Litecoin Gets Bullish Speculation, at Last, as Upgrade Approaches

Design for an embossed silver platter, 19th century, French. (Metropolitan Art Museum, PhotoMosh)

The cryptocurrency litecoin is often referred to as the silver to bitcoin’s gold. This year, litecoin investors might have been better off staying in the analog world: While bitcoin has gained twice as much as gold, litecoin has barely kept up with silver.

Some investors now foresee a rally developing in litecoin prices, with a key upgrade looming and signs that activity is increasing on the blockchain network.

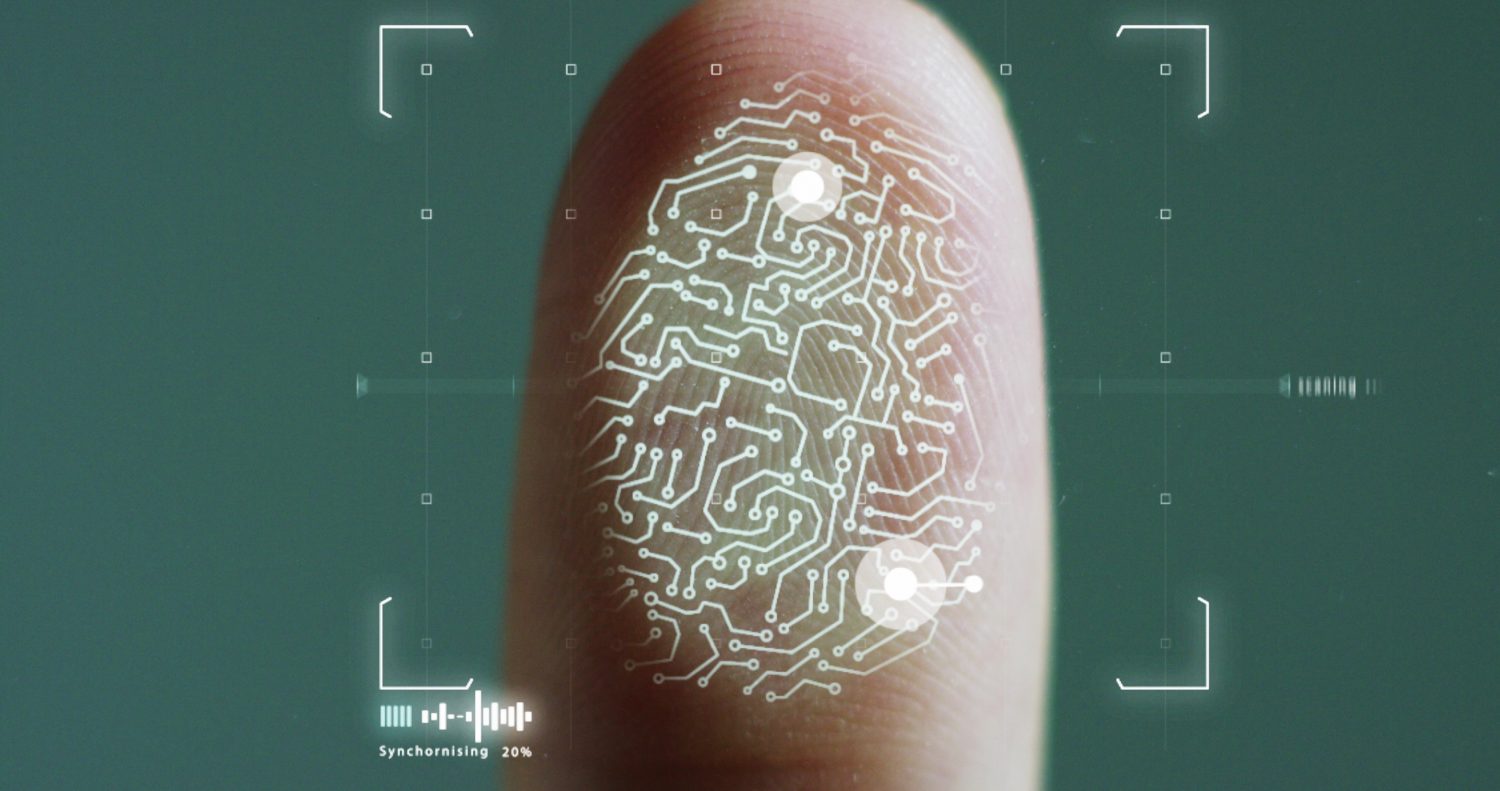

The upgrade will put in effect a “privacy protocol” known as Mimblewimble, which is supposed to help shield the identities of holders of senders and recipients of litecoin tokens while also improving the network’s ability to scale to handle more transactions. A testnet of Mimblewimble, in the works for almost a year, is targeted for the end of September.

And based on market data, it appears that the looming addition is generating enthusiasm among users: Daily confirmed transactions on litecoin’s blockchain has more than doubled this year, reaching a 7-day average of 48,948 last week, the highest since February 2018, according to data source Glassnode.

Litecoin backers hope the token’s added privacy features from the Mimblewimble upgrade will help attract users who otherwise might gravitate toward existing privacy coins like monero (XMR) and zcash (ZEC). Those tokens come with their own risks, such as the potential for holders to get diluted by new issuance.

The speculation is that the upgrade could help litecoin, which has gained about 50% this year to $63, catch up with bitcoin’s 64% increase.

“Litecoin’s upcoming Mimblewimble upgrade has led to a spike in transactions and active addresses,” said Matthew Dibb, co-founder of Stack, a provider of cryptocurrency trackers and index futures.

Litecoin’s facility for handling a large number of transactions at any given moment is supposed to increase with the upgrade, helping to solve “scalability” concerns that had deterred some users and investors, according to Nicolas Pelecanos, head of trading at NEM Ventures, a cryptocurrency investment firm.

Bottlenecks on the network were “huge” in 2017, Pelecanos said, when litecoin’s price shot to a record of about $400.

The network’s processing speed has doubled this year to about one transaction every two seconds. But that’s still far slower than the Bitcoin blockchain, which can handle about 3.7 transactions every second.

“The upcoming protocol upgrade would solve the issue,” Pelecanos told CoinDesk in a LinkedIn chat. “That would leave the valuation around all time highs.”

One concern with the added privacy features is that it’s not yet clear how they’ll sit with regulators. Coinbase UK delisted zcash last year, likely due to pressure from financial watchdogs. South Korean exchange Upbit delisted privacy coins monero, dash and zcash in 2019.

“There’s some stigma against privacy coins, and some exchanges have delisted them,” Litecoin founder Charlie Lee told CoinDesk in a recent interview. “But from what I can tell, the exchanges are OK with this litecoin privacy upgrade as an extension block because it’s kind of on the side. The exchanges don’t have to support the extension block side of things.”

David Schwartz, project director at Litecoin Foundation, a non-profit organization that sponsors development on the blockchain, wrote on Twitter earlier this month that he thought the cryptocurrency was undervalued.

“Its average usage has doubled since the start of the last bull run & is gaining steam,” he tweeted. “So much so, that transactions have outpaced historical price, which means price is not showing its true value.”

There’s some skepticism, of course. Crypto markets are notoriously speculative.

“The recent pick up may be attributable to the upcoming upgrade,” says Connor Abendschein, research analyst at CoinDesk, but “greater bullish sentiment across the entire crypto market has driven prices of most assets higher over the past few months.”

“As the upgrade draws closer, we will see whether litecoin is just rising bitcoin’s cottails, or if it can find some legs and run on its course,” Abendschein said.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.