Kik Suffers Setbacks With ‘Void for Vagueness’ Defense in SEC Case

Kik is struggling to mount a strong defense in a case brought by the U.S. Securities and Exchange Commission (SEC) over its $100 million initial coin offering.

As reported last month, Toronto-based Kik’s legal team attempted to persuade the district court of the Southern District of New York that the SEC’s case – alleging the 2017 token sale violated securities laws – was void based on the premise that the legal definition of an “investment contract” is unclear. Kik argued that this “vagueness” precluded the definition from applying to its “kin” token offering.

The firm also sought to depose SEC officials in a bid to show the securities watchdog wasn’t in a position to give clear guidance on token sales at the time of Kik’s ICO.

The SEC, not surprisingly, vigorously opposed the “void for vagueness” defense, stating at the time:

“This defense asserts that, notwithstanding 70-plus years of well-settled jurisprudence, the term ‘investment contract’ in the securities laws is void for vagueness as applied to Kik’s investment scheme. This claim is untenable and should be dismissed.”

Soon after our previous report, the judge in the case, Alvin K. Hellerstein, sided with the SEC view and refused Kik’s motion for discovery.

Not only that, but Hellerstein on Tuesday threw out a subsequent motion to reconsider from the former messaging app company, tearing up Kik’s vagueness defense with the explanation:

“Defendant’s motion for reconsideration is a reargument of matters that were before me when I denied the discovery sought. Defendant does not mention any new matter of fact or law, or any binding precedent that I failed to consider. That is enough to deny the motion. Furthermore, as I originally held, the deliberations within an agency sheds no light on the application of the statute or regulation in issue. If the law is vague, or confusing, or arbitrary, as defendant argues, that can be argued objectively. Proper discovery should be focused on what defendant did, and not why the agency decided to bring the case.”

Last month, Kik’s messaging platform was acquired by MediaLab, a holding company with Whisper and other apps in its portfolio. Kik CEO Ted Livingstone has said the SEC action prompted the sale.

So what’s next? In the latest filing, also made public Tuesday, the SEC asks Judge Hellerstein to allow it to depose seven individuals after the current fact discovery deadline of Nov. 29.

These individuals include blockchain author and investor William Mougayar, kin app developer Luc Hendriks and Ilan Leibovich, who was Kik’s VP of product around the time of the ICO. Hellerstein has yet to respond to the SEC’s request.

The date of the next hearing is yet to be determined.

You can read the SEC’s letter below:

SEC Letter to Judge Hellerstein in Kik Case by CoinDesk on Scribd

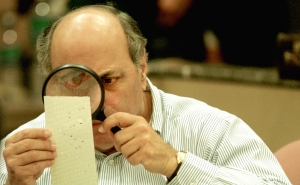

Law image via Shutterstock