Last Week In Bitcoin: Billionaires, Texas, And Mining

Ray Dalio discussing his bitcoin investment, Texas pushing through a bill that provides legal framework, and more in this weekly update.

Last Week In Bitcoin is a new segment covering the week that occurred in Bitcoin, with all the important bits and some analysis.

Summary

Despite what the charts and current price may say, last week was a bullish week in Bitcoin. Billionaire Ray Dalio confirmed he is holding bitcoin, activist investor and former bitcoin doom prophet Carl Icahn expressed interest in pursuing crypto in a “big way” and Texas pushed through a bill that will provide a legal framework for bitcoin in the state, paving the way for Texas to become a crypto hub. China and Iran cracked down on bitcoin mining for the umpteenth time, and prominent investors Elon Musk and Michael Saylor announced formation of their Bitcoin Mining Council.

Highlights

- Texas Law Creates Clarity For Bitcoin

- PayPal To Add Support For Third-Party Bitcoin Wallet Transfers

- Elon Musk, Michael Saylor Announce Bitcoin Mining Council

- PwC Survey: Bitcoin Will Hit $100,000 By The End Of The Year

- Biden’s $6 Trillion Budget Could Fuel Inflation Fears And Bitcoin Gains

A Chart To Consider

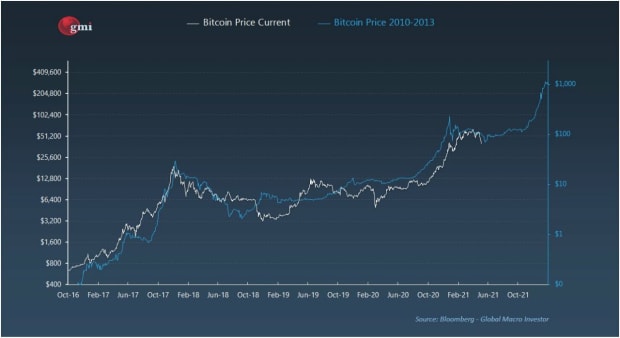

The chart above, courtesy of Bloomberg’s Global Macro Investor platform, compares bitcoin’s performance between 2010 and 2013 to between 2016 and now. As you can clearly see, we’re still overdue for a decent bull run which could likely peak somewhere around $400,000.

Of course, there are a lot more eyes on bitcoin this time around compared to a decade ago. The fear, uncertainty and doubt has increased as the media, billionaires, and many others pile on the anti-crypto sentiment. As we’ve seen over the years, bitcoin is a global community and its sole focus is a decentralized financial system where the power is in the hands of the people. Some might say even negative news is good news as it will introduce new people to the idea of bitcoin, and as they research it they may very likely decide to invest themselves.

Bullish: Short Term

Prominent investors are piling into bitcoin almost weekly now. Last week’s news that Ray Dalio holds bitcoin and Carl Icahn is interested also, just reiterates that no one can ignore bitcoin as a logical investment anymore. As prominent investors come on board bitcoin is perceived as even more legitimate to former skeptics which often has a positive effect on the overall price, further fueling bull runs. This current run could likely chart somewhere in the region of $400,000 over the next year, as shown in the chart above, and discussed in my previous piece comparing bitcoin’s performance after each halving. The most recent halving took place last year, kicking off the current bull market.

Bearish: Long Term

In an almost ironic twist, my reasons for being bearish long-term are almost the same as why I am bearish short-term. Billionaire investors and public companies joining the bitcoin bandwagon is both good and bad for price action. If bitcoin does eventually hit anywhere close to $400,000, the billionaires are likely to liquidate their positions with a fat short-term profit in hand. Similarly, public companies having seen a tremendous return on investment will likely see activist investors push to sell their holdings and pay out dividends to investors. Microstrategy should be safe as Michael Saylor controls most of the voting rights, but what about the rest of the publicly traded companies?

Verdict

I have little doubt that the current dip-intensive market we’re seeing is bitcoin finding its new bottom and stabilizing before the next boom. Yes, there will likely be several 20-30% dips before bitcoin hits its next peak, as seen during the 2017 bull run. However, as more and more people and companies embrace bitcoin as the future of the financial system, the price should reflect the same.

It’s important to keep a watchful eye on Texas and its lawmakers. As the state opens up to a more favourable legal framework, it is likely to invite investors and companies alike to relocate to Texas.This should act as inspiration for more states perhaps even some countries to follow suit and embrace bitcoin. View Texas as a trial run for now, but it is likely the start of big things to follow.

The effort to ban or curb bitcoin mining by some countries is another cause for concern, especially considering how much of the bitcoin hashrate is coming from China. Yes, on a positive note this should spread our mining operations worldwide, which will have the positive effect of creating a more decentralized hashrate. On the other hand, the formation of the Bitcoin Mining Council is also cause for concern, as it’s pushing a form of centralisation onto bitcoin mining.Should more miners move operations to the US and join this council, the possibility of a new form of centralization of power in the mining community looms.

What I haven’t mentioned above, is an important piece of information that came to light this week – Apple’s interest in hiring an executive with crypto experience. Some may speculate that Apple could be preparing a currency of its own, however this is unlikely. The more likely scenario is that they are opening up to bringing Bitcoin and other crypto payments onto their Apple Pay platform, and likely allowing crypto for app payments and acquiring devices. This would be very bullish. It is unlikely however that Apple will use some of their nearly $200 billion cash stockpile to invest in Bitcoin.

Overall, my sentiment is that this is the ideal time to stack some sats and build your holdings. The market is stabilizing, and even if there are a few more dips over the next week a bull run is imminent.

This is a guest post by Dion Guillaume. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.