Lido Community Weighing On-Chain Vote to Deploy Version 2 on Ethereum

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.

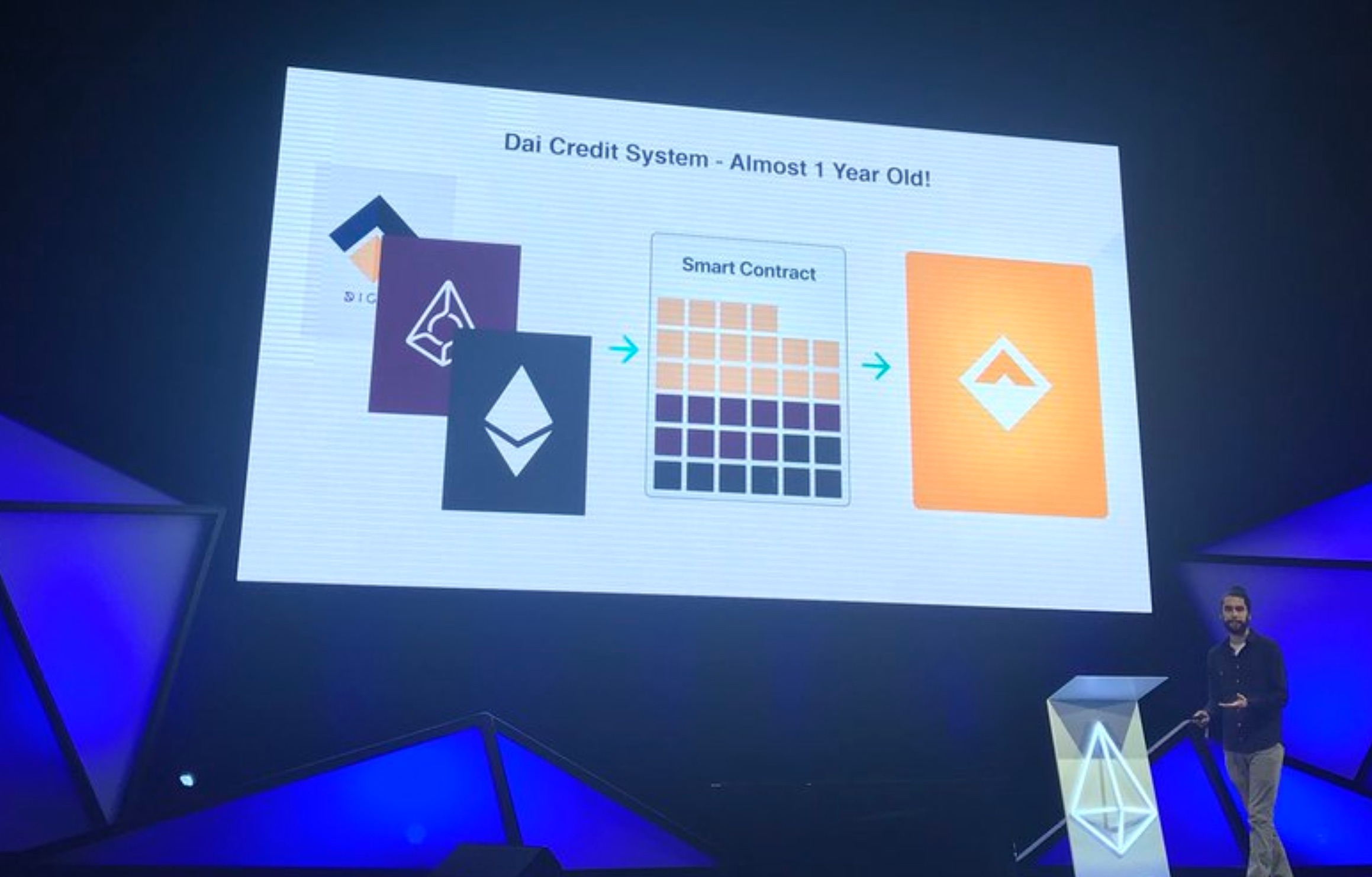

Lido, the dominant liquid staking platform, is voting to execute its second iteration on the Ethereum blockchain, a pivotal moment for users in the decentralized finance (DeFi) community that want further decentralization and better on and off ramps into Ethereum’s staking ecosystem.

Lido’s Twitter account is calling v2 the “most important upgrade to date” since its launch in December 2020 as Ethereum is Lido’s first and largest market for liquid staking tokens.

With two main focal points, ETH staking withdrawals and the introduction of a “Staking Router” said to increase participation from a more diverse set of node operators, v2 on Ethereum comes as Lido commands the lead as the largest liquid staking platform in the DeFi space, with $11.77 billion in total value locked across the Ethereum ecosystem, per DefiLlama.

According to a blog post, “The implementation of withdrawals coupled with the Staking Router proposal will contribute to an increase in the decentralization of the network, a more healthy Lido protocol, and enable the long-awaited ability to stake and unstake (withdraw) at will, reinforcing stETH as the most composable and useful asset on Ethereum.”

The vote ends on May 15. If it passes, Lido’s smart contracts will upgrade and v2 will go live.

At press time all participating LDO token holders have voted to deploy the upgrade. LDO, the governance token for Lido, has jumped 16% in the past 24 hours to $1.89, per CoinGecko.

Edited by Danny Nelson.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/3511dac7-07ba-4423-9003-82143ec00eab.png)

Sage D. Young is a tech protocol reporter at CoinDesk. He owns a few NFTs, gold and silver, as well as BTC, ETH, LINK, AAVE, ARB, PEOPLE, DOGE, OS, and HTR.