KillSwitch Finance: A Comprehensive Guide

The field of decentralized finance (DeFi) has been booming throughout the past couple of years, and there are absolutely no signs of slowing down.

It all started on Ethereum, and the peak of ETH DeFi happened during the summer of 2020 – also commonly referred to as the DeFi summer. However, this also revealed certain inefficiencies in the network, such as the inability to process a large number of transactions and sky-high transaction fees.

This is how chains such as the Binance Smart Chain, Solana, Avalanche, and layer-two solutions such as Polygon, also saw a tremendous surge in interest.

In terms of applications, many different use-cases came to light, and it appears that users are hungry for DeFi products. In any case, yield aggregators are undoubtedly amongst the most popular decentralized applications (dApps), and KillSwitch Finance attempts to deliver new features to this front.

What is KillSwitch Finance?

KillSwitch Finance brings forward a smart cross-chain yield aggregator that attempts to increase the convenience and security for yield farmers populating the Binance Smart Chain, KCC, Aurora, and the Arbitrum chain.

The user interface is relatively easy to handle, and past experience is a plus but not a must. Users are able to unstake, sell high-risk positions, and withdraw liquidity quickly and in a single click – something that is quite convenient.

Additionally, the platform also wants to integrate a take profit and a stop-loss feature that would allow users to limit their losses or set profit targets, which means they don’t have to monitor it constantly. Naturally, this also decreases human error.

So, without any further ado, let’s have a look at how to use it.

How to Use KillSwitch Finance?

Right off the bat, the user will need a web3 wallet, and we recommend the usage of MetaMask – it’s the most popular non-custodial wallet, and it’s very easy to set up.

Important: in case you install the wallet for the first time, beware of phishing and double-check you visit the correct website URL, read here for more security tips.

Once you have done so, you will be able to check out the various features of the platform and start yield farming. In the middle of the page, you will find general information about the current value locked, your deposit, your KSW balance, and the KSW you’ve earned with the ability to claim it.

As you can see, from the bottom bar, you are able to set the vault type, select the platform asset, and input additional filters to match your preference.

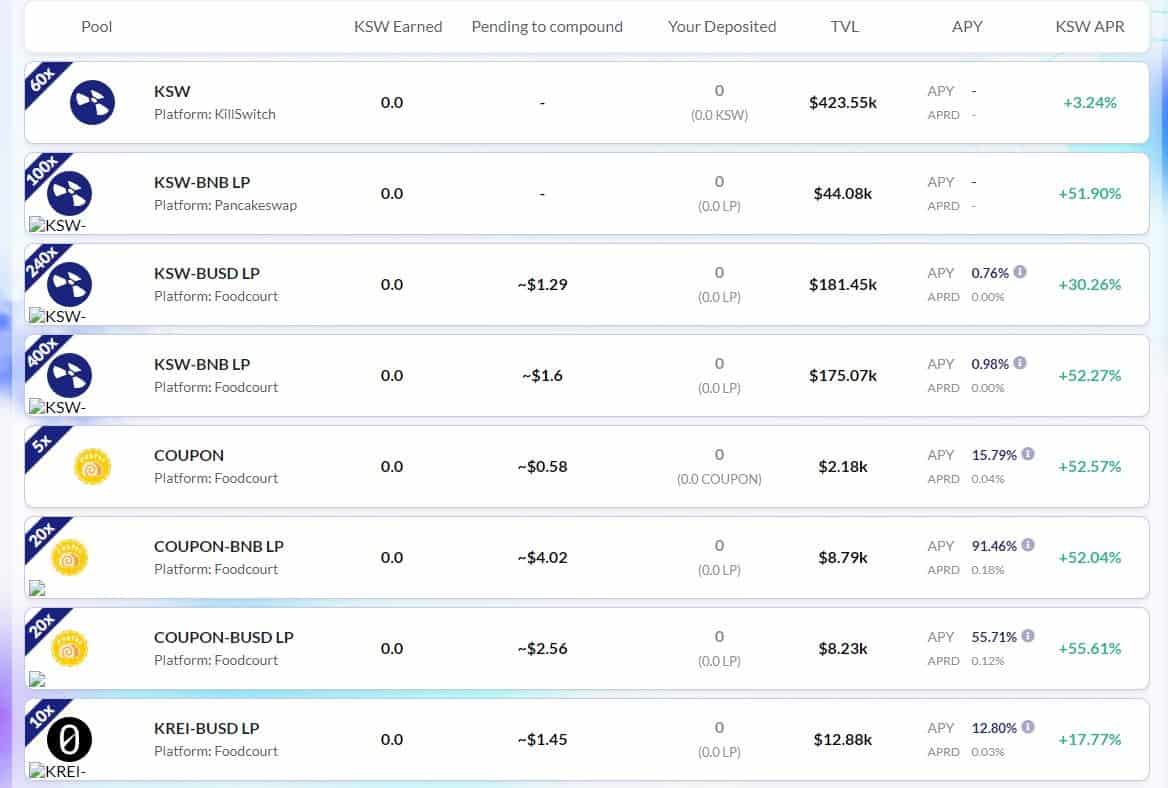

As soon as you scroll a little further, you will also be able to see the various pools that you can participate in and check their current return rates.

This is where you can track how much KSW you’ve earned, what’s the amount pending to compound, your deposit, the total value locked, as well as the APY and APR.

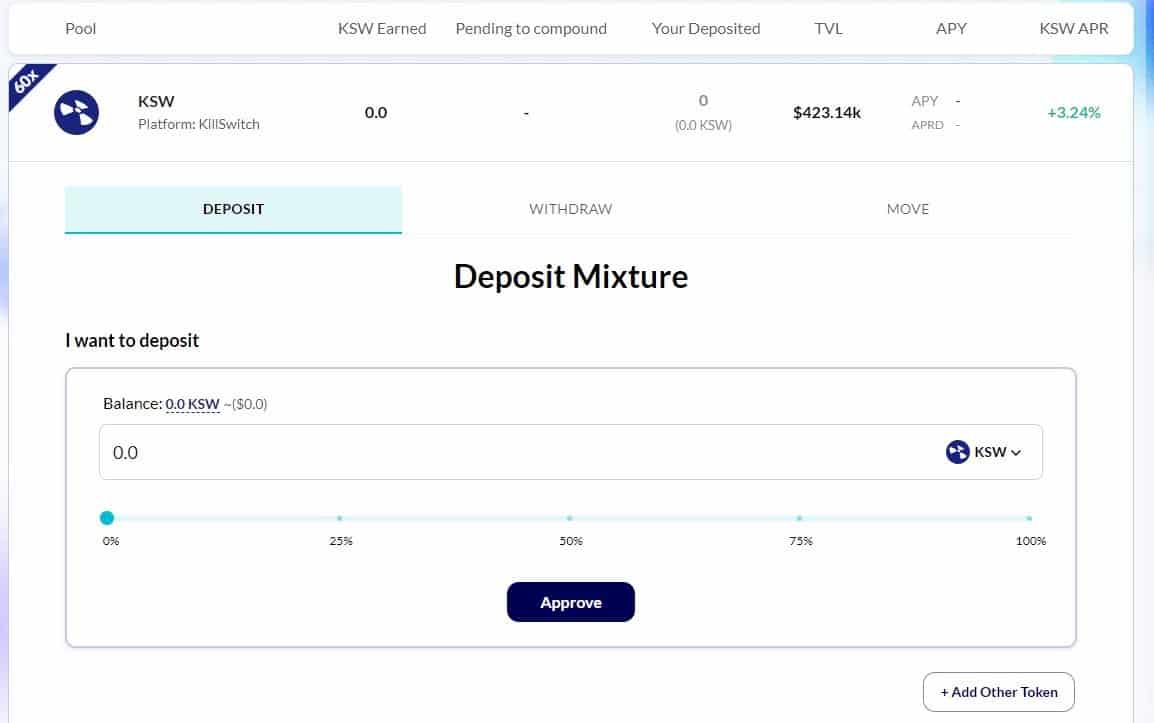

So, let’s imagine that you want to deposit funds into the KSW pool using the KillSwitch platform. All you need to do is click on it and follow the seamless process:

Once you’ve selected the amount you want to deposit, just hit the approve button, and you’re ready to go. Once time has passed, and you want to claim your rewards, just scroll down a bit and hit the claim button.

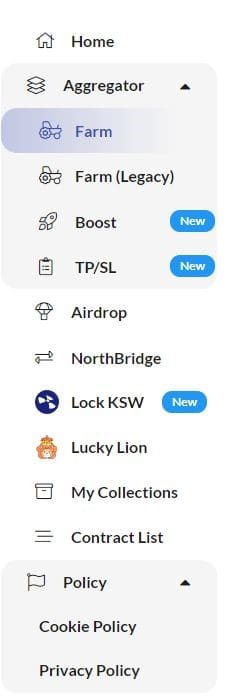

In any case, it’s as easy as it gets, but there are other features that you can find in the left navigation menu:

Now, let’s break down the various features of the platform because these are the things that set it apart from other yield aggregators.

Features of KillSwitch Finance

Auto Compound

This is quite interesting. It allows for rewards to be automatically compounded back to your position either by the KillSwitch system or by other investors who would, in return, receive a reward for compounding for others.

Mixture Deposit

The mixture deposit allows you to stake in any pool in one click. You can pick up to four assets as the input, and these don’t have to match the tokens of the respective pool.

Mixture WIthdraw

This feature allows you to withdraw any asset in a single click without having to go through a complicated process.

Boost

The boost pools are sponsored or endorsed by partners of the platform. You can get higher rewards from these types of pools, but it’s also worth considering the fact that they are, indeed, endorsed.

Mixture Move

You are able to transfer from one pool to another within the KillSwitch platform and enjoy no withdrawal fees – something that can help optimize returns.

Take-Profit / Stop-Loss

Now, it’s worth noting that this feature unlocks when you are holding 500 or more KSW. It allows users to set take-profit and stop-loss levels which can severely diminish the impact of volatile moves in unfavorable directions.

This can be used to tailor strategies, hedge, properly calculate and set risk, and a lot of other things. It can also seriously reduce the potential for human error and to reduce the impact of emotions.

Disclaimer: This feature is still in Beta, and you should use it at your own risk with funds that you can afford to lose.

The KSW Token

The KillSwitch token underpins the ecosystem and is the governance token of the platform. KSW can be used to unlock some features of the yield aggregator, to decrease the transaction fees, and so forth.

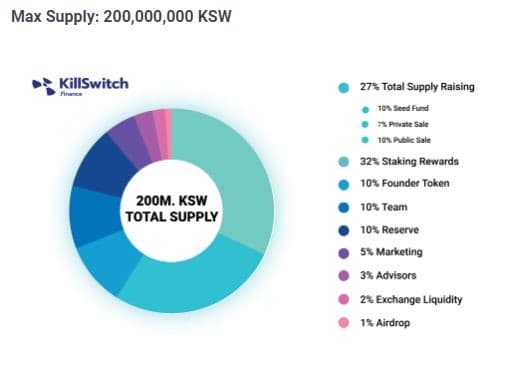

This is what the tokenomics look like:

Is KillSwitch Finance Safe?

The first thing to consider is that this is a decentralized application, and as with any other dApp, there’s always a protocol risk to some extent. This means that regardless of the audits, there’s always some sort of risk associated with potential security holes.

However, KillSwitch has been audited by Certik, which revealed some mistakes that have all been reportedly patched and fixed. The report can be found here.

All in all, while the protocol in itself might be safe, you have to approach the DeFi space, in general, with serious caution.

Conclusion

KillSwitch seems like a convenient platform for yield farming as it aggregates a range of different pools and provides quite a lot of opportunities.

It’s also worth noting that the platform is relatively easy to use, although there are some things that are still to be fixed and/or are in beta, such as the take-profit/stop-loss tool.