LetsExchange: Exchange Guide & Review

Cryptocurrencies have taken center stage in the fintech industry throughout the past year mainly because of their explosive growth and unparalleled bull market.

Reaching a total market capitalization of almost $3 trillion in 2021 cemented the industry as something that can no longer be ignored or written off lightly. With this came tremendous demand for cryptocurrency exchange services.

And while there are many centralized trading venues currently available, most of them require rigorous know-your-customer (KYC) verification processes and many other procedures that can be quite tiresome.

This is where LetsExchange steps into the picture – a multicurrency exchange aimed at those who don’t want to register anywhere.

LetsExchange brings forward a one-stop multicurrency exchange service. It’s built by a team of cryptocurrency experts with over ten years of experience in fintech and blockchain.

Quick Navigation

- LetsExchange: Quick Swaps to Crypto Users Worldwide

- LetsExchange: Step-by-Step How to Use Guide

- What Currencies Does LetsExchange Support?

- The Execution Speed of the Transactions

- What Are the Exchange Rates?

- What are the Transaction Fees?

- Is LetsExchange Secure?

- Conclusion, pros and cons

LetsExchange: Quick Swaps to Crypto Users Worldwide

One of the first to consider when using LetsExchange is that there’s no requirement for registration. In essence, this allows users to start trading and exchanging quickly, so long as the current rate is right for them. The exchange process is fully automated, and it’s quick to execute various swaps.

The interface is easy-to-use, and it’s pretty quick to get used to it. It’s designed for an effortless swapping experience as all you have to do is pick a currency pair, enter what amount you want to swap, your address, and hit the exchange button.

LetsExchange also uses the so-called SmartRate technology that’s designed to cherry-pick the most preferable rates across various major exchanges for every single swap. There’s also an abundance of currencies and currency pairs available.

With all that in mind, let’s have a look at how to actually use it.

LetsExchange: Step-by-Step How to Use Guide

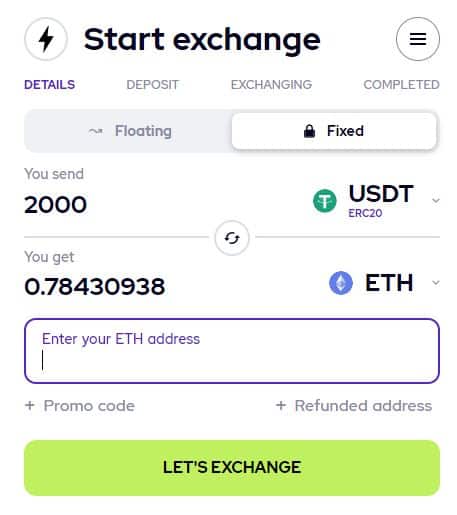

The process is quite simple, and once you get through it the first time, it becomes rather intuitive. The first thing you need to do is pick a currency pair and then enter the amount you wish to send. In this case, we’ve used USDT and ETH:

You need to input the amount you want to send, and the interface will automatically calculate the respective amount you will receive. If you are happy with the rate, you can proceed to the next step, which is to input your receiving address for the selected coin.

This is also where you can input a promo code if you have one available.

It’s also important to select a floating or fixed rate. The important thing to consider here is that with a fixed rate, this will exclude the slippage for 30 minutes, whereas the floating rate may change.

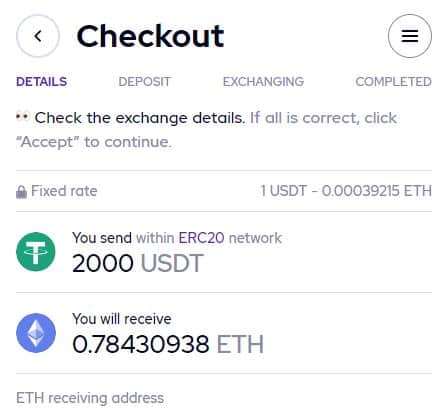

After this, you will get a new window with the terms of the trade that looks like this:

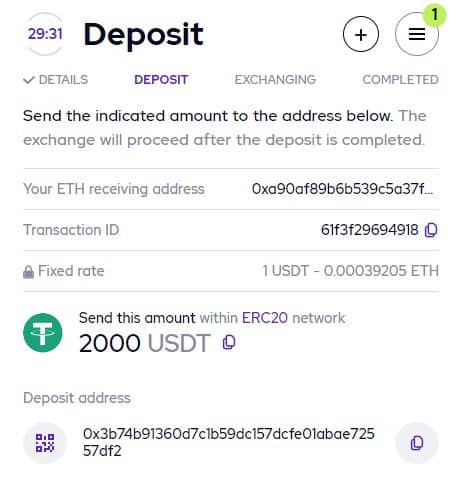

If you are happy with the rate, all you need to do is hit the big green accept button. Once you do this, you will need to deposit the ETH to the deposit address that you will get in the next window:

The exchange will proceed once you complete the deposit. That’s pretty much all you need to do. However, there are a few more things that have to be clarified before that.

What Currencies Does LetsExchange Support?

Presently, the list is considerable as there are over 350 cryptocurrencies that users can swap between, including Bitcoin, USDT, Ethereum, Zilliqa, AAVE, Binance Coin, Fantom, and so forth.

The Execution Speed of the Transactions

This would vary from transaction to transaction. It depends on many factors because the speed of the transaction is dependent on the network load of the blockchain that you’re using. For instance, if you’re trying to swap tokens on Ethereum’s network – it would depend on the network congestion how long the transaction would take.

Therefore, it might not be the best idea for you to attempt a swap while the selected network is congested because your transaction might fail or get seriously delayed. This is not the best option for traders.

What Are the Exchange Rates?

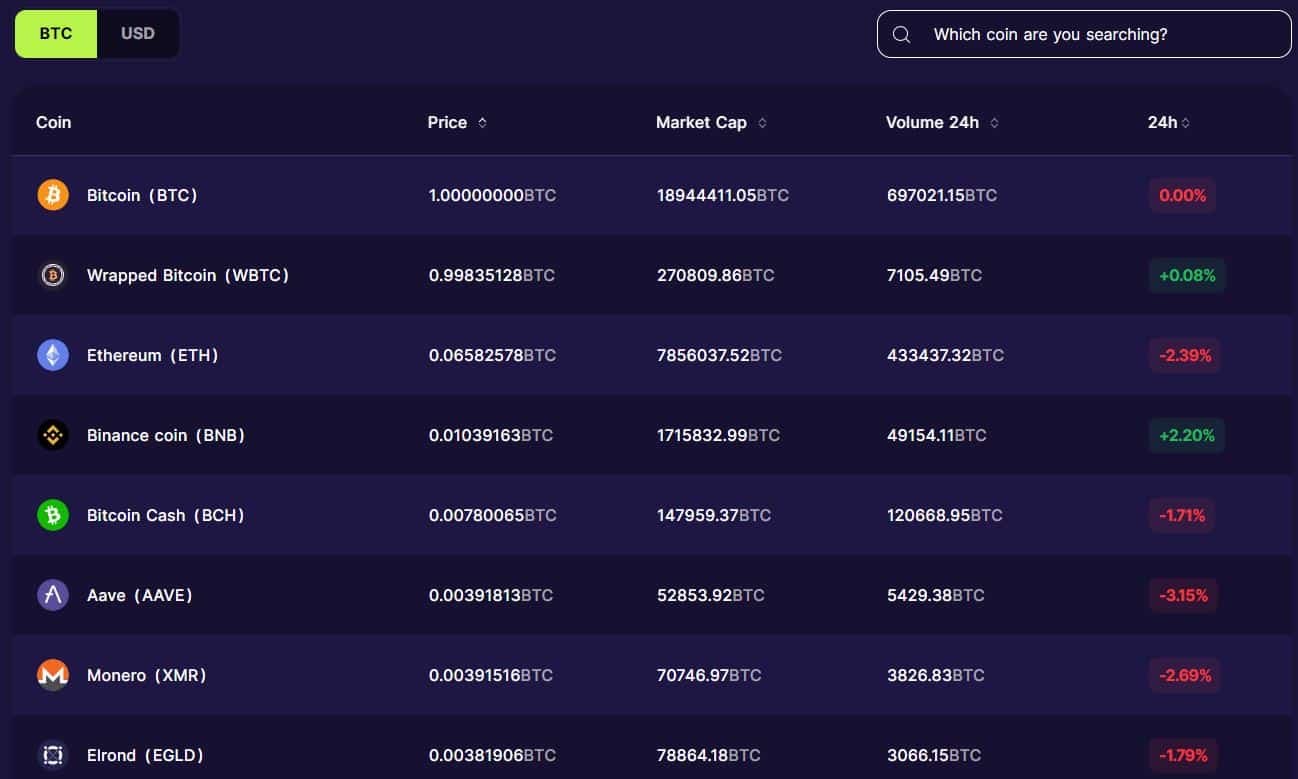

There are so many cryptocurrencies that are available on LetsExchange, and it’s important to take a look at the exchange rate before you complete a transaction. This can happen on the official website, and users can choose whether to denominate the rate in BTC or USD:

What are the Transaction Fees?

All transaction fees depend on the network that you’re using, similarly to the transaction time mentioned above. In any case, the number that you see as final during the swap includes the network fees as well.

Is LetsExchange Secure?

LetsExchange claims that it’s a non-custodial and registration-free service that doesn’t require the user to provide any financial or private data apart from a public receiving address. As such, the assets should be secured by the user’s own wallet, whereas the trade amount is exchanged automatically without intervention.

In addition, the website itself has implemented some additional security measures such as DDoS protection, strong security protocols, and an SSL certification preventing data interception.

However, it’s worth noting that there are some users who have complained about their transaction taking a very long time to process, which might be explained by heavy network loads.

Conclusion

LetsExchange seems like a convenient way to swap between cryptocurrency assets if you don’t want to go through a centralized exchange and verify your identity online. As such, it’s a good option for people who want to remain anonymous while transacting with cryptocurrencies.

On the other hand, there are some obvious drawdowns such as slower transaction speeds compared to centralized exchanges, as well as relatively higher network fees compared to the fees paid on CEXes.

Pros

- Easy-to-use interface

- Seamless swap platform

- Doesn’t require KYC (if that’s what you’re looking for)

- Cross-chain capabilities

Cons

- Slower transaction speed

- Higher transaction costs because of on-chain fees