Largest Korean Exchange to Review Listings and Drop Failing Coins

Bithumb will start reviewing its cryptocurrency listings on a monthly basis, becoming the second South Korean exchange this month to update its listing policies.

The audits will determine whether the crypto exchange’s listed coins and tokens are eligible for continued trading, according to a story by Yonhap New Agency. The reviews will be undertaken by the newly formed Listing Eligibility Deliberation Committee, starting from September.

Bithumb is the eighth largest exchange in the world by reported volume, according to CoinMarketCap, and is the largest South Korean exchange.

The Yonhap report says that failing coins will be put on notice and then delisted after two months if no improvement is seen. It also said that those not making a passing grade would only be denied exchange trading rights. The coins themselves could still be traded elsewhere.

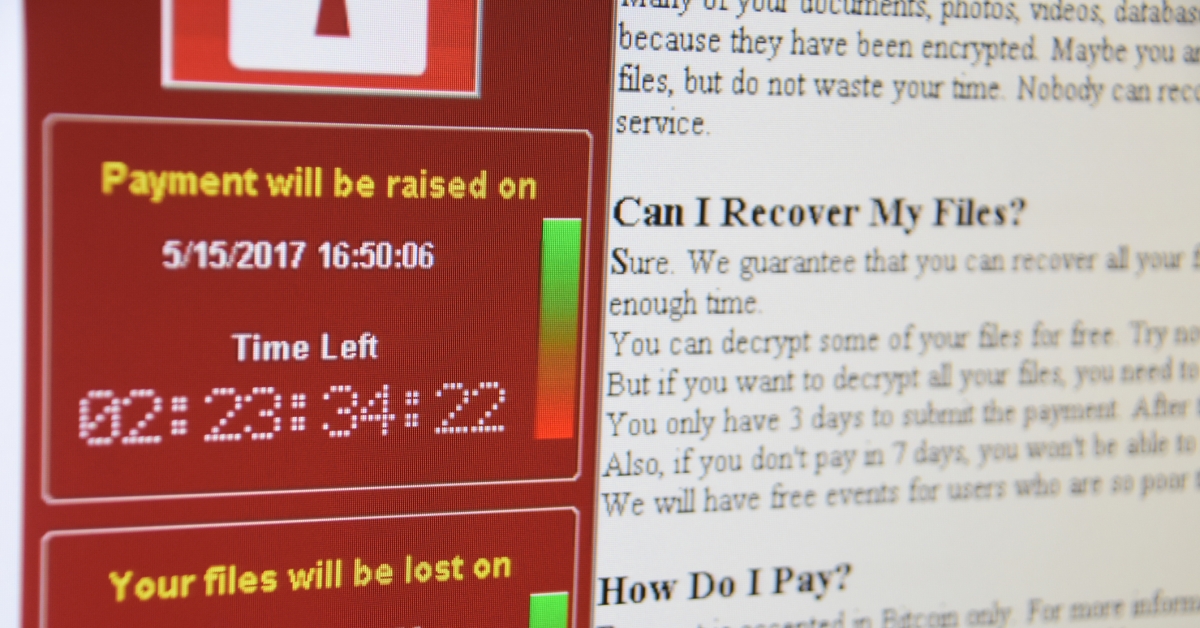

A number of triggers have been established for possible delisting. These include low trading volume, low market capitalization, lack of support from developers, problems with the underlying technology, illegal activity and requests from governing bodies.

The exchange says that the committee assembled will include attorneys and other professionals and that the process will be fair and transparent.

“We will strengthen the check on the technology development efforts and utility of cryptocurrency projects,” Yonhap quoted an exchange representative as saying.

The move by Bithumb comes amid a general upping of standards at exchanges as the South Korean authorities continue to crack down on crypto in the country and as banks tighten anti-money laundering procedures relating to the exchanges.

Earlier this month, Coinone hired CertiK to conduct a security validation. It then published criteria for coins wishing to list on the exchange, the third largest in the country and number 80 in the world. While Coinone’s move differs from Bithumb’s, in that it checks coins on the way in rather than on a rolling basis, both initiatives could improve the security and credibility of the trading platforms.

Bithumb was acquired in late 2018 by investors from Singapore. In March 2019, it was reported that the exchange would be cutting staff by about 50 percent. It suffered a theft of $13 million worth of crypto that same month.

Bithumb on phone photo via CoinDesk archives