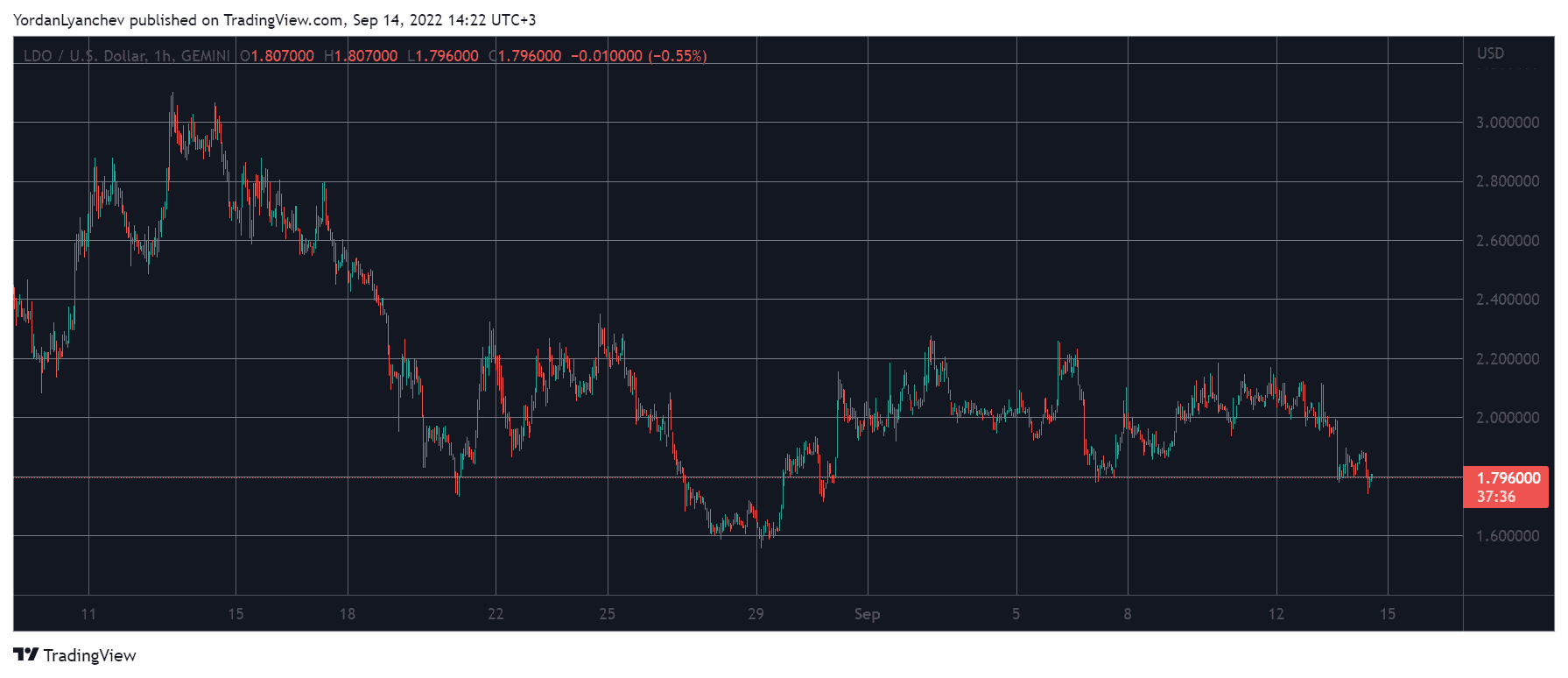

Lido Finance (LDO) Dumps 40% Monthly, Rebound Fails Ahead of Ethereum Merge

After posting heavy gains last month, bears took over the price of Lido Finance (LDO), posting double-digit losses.

Ahead of Ethereum’s biggest upgrade ever, the leading staker’s native token was in worrying territory.

- At the time of writing, LDO was trading at $1.78 after declining by nearly 10% in the last 24 hours. It lost more than 40% of its value over the past month as well.

- The token had been on a consistent uptrend leading up to the event but failed to hold momentum since mid-August as a result of slow demand for staking and mixed expectations for the Merge. Since then, its price movement has been rangebound.

- But many industry experts believe that the Merge could potentially become a “sell the news” event, further extending its downtrend.

- Lido happens to be the most popular Ethereum 2 staking-as-a-service provider. In fact, 31% of the entire amount of ETH staked is via Lido, according to a recent report by Nansen.

- Stats also reveal that Lido has deposited more than 4.14 million of the ETH into the Ethereum 2.0 smart contract on behalf of its users.

- The decentralized online liquid staking protocol was initially established as a counter-risk to centralized crypto exchanges raking in the majority of staked ETH, considering that these platforms are required to comply with jurisdictional regulations.

- However, Lido’s dominance became a bone of contention within the Ethereum community as fears of centralization emerged.

- The report highlighted the need for the staking pool to be sufficiently “decentralized” in a bid to maintain its position as censorship resistant as LDO ownership was observed to be concentrated.

The post Lido Finance (LDO) Dumps 40% Monthly, Rebound Fails Ahead of Ethereum Merge appeared first on CryptoPotato.