Litecoin Halving Completed: LTC Surges 12%, Miners Haven’t Shut Off Their Hashrate

One of the most anticipated events within the cryptocurrency field took place just a couple of hours ago. Litecoin experienced its block halving, which cut the reward that miners get for validating blocks in half – from 25 LTC per block to 12.5 LTC per block. In response, LTC enjoyed a significant price increase of around 12% against the dollar. It also increased against Bitcoin with an approximate 8 percent rise immediately after the halving.

Litecoin Halving: What Are the Early Consequences?

Today, August 5th, Litecoin underwent its halving event. The most substantial consequence of this is that miners will now be receiving 12.5 LTC for adding a new block to the network, rather than the previous 25 LTC.

With that transition, the protocol is going to be adding a substantially reduced amount of LTC to the market going forward.

This is perhaps why it sounds much like an interest rate hike, as well as other measures which are typically initiated by central banks around the world when battling high inflation. The difference, of course, is that, much like Bitcoin’s protocol, Litecoin is pre-programmed and its inflation is predetermined, leaving no room for human interference.

Naturally, an event of this kind has had an impact on the entire network. It appears, though, that miners didn’t shut off their hashrate after it took place. Commenting on the matter was Charlie Lee, the creator of Litecoin.

Since the halving, 12 blocks have been found in 17 minutes.

Seems like miners have not shut off their hashrate at all. Instead, we are mining at a rate of a block every 1.4 minutes on average, which is much faster than the expected 2.5 minutes.

Litecoin network is healthy! pic.twitter.com/xvgefqIPtP

— Charlie Lee [LTC⚡] (@SatoshiLite) August 5, 2019

He noted that not only are miners not holding off, but they are also mining a lot faster than the expected rate, potentially signaling that the network is healthy and well.

Of course, it’s still fairly early to draw any conclusions. That’s why Lee said he would provide updates once more time has passed.

Litecoin Halving and Its Impact on the LTC Price

Perhaps the thing that almost everyone was interested in was whether the halving would have an impact on Litecoin’s price. So far, it appears that it has.

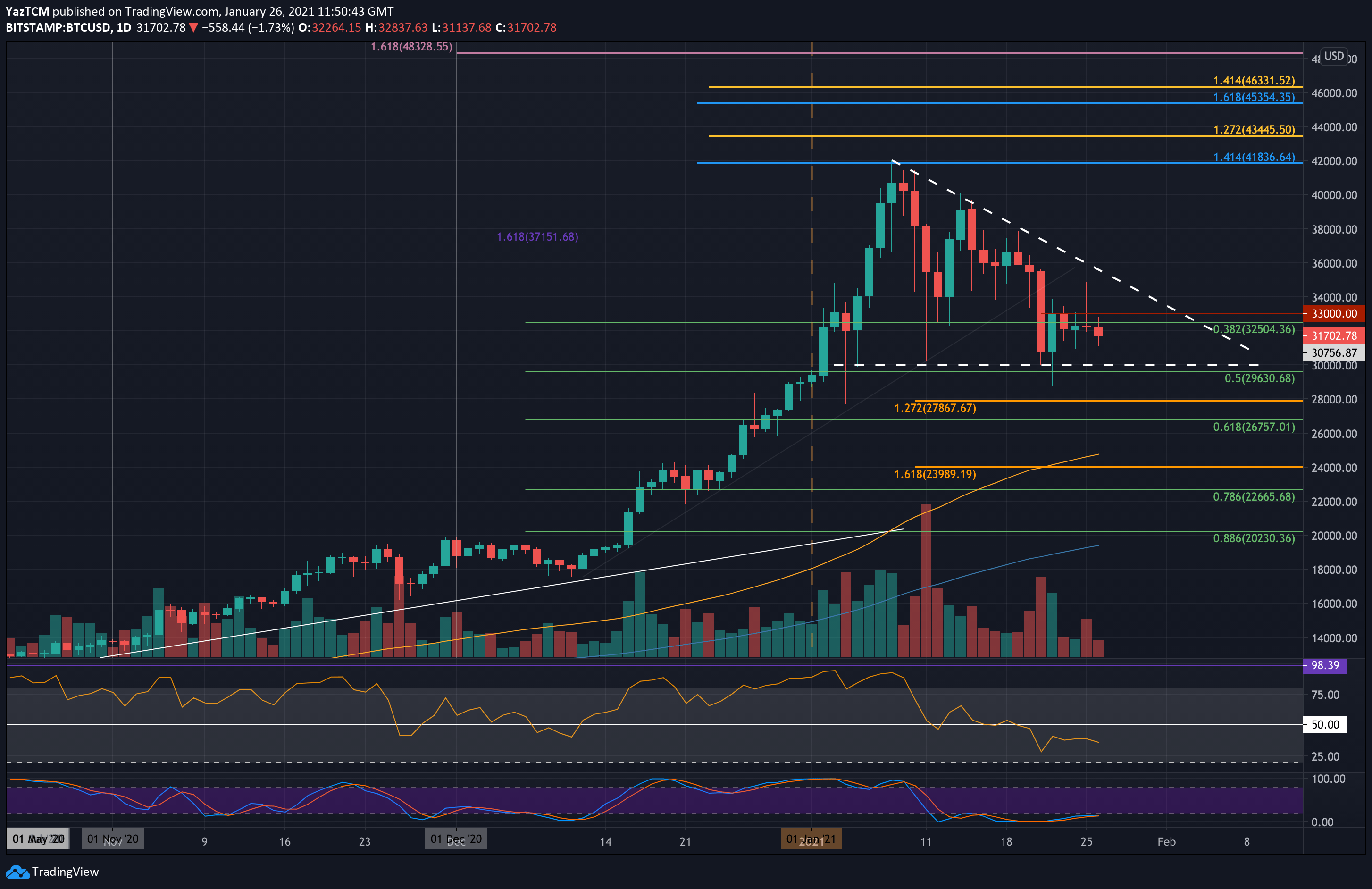

As you can see from the chart, Litecoin’s USD value has increased by more than 12% in the past 24 hours, with the majority of the gains coming immediately after the halving. At the time of this writing, LTC is trading at around $102, having broken above the important resistance level of $100. We have yet to see whether it will manage to hold that level.

Trading against Bitcoin, the situation also seems quite promising, and it appears that the halving catalyzed a positive change in this regard.

Trading against BTC, Litecoin gained upwards of 7.5% immediately after the block halving. However, in the 24-hour period following the event, LTC gained only 1% against BTC. This is because its value dropped notably hours before the halving.

We have yet to see how things will turn out, both for Litecoin’s network as well as for its price. Basic economic principles dictate that if the demand for an asset remains the same or increases while its supply is reduced, the price should go up. Many analysts, however, believe that the halving had already been priced in.

The post Litecoin Halving Completed: LTC Surges 12%, Miners Haven’t Shut Off Their Hashrate appeared first on CryptoPotato.