KeeperDAO Raises Seven-Figure Seed Investment From Polychain, Three Arrows

(Mendenhall Olga/Shutterstock)

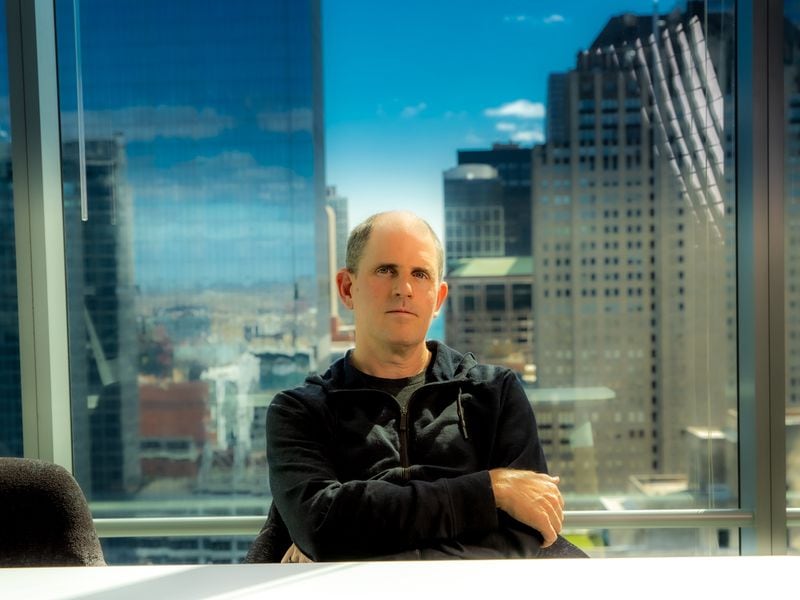

Crypto venture capital firm Polychain Capital and fund manager Three Arrows Capital have backed liquidity protocol KeeperDAO in a seed funding round announced Friday.

- Polychain and Three Arrows were KeeperDAO’s only investors in the round that raised a “seven-figure sum,” KeeperDAO founding member Tiantian Kullander told CoinDesk.

- KeeperDAO is a decentralized finance (DeFi) protocol that lets participants in communal liquidity pools (known as keepers) participate in strategies involving margin trading and lending.

- Keepers pool are able to pool their capital into Ethereum’s smart contracts and profit as a group from on-chain arbitrage and liquidation opportunities.

- Three Arrows Capital’s CEO Su Zhu said KeeperDAO would help to keep liquidations on Ethereum “efficient” while making sure participants “earn their keep.”

- Going forward, KeeperDAO plans to issue its own governance token as a tool for balancing incentives between keepers and liquidity providers.

- Thanks to the project, DeFi protocols based on on margin and borrowing would be able to “lower collateralization levels over time,” according to Sherwin Dowlat, investments at Polychain

- Three Arrows recently participated in a $3 million investment in Aave the firm behind the third-largest lending platform in DeFi.

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.