Kraken Lands Sponsorship Deal With Williams Racing Despite U.S. Regulatory Crackdown

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/www.coindesk.com/resizer/Bq34fFDLQLAxJq7jRzq--axWcvs=/arc-photo-coindesk/arc2-prod/public/BPHZ3N4FINGKHP4PJNCM265SOM.jpg)

Helene is a U.S. markets reporter at CoinDesk, covering the US economy, the Fed, and bitcoin. She is a recent graduate of New York University’s business and economic reporting program.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

Formula 1 team Williams Racing signed U.S. crypto exchange Kraken as a sponsor after losing one of its most prominent drivers, Nicholas Latifi, who reportedly brought in a large amount of sponsorship fees.

Kraken’s logo will be displayed on the team’s race cars and there will also be a non-fungible token (NFT) experience, the companies said Tuesday.

The partnership comes as U.S.-based crypto exchanges face not just ongoing scrutiny from traders but also accelerating regulatory actions after the collapse of the FTX crypto exchange and three banks that had links to the industry.

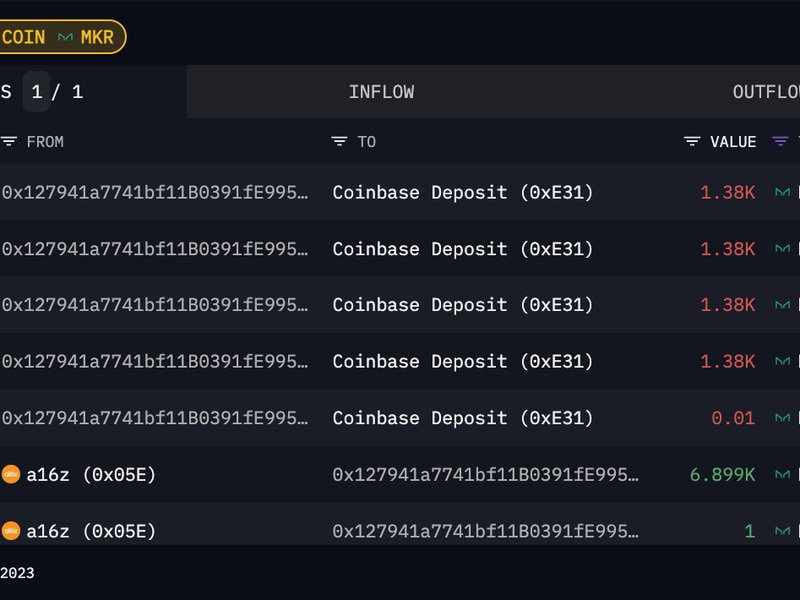

Last month Kraken was forced to shut its staking-as-a-service platform for U.S. customers and pay a $30 million fine to settle charges from the Securities and Exchanges Commission, which sued the exchange for offering unregistered securities. Other exchanges, including Coinbase and Binance, are also grappling with investigations by U.S. regulators.

While crypto sponsorships and partnerships slowed toward the end of 2022, roiled by the so-called crypto winter, some exchanges have nevertheless landed new partnerships. In January, Coinbase announced it became a premium partner of German soccer club Borussia Dortmund.

Edited by Sheldon Reback.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Bq34fFDLQLAxJq7jRzq--axWcvs=/arc-photo-coindesk/arc2-prod/public/BPHZ3N4FINGKHP4PJNCM265SOM.jpg)

Helene is a U.S. markets reporter at CoinDesk, covering the US economy, the Fed, and bitcoin. She is a recent graduate of New York University’s business and economic reporting program.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Bq34fFDLQLAxJq7jRzq--axWcvs=/arc-photo-coindesk/arc2-prod/public/BPHZ3N4FINGKHP4PJNCM265SOM.jpg)

Helene is a U.S. markets reporter at CoinDesk, covering the US economy, the Fed, and bitcoin. She is a recent graduate of New York University’s business and economic reporting program.