Lending Platform Maple Prepares New U.S. Treasury Pool; MPL Token Rises 23%

Featured SpeakerBowTiedBull

PresidentBowTied Jungle

The pseudonymous investor BowtiedBull explores the BowtiedJungle, where citizens swap advice on investing, job-seeking, …

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)

Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.

Featured SpeakerBowTiedBull

PresidentBowTied Jungle

The pseudonymous investor BowtiedBull explores the BowtiedJungle, where citizens swap advice on investing, job-seeking, …

Blockchain-based crypto lending protocol Maple Finance is preparing to launch a lending pool that invests in U.S. Treasury bonds, co-founder and CEO Sidney Powell said during a protocol community call on Tuesday.

Powell also said Maple is planning to hold a community vote later this year about new tokenomics and utility for its native token, MPL.

MPL rallied 23% ahead of the community call, which CoinDesk attended.

The developments come as the platform is recovering from a disastrous year for crypto lending that was plagued with insolvencies of borrowers. After the FTX exchange’s sudden implosion in November Maple experienced $36 million of credit defaults, causing hefty losses for liquidity providers.

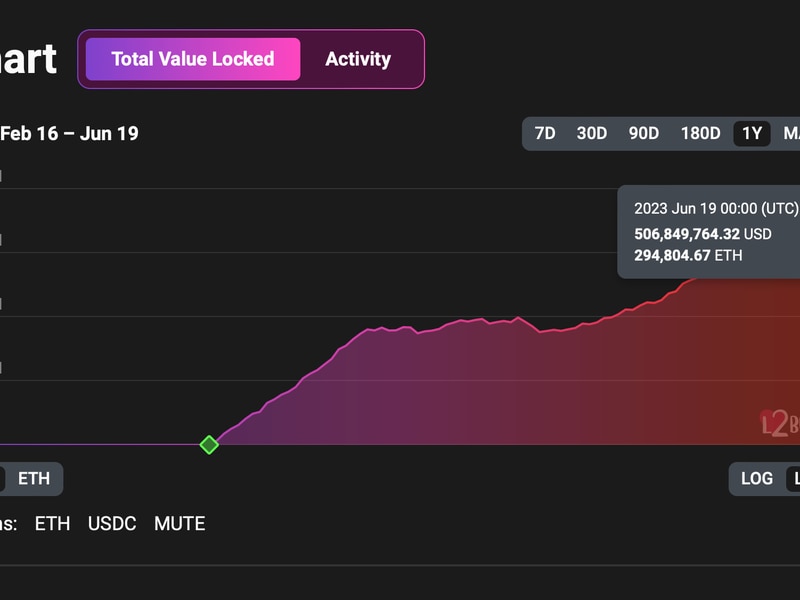

The total value locked (TVL) on the protocol, a popular metric in decentralized finance, dropped to $40 million from $930 million last May, per data by DefiLlama. The MPL token plummeted to as low as $4 from an all-time high of $68.2 last April.

Maple released an upgraded version of its platform late last year and started a new tax receivables lending pool last month as part of the protocol’s effort to position itself as a credit platform connecting traditional finance and blockchain technology.

“Real-world asset lending is going to be a huge trend,” Powell said during the call.

The upcoming pool will allow accredited investors and corporate treasuries based outside of the U.S. to invest their stablecoin holdings in U.S. Treasury bonds and earn a yield.

The protocol expects demand for the pool because crypto investors are looking for yields in traditional assets such as government bonds, while trust in banking facilities has decreased after recent bank implosions in the U.S.

Maple is also working on additions to its lending offerings, Powell said during the call. A new feature, internally referred to as Maple Prime, will let borrowers actively manage their collateral positions. The protocol plans to expand into open-term lending, which will let borrowers to open credit lines to borrow without a maturity date.

Edited by Oliver Knight.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)

Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/imb09KsNh9afdgQ4P24gQvq559Y=/arc-photo-coindesk/arc2-prod/public/DMIIPXHVZFBCPMOBTSEJ2YYG6U.png)

Krisztian Sandor is a reporter on the U.S. markets team focusing on stablecoins and institutional investment. He holds BTC and ETH.