Just Announced: Finalists for $1 Million in Seed Funding by Samara Alpha Management, Bitcoin Magazine PRO

Amsterdam, September 28, 2023 – Three finalists have been selected for the Bitcoin Alpha Competition, a crowd-sourced campaign to find the next top Bitcoin fund manager. The manager with the most promising approach for generating alpha in the bitcoin market will be awarded $1 million USD in seed capital and announced on the Main Stage of the Bitcoin Amsterdam Conference on Friday, October 13th by Samara Alpha Management.

Samara Alpha Management and Bitcoin Magazine PRO reviewed more than 150 applications from traditional finance and digital asset fund managers, and have selected the following finalists: Andrey Aakelyan (Theta Digital), Jaron Abbott (Armor Strategy), and Maximilian Pace (Animus Technologies). Of these three, one winner will walk away with one million dollars in seed funding – as well as all the necessary operational infrastructure to launch and run their fund strategy – thanks to the generous support of Samara Alpha Management and their signature seeding platform.

Below are insights into each of the finalists’ fund strategies:

Andrey Arakelyan – Theta Digital

Theta Digital is focused on taking discretionary Long or Short positions in Bitcoin Futures at varying timescales to achieve incremental alpha denominated in BTC preserved by systematic risk management.

Jaron Abbott – Armor Strategies

The Armor Strategy utilizes a portfolio of indicators to quantitatively describe and measure the psychological behavior of panic selling in its early stages. Signals are aggregated and translated to predict and extract alpha from impending price moves.

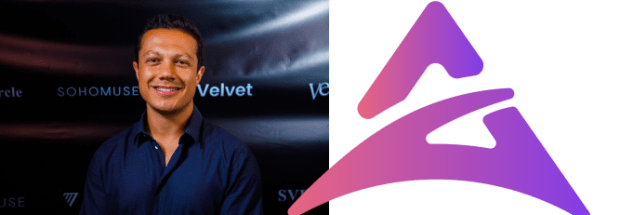

Maximilian Pace – Animus Technologies

Animus Technologies is an AI-platform designed to develop data-driven trading strategies for cryptocurrencies. The result, developed over the past 6 years, is a systematic solution to reducing market volatility and enhancing investor returns over market cycles.

Bitcoin Magazine spoke with Roy Tse, Chief Risk Officer at Samara Alpha Management, for his thoughts on the competition and why Samara Alpha Management has made such a decisive move into the Bitcoin ecosystem:

“We have a belief that we can find interesting managers that are really adding accretive value to the Bitcoin space. At Samara, a lot of us believe in the power of Bitcoin and what it can do for the world.

Every day, we hear tons of great investment ideas and strategies. Given the current regulatory environment, and the disjointed-ness of the exchanges and markets, that is why many of these market opportunities emerge, similar to the early days of other traditional finance businesses that we’ve seen such as mortgage-backed trading and CLOs. Any time there is a new industry, there is a chance for novel financial strategies to succeed. But, to capitalize on that, the difficulty lies in the environment to set up the required infrastructure in such a new market, like Bitcoin and digital assets.

We are Bitcoin maximalists, we want to increase adoption. If folks can’t enter the market because of things like setting up their fund, or not knowing who to call – those are the pressure points we want to alleviate.

Because of that, we created the Samara seeding platform, which is essentially a fund in a box. We provide the ability for a manager to come in with a great idea and subscribe to a technology platform complete with all of the different disciplines needed to set up a Bitcoin investment management company. You have fund administrator connectivity with data coming through from the exchanges, pre-existing exchange partners and accounts, risk management functions complete with analytics, calculations and customization, liquidity management functions etc.

The million dollar prize for the Bitcoin Alpha Competition is very exciting for us, but the true excitement we have is for the seeding platform — being able to provide this functionality to fund managers with great strategies and helping them bring their ideas to life at the push of a button.”

With the crowning of the Bitcoin Alpha Competition winner at Bitcoin Amsterdam fast approaching, stay tuned for the announcement on Friday, October 13th for who will take home the $1 million prize as well as full access to Samara’s fund management platform.

For media inquiries and additional information on the competition, please contact: kristyna.mazankova@btcmedia.org