Leveraged Funds Take Record Bearish Positions in Bitcoin Futures

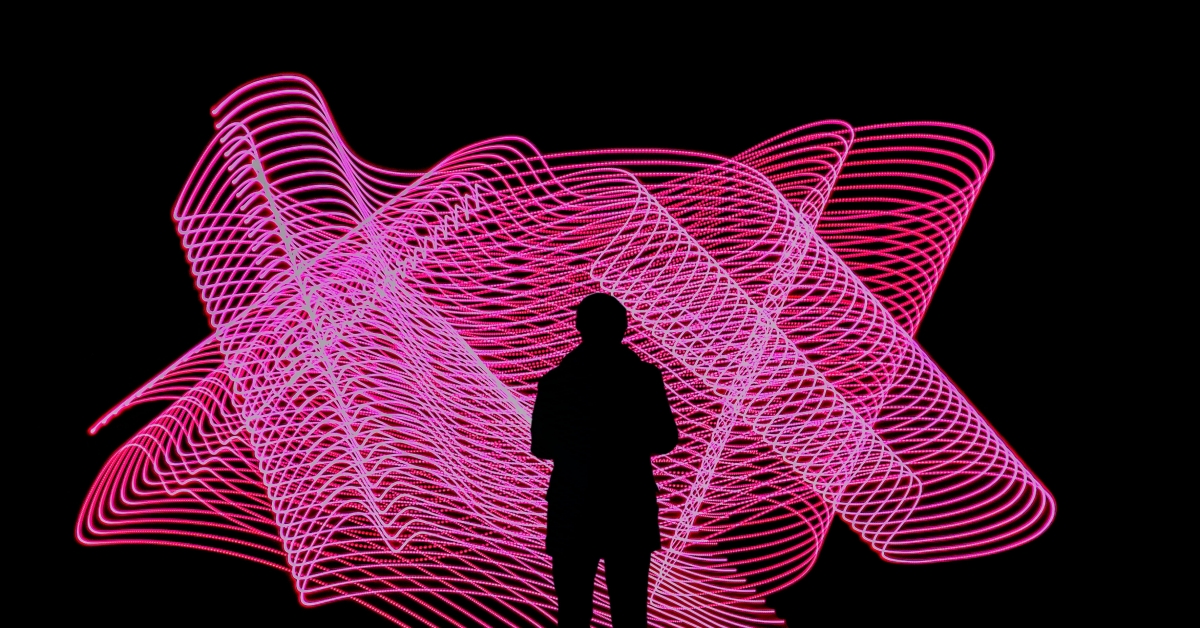

CFTC report data on bitcoin futures (chart via Skew)

Leveraged Funds Take Record Bearish Positions in Bitcoin Futures

Bearish bets in bitcoin futures from leveraged funds recently rose to record highs on the Chicago Mercantile Exchange (CME) – though that doesn’t necessarily imply a fresh sell-off is coming.

- In the week ended Aug. 18, leveraged funds – hedge funds and various types of money managers that, in effect, borrow money to trade – increased their short positions by 110% to a record high of 14,100 contracts.

- The data comes from a Commitment of Traders (COT) report published by the U.S. Commodity Futures Trading Commission (CFTC) on Friday.

- Institutional investors held 1,400 short contracts last week too, per the COT; a number that has also more than doubled

- “Record shorts [by leveraged funds] were mostly likely a function of attractive cash and carry levels,” according to Skew, a crypto derivatives research firm.

- “Cash and carry” is an arbitrage strategy that seeks to profit from mismatches in pricing between a derivative product and its underlying asset.

- The method involves buying the asset on the spot market and taking a sell position in the futures market when the latter is trading at a significant premium to the spot price.

- Futures prices converge with spot prices on the day of the expiry, giving a risk-free return to a carry trader.

- Bitcoin futures, due to expire on Aug. 28, were trading at a premium of $400 earlier this month, as per TradingView data.

- As the highest premium since April, that may have prompted leveraged funds to make carry trades. Other exchanges like OKEx also witnessed a surge in the futures premium, as discussed last week.

- The premium has declined to sub-$100 levels in the past three trading days (CME futures are closed on Saturday and Sunday), making carry trades relatively unattractive right now.

- Skew, therefore, expects the next CFTC report for the week ended Aug. 25 to show a decline in short positions.

Spot prices

- Having put in lows below $11,400 over the weekend, bitcoin has rebounded to over $11,790 at press time, according to CoinDesk’s Bitcoin Price Index.

- A series of higher lows (marked with arrows) seen on the daily chart suggest the path of least resistance is to the higher side.

- The low of $11,367 registered on Saturday is the level to beat for the bears.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.