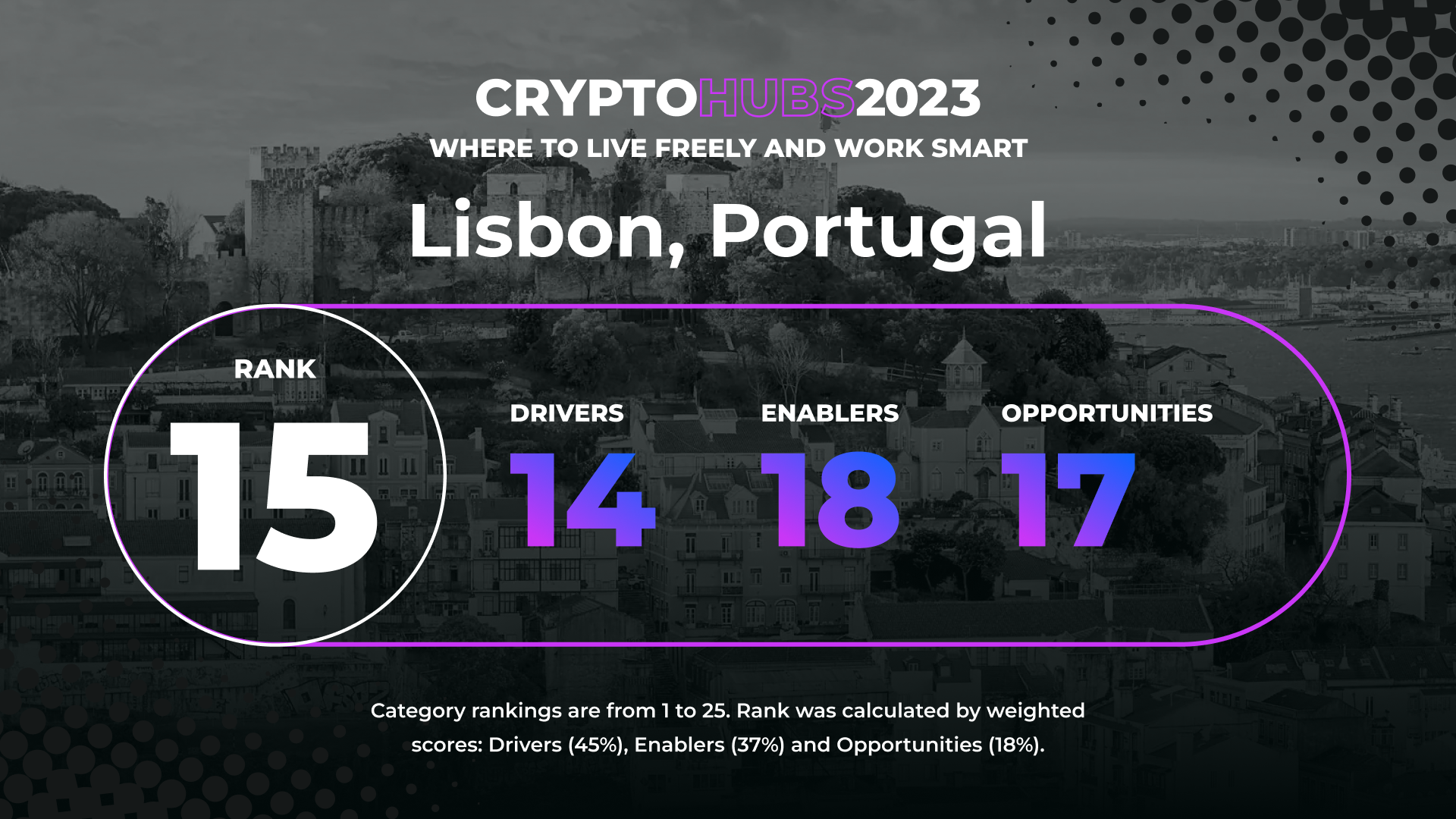

Lisbon: A Buzzy, Affordable Mecca for Buy-and-Hold Crypto Nomads

The final hub to make the cut into our top-15 ranking of crypto hubs, Lisbon had an above-average rating for crypto regulatory structure, 4 out of 5. That important criteria, in the drivers category, was worth 35% of the total score on its own. But Lisbon scored in the solid middle- to lower-middle of the 25-hub pack on nearly every other measure, from grassroots crypto adoption (another driver) to opportunities criteria including per-capita crypto jobs, companies and events. What lifted the popular expat destination into the final 15 was a higher-than-average quality-of-life score, in the enablers category, worth 15% of the total.

For more on the criteria and how we weighted them, see: How We Ranked CoinDesk’s Crypto Hubs 2023: Our Methodology.

In the fall of 2017 I sold everything I owned, left New York City, and bought a one-way ticket to a city where I would stay indefinitely: Lisbon.

This was the start of my three-year “digital nomad” journey. Digital nomads hunt for destinations that have both a high quality of life and a low cost of living. It’s a form of geographic arbitrage. Nomads crave cities with high-speed internet, active co-working spaces, a frisky nightlife, culture, sunshine, good food and cheap drinks.

Read Crypto Hubs 2023: Where to Live Freely and Work Smart

I started my journey in Lisbon, because Lisbon oozes all of these things. It’s a digital nomad wonderland. The Portuguese government realized they had a good thing going, and leaned into it further by creating a digital nomad visa in 2022. Coders, devs, entrepreneurs, and creatives flock to Lisbon for top-shelf Europe at discount prices. (That discount, of course, has narrowed as Lisbon has grown in popularity.) And even back in 2017, many of these digital nomads were obsessed with crypto.

“I really want to buy bitcoin, but I feel like the price is too high and I missed the bull run,” someone told me in a Lisbon bar. This was in 2017; bitcoin then traded at $7,000. And since then the crypto scene – and prices – have exploded.

“The best thing about Lisbon for the Web3 ecosystem is that everyone is here,” says Inês Bragança Gaspar, a blockchain lawyer who has lived in Lisbon all her life. “You have big projects. Small projects. Entrepreneurs.” There are so many recurring events and meet-ups, says Gaspar, that she can literally go to one every day of the week. There’s Web3 Wednesdays, Crypto Fridays, and larger conferences like NEAR-Con and NFT Summit.

One reason for the crypto boom is a friendly tax environment. “Until the end of last year, crypto was not taxed in Portugal,” says Gaspar. “It used to be a crypto tax paradise.” Even the new taxes are relatively painless; if you hold cryptocurrency for over a year and then sell it, you pay exactly zero Euros in tax. So your incentive is to buy and hold instead of short-term trading. As Gaspar puts it, “The government is trying to make us hold our coins.”

In another perk from the Portuguese government, if you earn capital gains from overseas investments, that’s also taxed at 0%. This isn’t specific to crypto, but it helped lure businesses and workers to Lisbon, adding more talent to the ecosystem. “It’s quite easy to hire high quality tech talent at a competitive cost,” says Gaspar.

Perhaps most surprisingly, the Web3 enthusiasm hasn’t slowed during crypto winter. You could argue it accelerated. After the FTX collapse, many events had a theme of “how to build in a bear market,” and those who were serious doubled down on their work. “In a bear market, that’s where you need community the most,” says Gaspar. “Even if you just want to vent about the prices of your crypto going down.”

Edited by Jeanhee Kim and David Z. Morris.