as the relentless spot market accumulation continues.

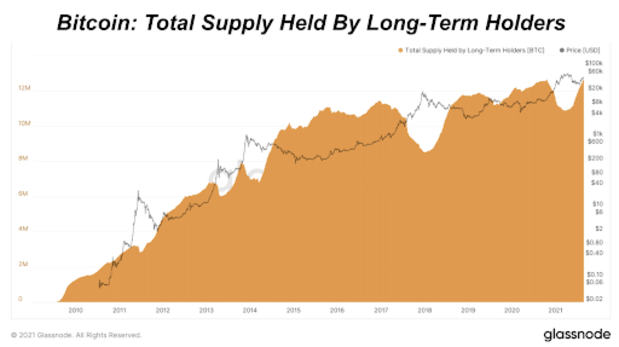

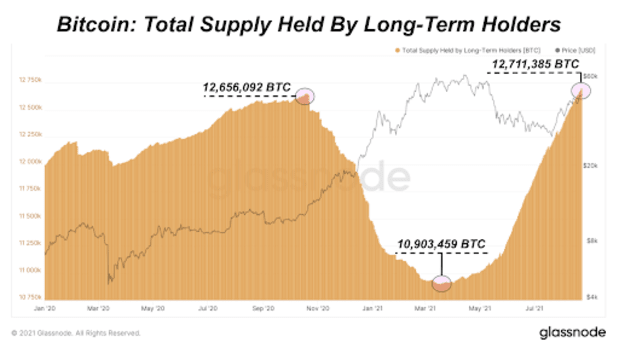

The total supply held by long-term holders hit an all-time high of 12,656,092 BTC on October 19, 2020 before gradually drawing down over the following four months as new capital poured into the asset.

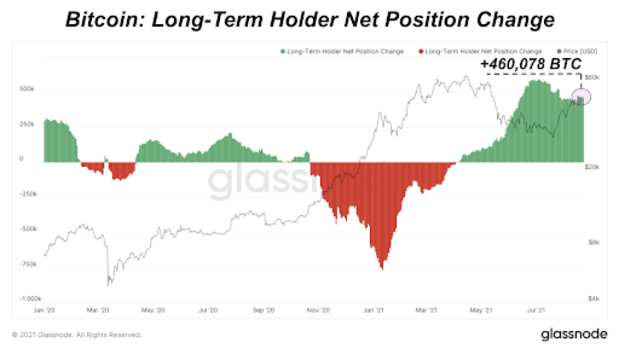

Long-term holder supply bottomed out on March 17, 2021 at 10,903,459 BTC, and started to steadily increase before a sharp acceleration following the mass market liquidations that occurred in May. With bitcoin more than 50% below its all-time high price, convicted market participants began to step in and accumulate bitcoin at a feverish pace. Today, long-term holders control 12,711,385 BTC and have accumulated 460,078 BTC on a net basis over the last 30 days.

When mapping out the percentage of the circulating supply held by long-term and short-term holders, it can be seen that HODLers are the ones who set the price floor. During pullbacks or periods of consolidation over the past decade, long-term holders take advantage by accumulating more of the circulating supply, essentially setting the price floor in the process.