Libra in Congress: A Chance to Define What Bitcoin Is and What Libra Isn’t

Facebook finished up its second round of Congressional hearings yesterday, marking the end of the beginning for what some U.S. Congressional members consider the social media platform’s ill-advised venture into the monetary realm.

The House of Representatives Financial Services Committee hearing, following in the footsteps of the Senate Banking Committee’s own earlier this week, went on for a grueling six-and-a-half hours. Libra project head, David Marcus, spent most of this time trudging through a repeat of some of the Senate’s concerns for AML and anti-terrorist funding practices, while confronting questions about libra as a systemic risk to the USD’s dominance.

House members did not skewer Marcus over Facebook’s past privacy abuses, but that didn’t stop a few anxiety-laced comments (and one outlandish one) from slipping out during the hearing. Representative Brad Sherman, for example, amazingly said that “Libra may endanger more Americans than [911].” More sensibly, Ann Wagner wants to make sure that “the dollar is not overtaken as the leading international currency that undergirds global economic stability.”

The most notable difference between the House’s hearing and the Senate’s, though, was the thing that makes Libra relevant in the first place: Bitcoin.

Bitcoin Reclaiming the Conversation

Bitcoin, blockchain technology and cryptocurrencies in general were markedly absent from the Senate’s time with Marcus, but in the House, Bitcoin was at least on the periphery of the discussion — as well as at the center of many of the representatives’ inquiries into Libra.

“The reality is, whether Facebook is involved or not, change is here, digital currencies exist, blockchain technology is real and Facebook’s entry into the world is just confirmation, albeit at scale,” Representative Patrick McHenry, a ranking member of the committee, said in his opening statements. “The world that Satoshi Nakamoto … envisioned, and others are building, is an unstoppable force. We should not attempt to deter this innovation, and governments cannot stop this innovation. Those that have tried have already failed … So the question then becomes: What are American lawmakers going to do to meet the challenges and the opportunities of this new innovation?”

With his opening statement, McHenry broadened the hearing’s rhetorical scope. No longer was it solely a discussion of Libra, but of cryptocurrency and blockchains writ large and how Libra fits (or doesn’t fit) into this ecosystem.

“[We] must differentiate between Libra and other digital currencies like bitcoin,” Representative Ted Budd said.

“Bitcoin is 10 years old, and now suddenly, magically, Congress is responding. After more than a decade, Congress has apparently started to care. I’m glad that Congress is paying attention to the technology that, just like the internet, could upend the way we do everything in our lives,” Representative Tom Emmer emphasized.

Spoken as they were during Marcus’ testimony, these statements were more charges to Congress than lines of questioning.

“This is not a partisan technology,” Emmer, who co-chairs the Congressional Blockchain Caucus, continued about Bitcoin and blockchain more broadly. “Unfortunately, some people want to unnecessarily suppress or ban it. They fear it. Nothing has been more apparent in this committee than the blind aversion to change … I hope that will be the same approach when discussing the depth and breadth of cryptocurrency, which Libra does not represent, but thankfully, amplifies our discussion around.”

Congressman Warren Davidson, who helped to introduce the Token Taxonomy Act, also expressed his hope that the “committee would hold more hearings on cryptocurrencies.”

Libra vs. Bitcoin

“Libra represents an incredible opportunity to define what it is not. It offers an incredible opportunity for this committee to learn more about actual cryptocurrencies,” Emmer said in the conclusion of his speech.

The end of the testimony seemed to transition into sort of Bitcoin and blockchain 101 session. This focus carried over into the blockchain industry panel hosted afterward. Both offered further opportunities to delineate key differences between Libra and true cryptocurrencies.

Libra “borrows aspects of cryptocurrencies but isn’t a cryptocurrency,” Coinshares CEO Meltem Demirors said during the panel. “Bitcoin is a technology … a network … and a cryptocurrency. The technology is not regulated. Much like the internet, it could be considered a public good … Libra is not like bitcoin.”

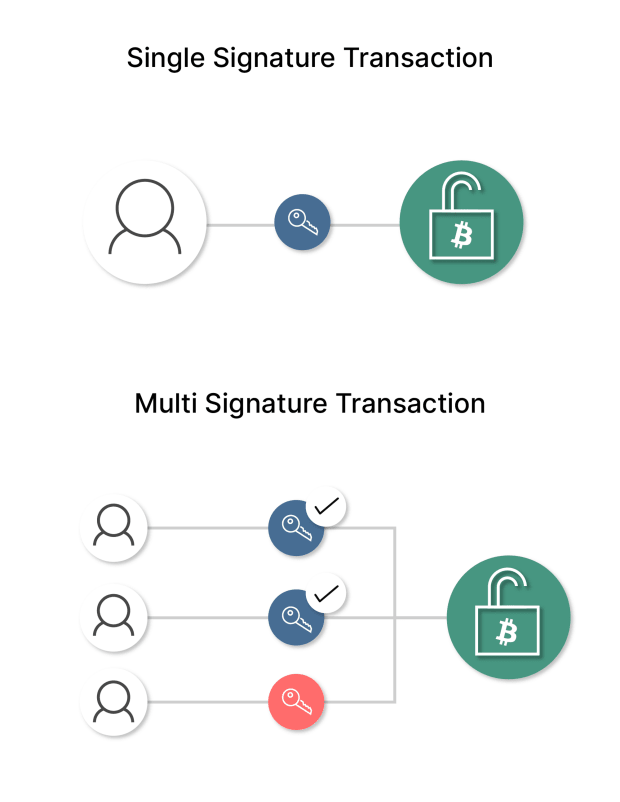

She continued to explain that Libra’s plutocratic structure would preclude the decentralized, permissionless access that makes something like bitcoin a true cryptocurrency.

“There is a tremendous anticompetitive component,” she said. “This is a private group of 100 corporations … who will be responsible for determining what code Libra runs on, who gets to run nodes and participate in the network and what applications and transactions and products and services will be allowed. This is in sharp contrast to what bitcoin and other open, distribute cryptocurrencies are. They are open for anyone to build on.”

The general consensus in the room, as Davidson’s remarks typified, was “not to conflate cryptocurrency with [Facebook’s efforts].” Most Representatives, even those less seasoned than Davidson, McHenry and Emmer, seemed to grasp the differences. Representative Trey Hollingsworth, for instance, said Libra is “different than a peer-to-peer technology” because it has a “central piece” with which to conduct AML compliance.

This central piece was at the core of defining what Libra is not. Despite Marcus’ insistence on Libra’s decentralization (that Facebook will be “1 of 100” in the Libra Association), Congressional members butted up against the paradox of Facebook spearheading a distributed effort and saying there’s no need to trust them as a central authority.

“But that’s not entirely true, is it?” Maxine Waters asked in her questioning. “The project was Facebook’s idea, Facebook is spearheading it and recruiting partners, Facebook’s subsidiary Calibra will provide consumers with a digital wallet to store libra tokens. As I understand it, no member of the association has paid anything towards the project.”

Representative Jesús Garcia likened Facebook to “the Godfather” of the Libra cabal.

What Is Libra, Then?

Recognizing that Libra is a different animal than Bitcoin, much of the hearing revolved around the question, “What is Libra?”

“Libra is a reserve-backed digital currency,” Marcus replied. “Under current U.S. law, it might be a commodity, but we see it as a payment tool.”

Bitcoin, along with a few other decentralized cryptocurrencies, is considered to be commodity under U.S. law. Most tokens, however, are considered securities because their development is centralized. With these taxonomies in perspective, Congress struggled to bring Libra’s specific classification into focus.

“What we’re struggling with [is] ‘What are you?’ You’re a medium, an intermediary, you’re facilitating financial transactions,” Representative Ed Pearlmutter said. To him, he added, that sounds a lot like a bank.

Congressman Mark Meek thought so, too, asking Marcus whether “Facebook and Libra Associations [would be] willing to establish bank holding companies.”

“You said a while ago that you were going to offer more financial services down the road, but you also said you’re not a bank. Which one is it?” he continued, alluding to Marcus’ claim that “they will not provide banking services.”

Meek, citing a Wikipedia page on the definition of fiat currency, also compared Libra to a fiat currency built on top of other fiat currencies.

Representative Katie Porter asked how these “basic concepts of [Libra are] fundamentally different from … Wildcat banks” established in the 1800s, which issued currency and IOUs on top of government tender.

Marcus’ equivocating responses to questions like these offloaded the banking responsibilities onto wallets and other service providers on the network, which Marcus insisted will provide competition to Facebook’s Calibra wallet.

Less than a bank to some politicians, Libra’s plans to hold a basket of customer deposits and government securities makes it look like an exchange-traded fund. When McHenry asked Marcus about this, he doubled down on his stance that Libra is a payment tool “more like … PayPal,” Marcus’ former employer.

Cryptocurrencies Are the Future: Will the U.S. Stand in the Way?

Congress’ inability to define how Libra fits into the U.S.’s regulatory mold exposes the perfunctory state of the U.S.’s approach to cryptocurrency and blockchain technology. Unlike other countries that are “ahead of the U.S. in providing regulatory clarity and guidance” for the sector, as McHenry put it, the U.S. could deter innovation with its sluggish — and at times, hostile — response to the industry.

“I think, given the commentary we’ve heard today, we are discovering why a decision has been made to locate in Switzerland instead of the U.S.,” Representative Andy Barr teased during his time on the mic.

Congressional members during both the Senate and House hearings were hard on Facebook for deciding to incorporate in the famous tax haven, though others, like McHenry and Barr, recognized that Switzerland has a favorable regulatory climate for fintech and crypto.

Satoshi willing, the topics discussed in yesterday’s hearing made crypto more concrete for U.S. lawmakers and laid a foundation to build a more suitable framework for crypto companies in the future. At the least, Libra got Congress talking about cryptocurrencies, and it seemed more receptive of Bitcoin than its corporate copycat.

“It is inevitable that the Bitcoin ecosystem will continue to move forward,” Demirors said during the panel. “The question is, where?”

Following these hearings, Congress is now weighing this question more than ever — and whether or not it will lean into, or against, the trend.

The post Libra in Congress: A Chance to Define What Bitcoin Is and What Libra Isn’t appeared first on Bitcoin Magazine.