Lightning Labs Releases ‘Better’ Version of Token Minting on Bitcoin After BRC-20s Clog System

:format(jpg)/www.coindesk.com/resizer/pMUhpW4u-mwZgc89YVYeL2C44uI=/arc-photo-coindesk/arc2-prod/public/P6EMHK6DTBE4NPQGXW2UOBVOLE.png)

Frederick Munawa is a Technology Reporter for Coindesk. He covers blockchain protocols with a specific focus on bitcoin and bitcoin-adjacent networks.

Lightning Network infrastructure firm Lightning Labs has rebranded its Taro project to Taproot Assets and released a software update after a contentious trademark infringement suit was filed by blockchain software development firm Tari Labs Last December.

The suit resulted in an injunction that prevented further development of the project. But with the rebranding, Lightning Labs has resumed work on the primary software for implementing the newly renamed Taproot Assets protocol, which will allow users to issue assets such as stablecoins on the Bitcoin blockchain.

Tari Labs has not responded to CoinDesk’s request for comment.

Today’s update closes the chapter on a lawsuit resulting from a brand name – Taro, that Tari Labs claims was too similar to their own – and opens up the ability for developers to experiment with software that has a new set of core features designed to “bitcoinize the dollar,” according to Lightning Labs.

Taproot Assets is currently available on a test network, with main network support “coming soon,” according to the team.

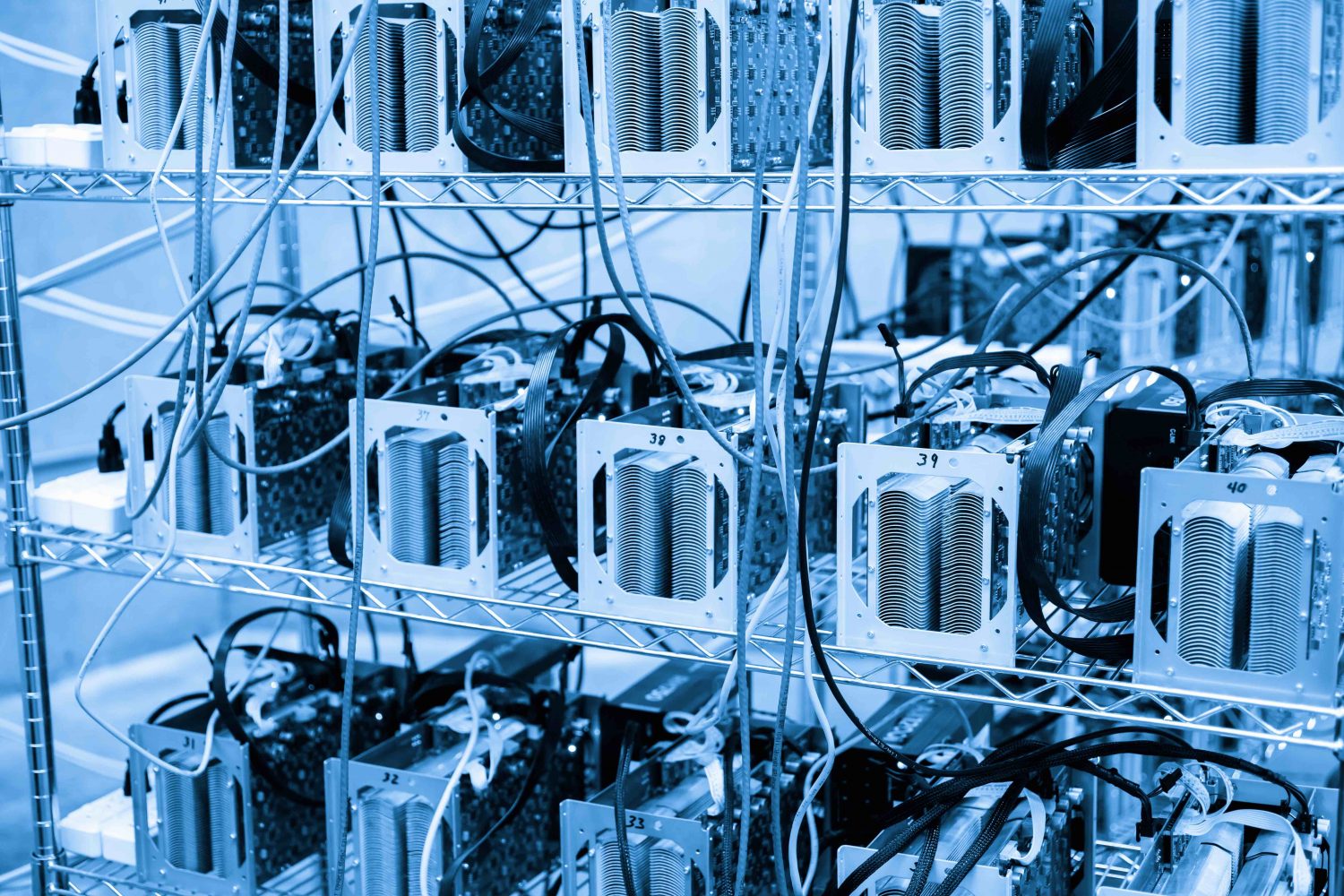

“We are committed to building an assets protocol for Bitcoin and Lightning,” Elizabeth Stark, CEO and co-founder of Lightning Labs told CoinDesk. “That scales to many people around the world and doesn’t make the Bitcoin blockchain effectively unusable,” a reference to last week’s record-high congestion and transaction fees on the Bitcoin network due to a surge in minting of BRC-20s – fungible tokens generated via the controversial Ordinals protocol.

Interestingly, Domo, the pseudonymous creator of BRC-20, recommended Taproot Assets as “unequivocally a better solution.” This is because Taproot Assets creates multiple assets off-chain before settling them as a single on-chain transaction. Also, witness data – the type used by Ordinals – is transacted and stored off-chain.

Lightning Labs says the next step for the company will be to propose finalized specifications of the protocol to the Bitcoin community via bitcoin improvement proposals (BIPs) and Bitcoin Lightning improvement proposals (bLIPs) with the ultimate goal of enabling Bitcoin-based asset transfers over the Lightning Network – a secondary system for cheaper and faster Bitcoin transactions.

“Super excited to have so much developer support and enthusiasm,” said Stark. “Taproot Assets mainnet is just around the corner.”

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/pMUhpW4u-mwZgc89YVYeL2C44uI=/arc-photo-coindesk/arc2-prod/public/P6EMHK6DTBE4NPQGXW2UOBVOLE.png)

Frederick Munawa is a Technology Reporter for Coindesk. He covers blockchain protocols with a specific focus on bitcoin and bitcoin-adjacent networks.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/pMUhpW4u-mwZgc89YVYeL2C44uI=/arc-photo-coindesk/arc2-prod/public/P6EMHK6DTBE4NPQGXW2UOBVOLE.png)

Frederick Munawa is a Technology Reporter for Coindesk. He covers blockchain protocols with a specific focus on bitcoin and bitcoin-adjacent networks.