Ledger Taps $1.4 Billion Valuation After Securing $109 Million Funding

As the digital asset market grapples with regulatory confusion, Ledger’s renowned catchphrase, “not your keys, not your coins,” has proven increasingly popular among its clientele.

On March 30th, Ledger, the firm behind hardware wallets like the Nano S and Nano X, announced the successful closure of its Series C extension fundraising round, raising a total of $109 million to optimize and expand wallet production.

Ledger is proud to announce our Series C extension fundraising round.

We continue our mission of bringing ease-of-use and uncompromised security to your digital value.

Read what our CEO @_pgauthier has to say:https://t.co/JSHyi5jKIQ pic.twitter.com/aGi2FhOXCs

— Ledger (@Ledger) March 30, 2023

Thanks to the funding, Ledger has attained a valuation of €1.3 billion – nearly $1.418 billion). According to Bloomberg, the french hardware company plans to have a second and third closing in April, owing to high investor interest.

Among the institutional investors participating in the latest funding round are Morgan Creek, Cité Gestion SPV, Digital Finance Group, VaynerFund, True Global Ventures, and 10T.

Ledger Wants to Grow Despite Regulatory Uncertainty

Despite the regulatory uncertainty in the digital asset industry, Ledger continues to thrive, expanding to the extent that it now safeguards almost 20% of the world’s cryptocurrencies.

In an official statement, Pascal Gauthier, Chairman & CEO of Ledger, expressed his gratitude to investors who have supported the company’s growth, welcoming new ones who will help the firm lead the “undeniable revolution of value and hardware.”

According to Gauthier, the funds raised will expedite the firm’s mission to distribute its devices to hundreds of millions of people in the crypto ecosystem. These funds will catalyze a new generation of devices built with safety in mind when managing digital assets and other products using blockchain technology.

“Today, Ledger announced our funding round. I’m grateful for our long-term investors’ continued support, and I welcome the new investors backing the current undeniable revolution of value and hardware. These funds will accelerate our mission to bring a new generation of secure consumer devices to hundreds of millions exploring critical digital assets and blockchain-enabled technology.”

Gauthier asserted that despite the various challenges facing the digital asset industry, Ledger remains a “safe haven for customers,” particularly in periods of volatility and regulatory confusion, a fact that is evident in the surge of demand for hardware wallet devices.

Leadership Needs Innovation

Ledger is committed to continuous innovation and maintaining its market position, Gauthier explained, emphasizing the need for secure hardware devices that cannot be supplanted by mobile phones due to their specific characteristics focused on security.

For now, Ledger’s primary focus is on enhancing the user experience via software, enabling the integration of new cryptocurrencies, blockchains, services, and other tools to transform Web3.

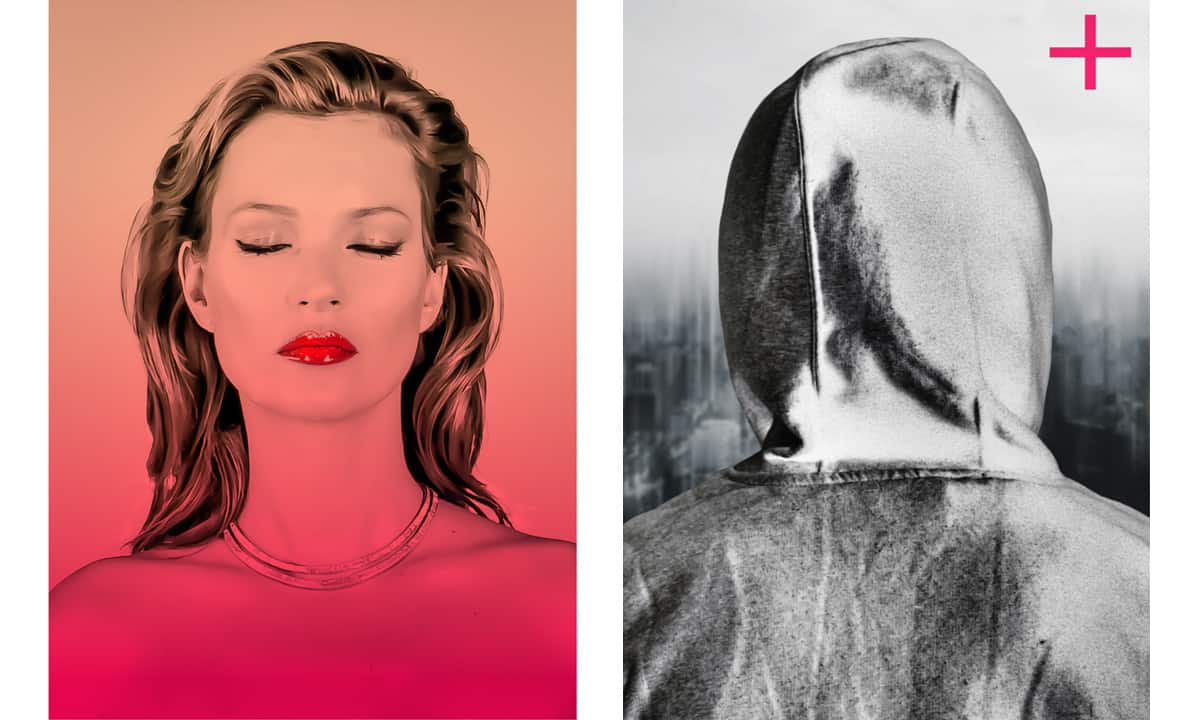

As reported by CryptoPotato, the company’s latest product, the Ledger Stax, is set to go on sale sometime in April 2023 for around $279.

As the image above suggests, the new wallet boasts a modern and innovative design akin to the iPhone, a result of Ledger’s partnership with Tony Fadell, co-creator of the iPod and iPhone.

The post Ledger Taps $1.4 Billion Valuation After Securing $109 Million Funding appeared first on CryptoPotato.