Major Brazilian exchange Mercado Bitcoin has raised $200 million from SoftBank and will seek to increase offerings and penetrate new markets.

The biggest bitcoin exchange in Latin America, Mercado Bitcoin, has raised $200 million from SoftBank as announced by its parent company 2TM Group. The fundraising is the most significant series B round in the history of Latin America and values 2TM at $2.1 billion — now the eighth biggest unicorn startup there.

“Millions of people around the world are realizing that digital assets and cryptocurrencies are both innovative technologies and efficient stores of value — Brazil is no exception to that trend,” said Roberto Dagnoni, executive chairman and CEO of 2TM Group, in the announcement. “This series B round will afford us to continue investing in our infrastructure, enabling us to scale up and meet the soaring demand for the blockchain-based financial market.”

Mercado Bitcoin plans to use the round’s proceeds, representing SoftBank’s most prominent investment in a cryptocurrency company in Latin America, to increase its scale, expand its offerings and invest in infrastructure to meet demand. The company also plans to penetrate other South American markets such as Chile and Argentina.

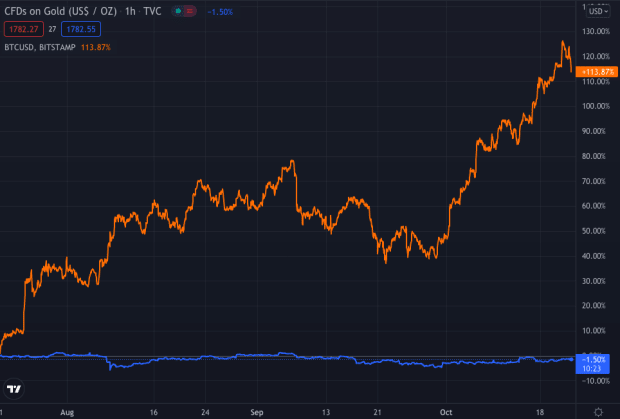

Brazil has seen greater involvement in bitcoin trading than it has in traditional securities for a few years now. And according to the announcement, Mercado Bitcoin has processed almost $5 billion in transaction volume in the first five months of 2021 with a client base of 2.8 million — compared to a total of 3.7 million individual investors on the country’s stock exchange.

Marcelo Claure, CEO of SoftBank Group International, also commented on the series B round, saying that bitcoin and cryptocurrencies have “incredible potential in Latin America,” and later adding that SoftBank is “excited to take part in this incredible journey” with 2TM.

The Brazilian bitcoin exchange, founded in 2013, raised this latest investment just five months after its series A round in January 2021. The company’s first round was co-led by G2D/GP Investments and Parallax Ventures and advised by J.P. Morgan. Other firms that also participated in that round include HS Investimentos and Gear Ventures.