Last Market Watch of 2020: Bitcoin Price Eyes $30K, Polkadot (DOT) Breaks ATH

Despite retracing with over $1,000 after the latest all-time high, BTC has surged back up and reclaimed the $29,000 level. Some altcoins have expanded in value – Polkadot’s DOT has marked a new all-time high.

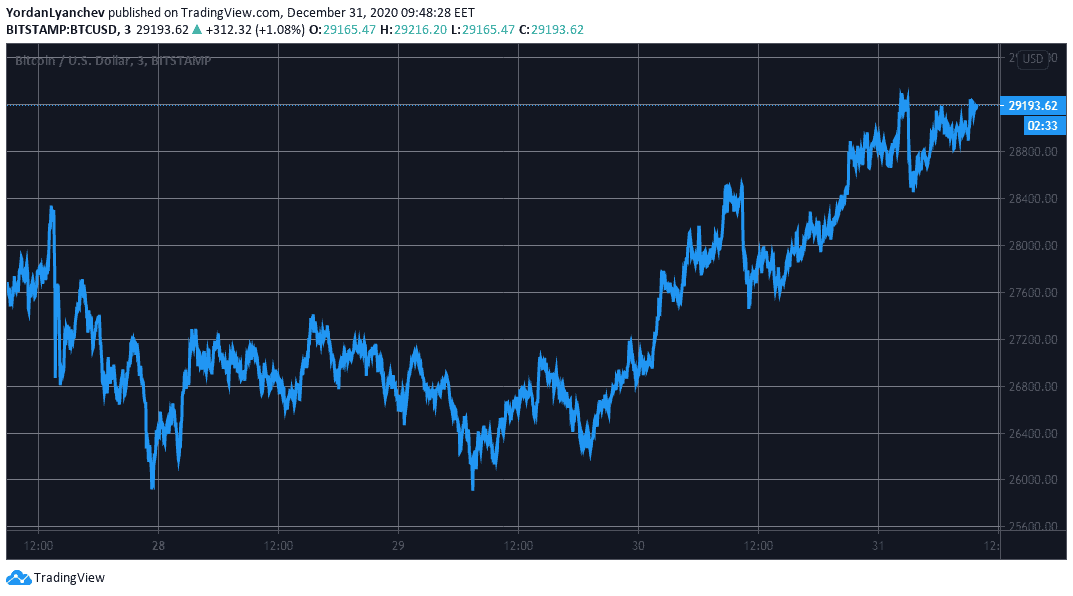

Bitcoin’s Latest ATH Above $29K

After a few days of relative stagnation around the $28,000 level, the primary cryptocurrency returned to its Q4 2020 bull run.

CryptoPotato reported yesterday that BTC charted two consecutive all-time highs in a day. The asset firstly reached $28,570 before initiating another impressive leg up – this time breaking above $29,000.

Ultimately, bitcoin’s latest ATH came at $29,300. Despite briefly retracing to 28,200, the cryptocurrency has recovered most losses and currently sits very close to that ATH again.

Nevertheless, if BTC retraces and heads south for a correction, the technical indicators suggest several significant support levels that could contain the possible drop. They are situated at $28,400, $27,850, $27,300, $26,750, and $26,300.

Ethereum Marks YTD High; Ripple Bounces Off

Following BTC’s gains, Ethereum has been on quite the roll in the past several days. The second-largest digital asset struggled beneath $600 before Christmas but has exploded to a new yearly high just a week later at $760. Despite retracing slightly to $750, ETH is still 2% up in a day.

Bitcoin Cash, Cardano, Litecoin, Chainlink, and Binance Coin have remained practically at the same price spot as yesterday with minor moves. However, Polkadot has doubled-down on its recent impressive price performance with another 10% surge to above $8. This is DOT’s newest YTD high.

Interestingly, Ripple has also added value on a 24-hour scale. After plummeting for weeks following the SEC charges and multiple exchanges delisting the token, XRP has increased by 8% since yesterday’s low.

Further gains come from Blockstack (7%), HedgeTrade (6%), Decred (6%), OKB (5%), and Gnosis (5%). Nevertheless, BTC’s dominance over the market is still above 70% as most alternative coins can’t keep up with bitcoin’s gains.

The total market capitalization has surged to $765 billion. Thus, it has neared the all-time high marked during the parabolic price increase in 2017/2018 at above $800 billion.