Litecoin Completes 20% Surge In 7 Days: How High Can It Go From Here? LTC Price Analysis & Overview

- Liteocin saw a 20% price surge this week that allowed the price for the coin to rise toward the $54 level.

- Against BTC, LTC has also increased as the market meets resistance at the 100-days EMA.

- Litecoin has now shot back into the 7th ranked position with a market cap of $4.64 billion.

Key Support & Resistance Levels

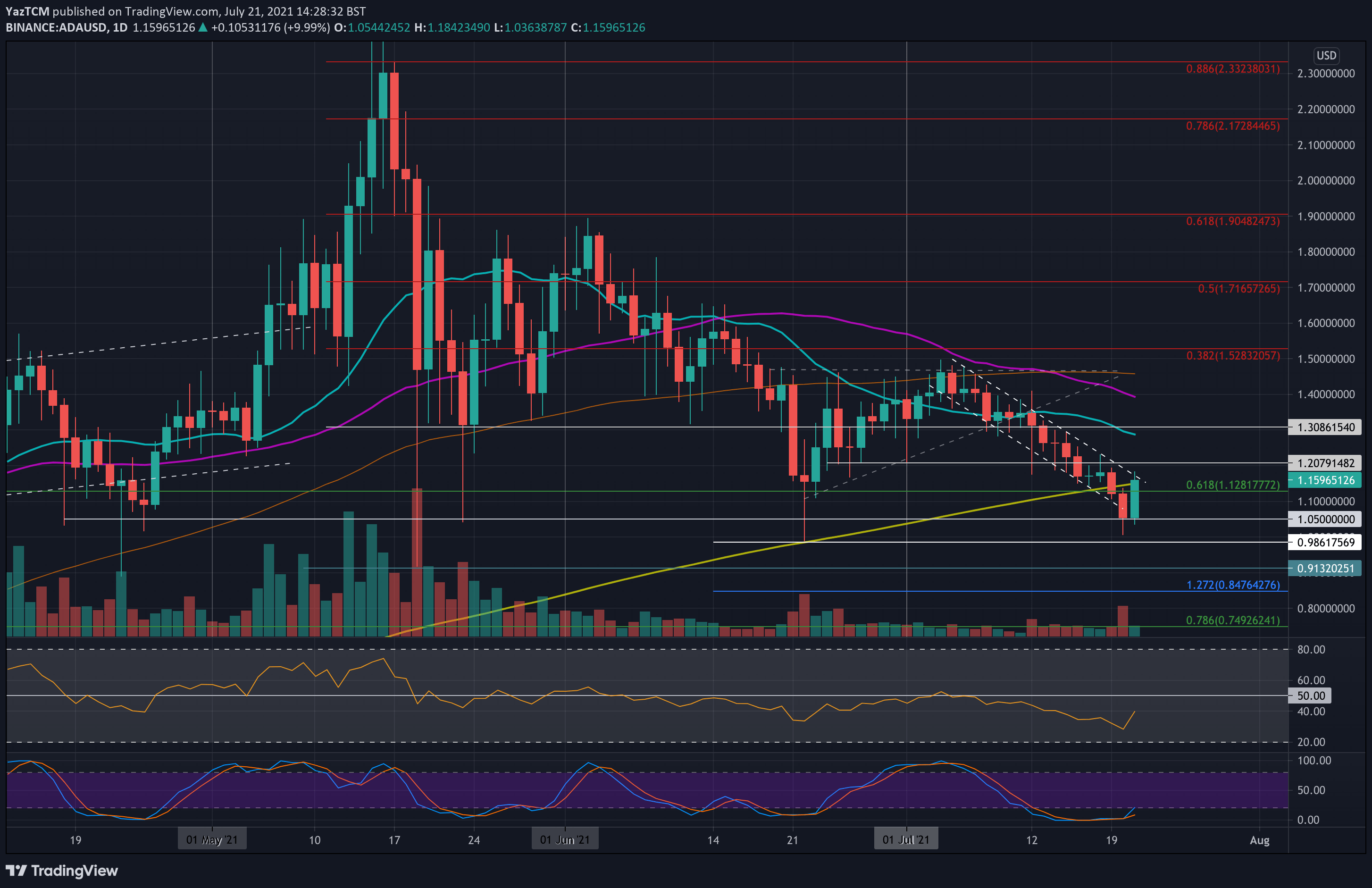

LTC/USD

Support: $50, $47.76, $44.31.

Resistance: $55.03, $60.20, $64.91.

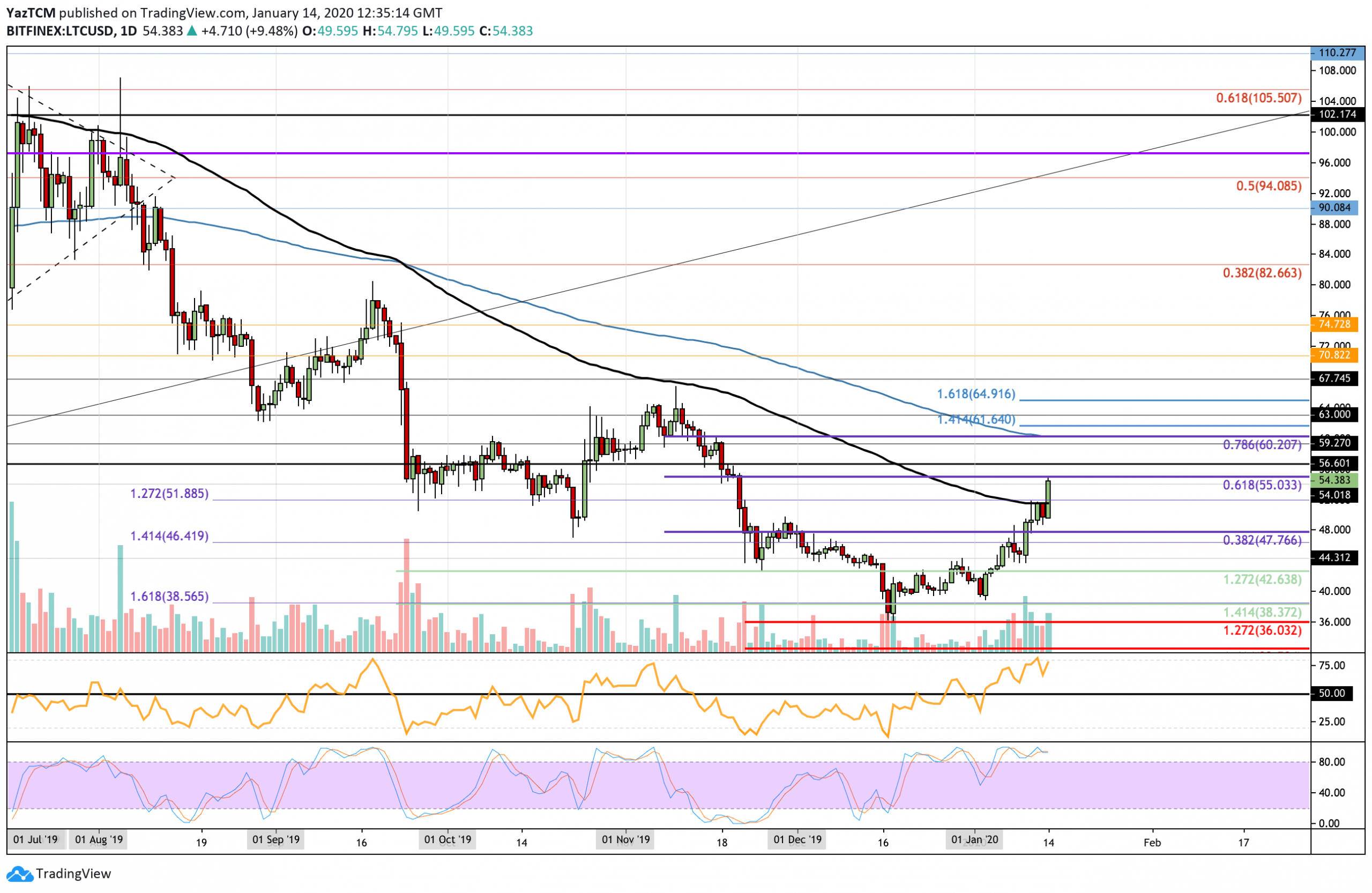

LTC/BTC:

Support: 0.0062 BTC, 0.0060 BTC, 0.0058 BTC.

Resistance: 0.00648 BTC, 0.0067 BTC, 0.0070 BTC.

LTC/USD: Litecoin Breaks Back Above $50 To Meet Resistance At $55.

The daily chart above shows Litecoin surging above the 100-days EMA in today’s session to climb higher and meet resistance at the $55.03, which is provided by the short term bearish .618 Fib Retracement. The coin has been on the strongest bullish footing since the start of the year as it rebounded from support at $39 and traveled higher. The latest price surge above $50 is largely caused by the 6% Bitcoin price hike seen in today’s trading session.

As Litecoin managed to break above the December highs at $47.76 and the 100-days EMA at $50, the coin is now considered to be in a bullish market. For this market to turn bearish, Litecoin must drop and fall beneath the support at $38.

Litecoin Short Term Price Prediction

If the bulls continue to push higher above $55, immediate resistance is to be expected at $56 and $60.20 (bearish .786 Fib Retracement). The resistance at $60 is deemed to be significant as it is bolstered by the 200-days EMA. If the bulls can pass the 200-days EMA, resistance lies at $61.64 (1.272 Fib Extension), $63, and $64.81 (1.618 Fib Extension). Alternatively, if the sellers step back in and push LTC lower, initial support is located at $50, where lies the 100-days EMA. Beneath this, additional support is found at $47.76, $44.31, $42.63, and $38.37,

The RSI is well above the 50 level, which shows that the bulls fully dominate the market momentum. Similarly, the Stochastic RSI is also in overbought territory. However, it can remain here for extended periods.

LTC/BTC – Litecoin Sees Resistance At 100-days EMA

Against Bitcoin, Litecoin has also rebounded from the 0.0056 BTC level this week. It continued to rise higher until meeting resistance at 0.0064 BTC, which is provided by the 100-days EMA level. The market is looking very strong. However, if Bitcoin continues to tear higher, it might be expected for Litecoin to fall against BTC during this time.

Litecoin remains neutral against BTC until it can break above the 100-days EMA and the December high at 0.0064 BTC. For this market to turn bearish, Litecoin must fall and break beneath the support at 0.0055 BTC.

Litecoin Short Term Price Prediction

If the buyers continue to dominate and push LTC above the 100-days EMA, initial higher resistance is located at 0.00648 BTC (bearish .5 Fibonacci Retracement level). Above this, resistance lies at 0.0067 BTC, 0.0070 BTC, and 0.00713 BTC. On the other hand, if the sellers step in and push LTC lower, support is located at 0.0062 BTC and 0.0060 BTC. Beneath this, additional support is located at 0.0058 BTC and 0.0056 BTC.

The RSI is well above the 50 level as the bulls dominate the momentum. However, the Stochastic RSI recently produced a bearish crossover signal that could send the market lower.

The post Litecoin Completes 20% Surge In 7 Days: How High Can It Go From Here? LTC Price Analysis & Overview appeared first on CryptoPotato.