Lies, Deception And Unnatural Money

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning”

– Henry Ford

The continued functioning of the financial system you have lived under for your entire life is dependent on the average person not understanding exactly how it works, and there are many reasons for this. As you read deeper and deeper into this article, I hope that you will realize how deceiving our money really is. Governments and banks lie to you and take advantage of you every single day, most people just don’t realize it. The money you use to save your value or purchase goods and services is unnatural; it is the equivalent of manmade garbage that you’d throw away in a second if you understood it better and had a viable alternative to opt into instead.

I was always told growing up that the financial system was broken and that it doesn’t work properly, but that there were no good solutions to its problems. While most agree that the system is unfair, I wanted to find out what about it is broken exactly, and I did. But I also found that because the entire financial system is broken for the vast majority of people, that means it’s working just as intended.

What Makes Money Valuable?

Money is a fundamental aspect of our daily lives that touches almost everything that we do, but the vast majority of people aren’t taught everything they should know about the history of money and how it works.

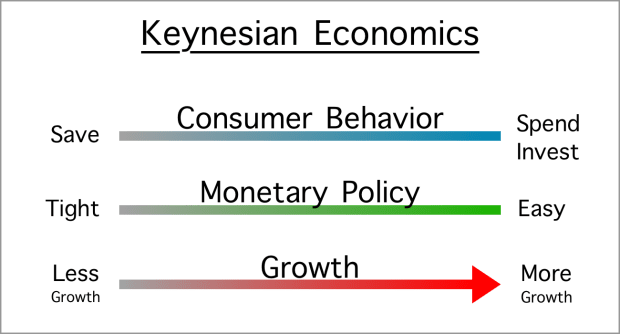

So, what are people generally taught about money? At most, they are usually taught some basic Keynesian economic principles, which emphasize governments and central banks while deemphasizing the sovereignty of their constituents. Keynesian economics are macroeconomic philosophies that developed in the wake of the Great Depression, but have resulted in an unfair system that most people don’t understand, even if they live under it. But here is some truth about what really makes money valuable.

Good money typically has six main characteristics: durability, portability, divisibility, uniformity, scarcity (limited supply) and acceptability. Each one of these characteristics plays a key role in the value that a certain form of money can provide, with all different forms of traditional money having tradeoffs.

All effective monetary media throughout history have possessed some combination of these qualities, but not all. Historical forms of money include gold, silver, stones, seashells, glass beads and more. These tools were used as money because they fulfilled a certain role in a given society typically in either storing value or facilitating exchange.

Money is a universal tool used by everyone to exchange value for goods and/or services; it’s an asset that requires certain characteristics to be functional in exchange. If someone is using money without most of these characteristics, then it is bad money.

The U.S. dollar, for instance, is not durable, it has an unlimited supply, it’s not very divisible and doesn’t have solid uniformity. You can use just about anything people deem as having any value as money, but there are long-term, harsh consequences to using bad money. Such as wealth evaporation.

Good money comes and goes and has always served a particular role in its given society. But over time, historically good money has often become bad money, as a society shifted to a better form of money. Money has evolved over time, adapting to its surroundings and technology. With enough time having passed, we’ve seen good money turn to bad money and ultimately fail, time and time again.

So, you may be asking yourself: “If these characteristics are what make good money, then how can good money turn to bad money and fail?”

Money Printing Is Inevitable

“The root problem with conventional currency is all the trust that’s required to make it work. The central banks must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

– Satoshi Nakamoto, 2009

History has proven that if humans are able to print money, they will. Everyone wants a shortcut and nobody can be trusted with this power, as history has demonstrated.

It’s been estimated that during the time of the Civil War, about one-third of all of the money in circulation was counterfeit. And today, counterfeiting is still rampant. Zero Hedge reported earlier this year that a Chinese gold processor was behind a scandal involving 83 tons of fake gold bars, which would account for 4.2 percent of the country’s total gold reserves in 2019.

There have been many different examples of money printing throughout time, resulting from cycles of human greed that lead to lies, deception and unnatural money. Whether it be counterfeiting banknotes, gold bars or even glass beads, people will always try to get an unfair edge over others.

If you were to print money for little to no cost, quickly or over long periods of time, you end up devaluing everyone else’s hard-earned money. But since it costs you little to nothing to produce, you’re not losing any wealth, you’re just stealing it from everyone else. This same reasoning applies to “legitimate” money printing — not just counterfeiting, but governmental money production — and then becomes a function that is dependent on the people not realizing that their wealth is deteriorating.

Inflation stems from money printing, the same process that is known as “counterfeiting.” It’s unnatural, man-made intervention that screws up everything in an otherwise natural, free market.

Money Printing Is Unnatural

Now that we know what makes good money and that money printing is inevitable and inflationary, let’s take a look at the root cause of the failure of all previous forms of good money. If we look at the characteristics that make good money, there is one that stands out among the rest. I’m talking, of course, about scarcity, or the enforcement of a limited supply, which is critical in making good money and simultaneously something that is constantly being undermined by greedy people who find a way to exploit the system.

“Deception is an act or statement which misleads, hides the truth, or promotes a belief, concept, or idea that is not true,” according to Wikipedia. “It is often done for personal gain or advantage.”

As noted above, money printing only “works” if the majority of people don’t even realize that it is steadily devaluing their earnings and savings. People must be deceived into believing a false ideology about this practice, but that can only work for so long; as we’ve seen throughout history, bad money doesn’t last forever. The people who were deceived also pay for the consequences that bad money causes.

One of the most impactful stories of how money printing ruined a society involves the Rai Stones on the Island of Yap. These giant limestones were used as money there and stored families’ value for generations. These stones were very difficult to produce so, the bigger the stone, the more value it had, with some stones larger than a fully-grown human.

As Saifedean Ammous described in “The Bitcoin Standard,” the Island of Yap thrived until Irishman David O’Keefe immigrated there and saw the immense opportunity to mass produce these stones using iron tools. The key here was that O’Keefe was able to make these stones at a quicker rate and to make them smaller, making them more transportable. Over time, the Rai Stone market was so flooded that the stones became worthless, and the value held by the islanders was wiped out.

Effects Of Government Money Printing

One of the most recent examples of the devastating effects of money printing happened in 2019 when the Venezualan bolívar experienced hyperinflation of some 2,000,000 percent, destroying the wealth of the country. Venezuela was once South America’s richest country, until it started going down a slippery slope via corrupt leaders with deceiving, flawed and socialist ideologies. The country’s death knell was put into motion when President Nicolás Maduro was voted into office.

Maduro appealed to many voters because of his socialist policies, knowingly deceiving his target audience. Once Maduro was elected, the money printing press ran hot while deficit spending rose astronomically. The wealth of the country vanished as the once-richest country in Latin America became the poorest. The public was taken advantage of for Maduro’s ideological gain, and was ultimately punished, with many no longer being able to afford to eat.

The destruction of Venezuela’s national currency transformed the country into a totally failed state. Since the government has full control over the bolívar, they are able to force people to get paid at the official exchange rate, which is significantly less than it is on the unmanipulated black market, stopping the citizens from having any hope of saving their wealth or getting ahead, while benefiting the government by keeping hold over its citizens.

This horrible aftermath of money printing is not unique to this specific case. As you study the after effects of other hyperinflated currencies, it becomes apparent that the results are always the same.

You’re Being Blatantly Lied To

“The CPI is deliberately designed to understate and mask the inflation that the Federal Reserve is creating”

– Peter Schiff

Inflation silently steals our wealth from right under us and yet, governments and central banks can’t even be truthful to us about that. But how do we calculate and know what the inflation rate is? We find out through something called the Consumer Price Index (CPI). According to the U.S. Bureau of Labor Statistics, CPI is a measure of the average change over time in the price paid by urban consumers for a market basket of consumer goods and services (food, housing, clothes, transport, medical care, recreation and education).

This bureau implies that CPI is calculated simply, but it’s actually extremely complicated. On the bureau’s website, you can download a PDF file with its methods of calculation. The only problem is that it’s a whopping 107 pages long! And to think it calculates just one simple and fundamental problem: the degree to which the money that you have today will be devalued by tomorrow. The main goal for the Bureau of Labor Statistics seems not to be solving this problem, but to be jumping through loopholes and twisting and turning things until it gets a low enough number to report to the public.

Even as real inflation goes up due to money printing, the government may say that there was 0 percent inflation for that year, because the government calculates inflation via CPI, which allows it to jump through loopholes to get a certain number most appealing to the public. A huge consequence of actual inflation means that your dollar is purchasing less and less every year while you end up getting taxed more because of CPI. Then, the government bumps you up into a new tax bracket in which you are now taxed at a higher percentage of your income and end up taking home less value than before.

It lies about the inflation rate for political gain and it saves the government money while stealing from the citizens.

Bitcoin Fixes This

Humanity cannot advance forward unless we solve the problem of money printing, and Bitcoin actually fixes this.

Bitcoin has all of the qualities of money as mentioned in “What Makes Money Valuable?” above, unlike all previous forms of money before, which have either lacked these qualities or failed to retain them.

Durability isn’t a problem for bitcoin, as it’s completely digital money that can’t be destroyed or withered like paper money or gold. Bitcoin is extremely portable and can be stored or transferred anywhere in the world with ease, as it is not bound to border restrictions — you can send money to anyone in the world no matter where you are, with it arriving safely and quickly.

Bitcoin is the most divisible form of money humanity has ever experienced. Whereas the U.S. dollar is divisible into 100 pennies at most, 1 bitcoin is divisible into 100 million units called satoshis (or “sats” for short). Bitcoin has strong uniformity as each unit is essentially the same as all others.

BTC is accepted by more and more people all over the world every day. We’ve seen a large increase in people, small businesses and large institutions that have come to accept bitcoin as money since it was introduced.

Lastly, the bitcoin supply is capped at 21 million, as mentioned above, and, as a result, it has a finitely limited supply. Historically, money printing was inevitable, but not anymore. Everyone abides by the rules of the network enforced by the nodes and miners, which keep everyone else honest and prevent anyone from ever increasing the supply cap, ever.

You can look at historical forms of good money as having a set of “rules” that the system is based on, until someone comes in and “cheats” the system for selfish gain. That money created by the cheater is unnatural and ruins the “game.” Bitcoin fixes this, because everyone and anyone is capable of running a full node to maintain their own exact copy of the Bitcoin ledger, which keeps everyone honest and prevents bad actors — especially when the nodes and miners are financially incentivized to do so!

Bitcoin is superior money compared to hyper-inflatable currency. It doesn’t bear the same problems that have come with forms of money in the past, and it prevents the issues mentioned above from happening again. History has shown that humanity has thrived when society had hard money, and the impacts of a currency that can never be hyperinflated look very promising. It has the potential to usher in a new Renaissance or Industrial Revolution.

And, last but not least, the Bitcoin network will never lie to you. It is open-source, meaning you can look at the code yourself, for free, right down to every last detail. BTC has an open ledger that lets you become your own bank, and the master of your money. With Bitcoin, you take back the power from the corrupted people you were blindly trusting.

This is a guest post by Nik Hoffman. Opinions expressed are entirely his own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The post Lies, Deception And Unnatural Money appeared first on Bitcoin Magazine.