Legacy Trust Launches Digital Asset Pension Plan

In what it claims is a world’s first, Legacy Trust Company Limited is launching a voluntary pension plan open to employers and the self-employed for which contributions and the underlying portfolio can include digital assets.

“Investors are moving beyond speculation — they want to use digital assets and bring them into a diversified portfolio,” Vincent Chok, CEO of Legacy Trust, told Bitcoin Magazine. “We see this retirement plan as an important step towards the mainstream adoption of digital assets and a compliant way for early adopters and recent investors alike to make a long-term play in the cryptocurrency space.”

The plan is fully compliant with regulations in Hong Kong, where the company is based, and open to citizens from anywhere in the world as long as they are gainfully employed. Plans can be funded voluntarily or directly from salaries and can include fiat currencies alongside digital assets. The fund will invest in bitcoin, ether and other cryptocurrencies.

Legacy Trust touts the pension plan as one that encourages hodling and resolves the potential tax issues that come with selling crypto assets by placing these assets in a fund that is paid out upon retirement.

“The new product addresses various tax concerns for digital asset holders, and eliminates the temptation to sell during price dips thanks to limitations on accessing the capital assets,” according to a press release shared with Bitcoin Magazine.

Legacy Trust has offered pension plans for over 25 years but has since pivoted to serve the cryptocurrency community. In April 2019, it formed a partnership with hardware wallet manufacturer Ledger to create an institutional-grade, multi-authorization wallet called Ledger Vault. In June 2019, it worked with stablecoin project TrustToken to launch TrueHKD.

The First Digital Asset Pension Plan?

Though its regulatory clearance in Hong Kong and availability to the self-employed appear to be unique for a digital asset pension plan, Legacy Trust’s offering is not completely novel.

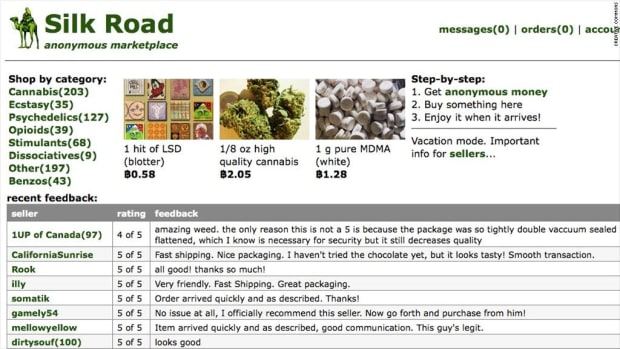

In February 2019, Morgan Creek Digital solicited significant investments from both the Police Officer’s Retirement System and the Employee’s Retirement System of Fairfax County, Virginia. Because Morgan Creek’s venture fund holds cryptocurrencies, including bitcoin, this was reported as the first time a U.S. pension fund had invested directly in cryptocurrency assets.

Still, this appears to be one of the only, if not the first, options for the self-employed to invest in a digital asset pension plan, and it may be a powerful option for employers who want to do the same without going through a venture fund, such as Morgan Creek’s.

Legacy Trust did not respond to Bitcoin Magazine’s request for comment in time for publication.

The post Legacy Trust Launches Digital Asset Pension Plan appeared first on Bitcoin Magazine.