LIVE BLOG: Ethereum’s Shanghai Upgrade

Featured SpeakerDeep Dive: Ethereum

Protocol VillageAustin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

:format(jpg)/www.coindesk.com/resizer/4jlkVfIJyhWbHl-4dZKorrHWZHQ=/arc-photo-coindesk/arc2-prod/public/AD4ZHCPHURCXLMUECKW67TDXSY.png)

Bradley Keoun is the managing editor of CoinDesk’s Markets team. He owns less than $1,000 each of several cryptocurrencies.

:format(jpg)/www.coindesk.com/resizer/Kjea5zGf89qzyacI8fZ49yhnaks=/arc-photo-coindesk/arc2-prod/public/S7SPGELTNBFITA3UBCS2CMRBQM.png)

Margaux Nijkerk reports on blockchain protocols with a focus on the Ethereum ecosystem. A graduate of Johns Hopkins and Emory universities, she has a masters in International Affairs & Economics. She holds a very small amount of ETH and other altcoins.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.

Featured SpeakerDeep Dive: Ethereum

Protocol VillageAustin Convention Center

Join an hour long exploration of the advancements defining the Ethereum community in 2023.

1:24 p.m. (BK): ZkSync Era, the zero-knowledge rollup on Ethereum that went live a couple weeks ago with a big splash (h/t to Margaux for that scoop), released an update on its operational plans for later in the day when Shanghai goes live. Probably a lot of teams are doing stuff like this.

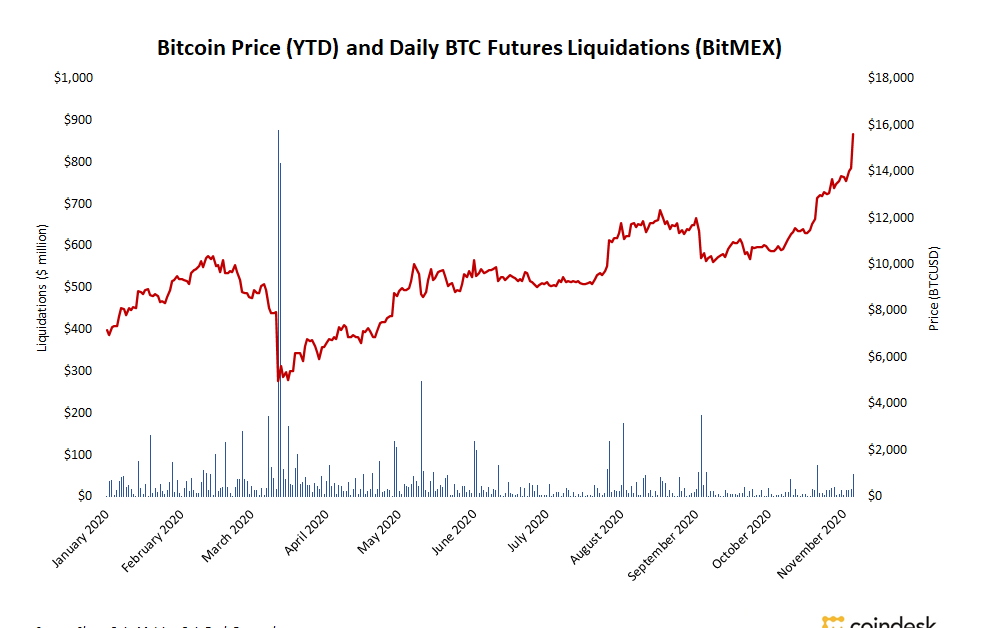

1:13 p.m. (BK): CoinDesk’s Daniel Kuhn just published this: Everything You Need to Know About Ethereum’s Big Upgrade. He highlighted a piece out earlier in the day by our Shaurya Malwa citing the blockchain-analysis firm Glassnode with the estimate that some $300 million of ether might be sold after the Shanghai upgrade. It might sound like a lot, but according to the Glassnode report, that amount of selling pressure could be absorbed quickly: “Even in the extreme case where the maximum amount of rewards and stake are withdrawn and sold, the sell-side volume still falls within the range of the average weekly exchange inflow volume. Therefore, we conclude that even the most extreme case will have an acceptable impact on the price of ETH.”

1:10 p.m. (BK): Bank of America analysts noted in a report last week that Shapella “acts as a precursor for future upgrades, providing a small step forward,” as reported earlier Wednesday by CoinDesk contributor Will Canny. “Ethereum’s ‘long-term viability’ is dependent on the execution of its development roadmap, the report said. This includes the implementation of a sharding approach called Danksharding, which aims to reduce the costs of transactions originating on scaling solutions and cut the processing and storage requirements for validators,” Canny wrote. Note that the dank-sounding “danksharding” and the perhaps even danker-sounding “proto-danksharding” were featured in Margaux’s piece out Tuesday on what comes next after Shanghai.

1:04 p.m. (BK): QCP Capital not sounding so bullish in its Telegram broadcast just out:

We fail to see what the bullish case can be for this event as those at the front of the queue are likely to sell spot, while those further back will be hedging via perps/futures if they have not already done so. The market has already seen bearish price action in anticipation of this event, with ETH underperforming BTC in recent weeks. ETHBTC has broken through the key support level of 0.658, and can potentially head back to 0.0553 (See chart), as continued and sustained spot selling pressure in thin markets for days after Shapella leads to further bearish price action on ETH. This can also potentially drag down the broader market.

QCP Capital Broacast

Technical analysis levels of ETH/BTC ratio. (QCP Capital)

12:37 p.m. (MN): Ethereum developers’ comments continue to roll in showcasing their faith in tonight’s Shapella upgrade. “I’m feeling confident that our rigorous testing will be fruitful this evening, and looking forward to a smooth Shapella activation. I’m curious to see how the withdrawal/deposit queues will play out in a few months of time,” said Barnabas Busa, a DevOps Engineer at the Ethereum Foundation, to me via DM on Discord.

12:20 p.m. (MN): RockX CEO Zhuling Chen told CoinDesk TV’s “First Mover” this morning that the Shapella upgrade will be a game changer. “From the dapps or application layer, we’re expecting a lot of innovative financial products, and also, different types of new products.”

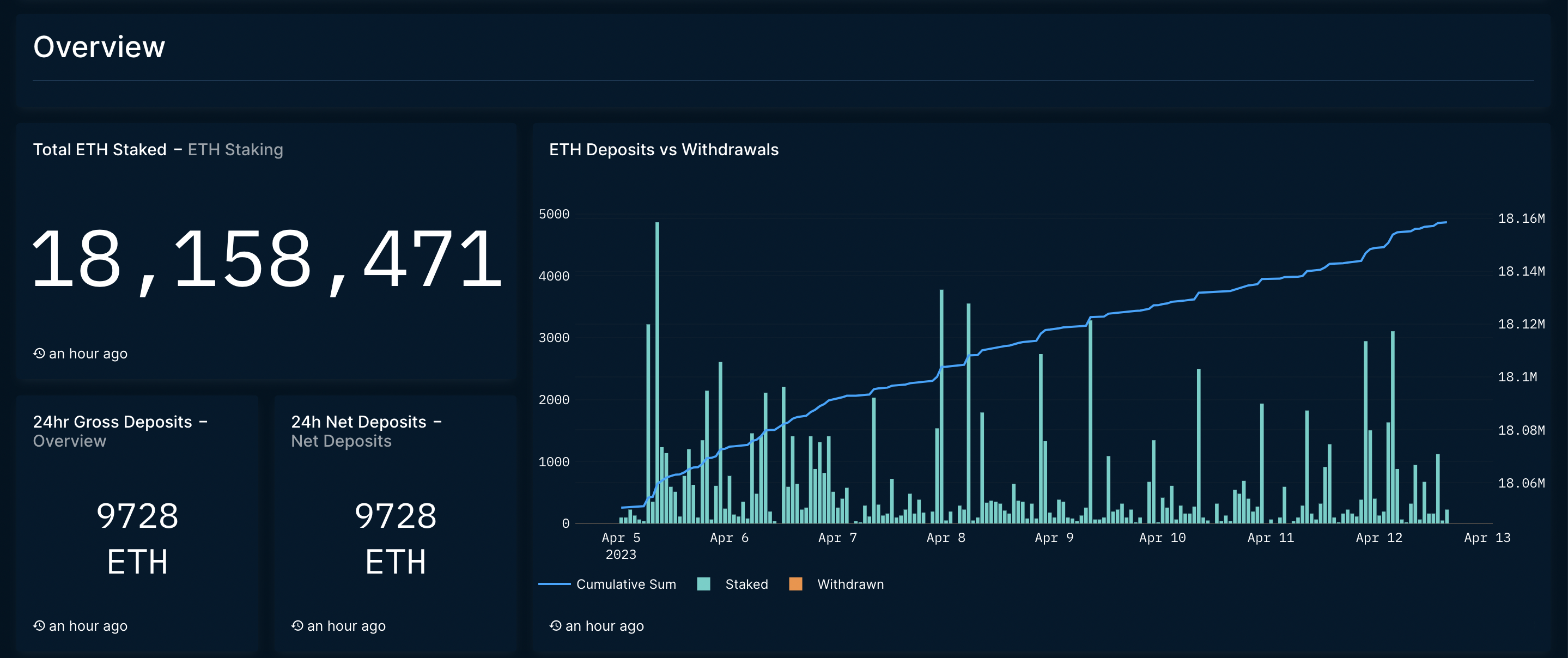

12:10 p.m. (MN): Nansen, a leading blockchain data provider, has released its Shanghai Upgrade dashboard so eager folks can track ETH deposits and withdrawals once Shapella is live. The Withdrawal Queue list is already starting to pick up!

Nansen’s Shanghai Upgrade dashboard (Nansen)

12:01 p.m. (MN): CoinDesk caught up with Ethereum DevOps Engineer Parithosh Jayanthi, who was in charge of much of the testing for Shapella. “I’m feeling quite good about Shapella, it somehow feels very different than the adrenaline fuelled rush before the Merge,” Jayanthi told CoinDesk via DM on Discord. “We made some last minute checks that we’ve updated all of our nodes and now I’m looking forward to the watch parties to start!”

11:30 a.m. (BK): ICYMI here’s a link to our roundup of all the Shanghai watch parties planned for Wednesday night, and a bunch of other great web tools that people can use to monitor the action on the blockchain – compiled by Ethereum beat reporter extraordinaire Margaux Nijkerk and blockchain-data-master Sage D. Young: Ethereum’s Shanghai Upgrade: Here’s Our Guide to Watch Parties, Blockchain Tools.

11:26 a.m. (BK): Galaxy Digital’s Christine Kim put together a cool primer on what to watch for. She tweeted this out April 6 but we were just having a look and she does a really good job of breaking down some of the technical stuff. A teaser: “The major code change in Shapella is EIP 4895, which adds a new system-level operation to support validator withdrawals. The addition of withdrawal functionality to the Ethereum codebase represents the final step in completing the network’s multi-year transition to a proof-of-stake (PoS) consensus protocol.”

11:17 a.m. (BK): One of the biggest unknowns about the Shanghai upgrade is how the price of ether (ETH) will trade through it all. CoinDesk reporter Lyllah Ledesma has a story out showing just how spilt crypto market analysts are in their predictions. “Some observers expect an ether price swoon after the upgrade as users liquidate their holdings, while others believe the expected uptick in the selling pressure is already baked in and the market will bounce after the event in a classic ‘buy the news’ move,” Ledesma wrote.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/4jlkVfIJyhWbHl-4dZKorrHWZHQ=/arc-photo-coindesk/arc2-prod/public/AD4ZHCPHURCXLMUECKW67TDXSY.png)

Bradley Keoun is the managing editor of CoinDesk’s Markets team. He owns less than $1,000 each of several cryptocurrencies.

:format(jpg)/www.coindesk.com/resizer/Kjea5zGf89qzyacI8fZ49yhnaks=/arc-photo-coindesk/arc2-prod/public/S7SPGELTNBFITA3UBCS2CMRBQM.png)

Margaux Nijkerk reports on blockchain protocols with a focus on the Ethereum ecosystem. A graduate of Johns Hopkins and Emory universities, she has a masters in International Affairs & Economics. She holds a very small amount of ETH and other altcoins.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/4jlkVfIJyhWbHl-4dZKorrHWZHQ=/arc-photo-coindesk/arc2-prod/public/AD4ZHCPHURCXLMUECKW67TDXSY.png)

Bradley Keoun is the managing editor of CoinDesk’s Markets team. He owns less than $1,000 each of several cryptocurrencies.

:format(jpg)/www.coindesk.com/resizer/Kjea5zGf89qzyacI8fZ49yhnaks=/arc-photo-coindesk/arc2-prod/public/S7SPGELTNBFITA3UBCS2CMRBQM.png)

Margaux Nijkerk reports on blockchain protocols with a focus on the Ethereum ecosystem. A graduate of Johns Hopkins and Emory universities, she has a masters in International Affairs & Economics. She holds a very small amount of ETH and other altcoins.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.