Judge Rules Bored Ape Yacht Club Ripoff NFTs Violated Yuga Copyright

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

A U.S. court in California has handed Yuga Labs, the company behind the popular Bored Ape Yacht Club (BAYC) NFT collection, a legal victory in the form of a partial summary judgment in its case against Ryder Ripps and Jeremy Cahen.

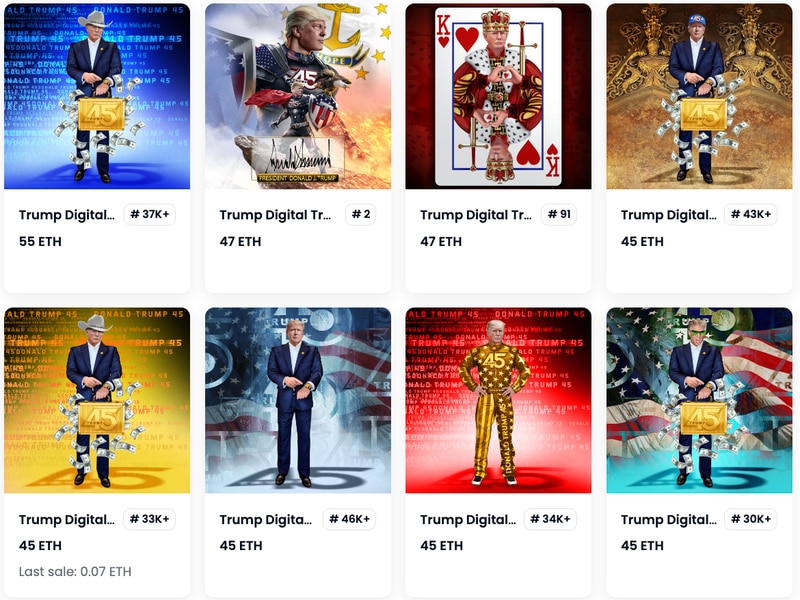

Ripps and Cahen are the duo behind the RR/BAYC NFT collection, which featured primates in similar poses to Bored Apes, and also used marketing material similar to BAYC. The two created RR/BAYC as a satirical and critical response to Yuga Labs, and have said that the BAYC NFT contains racist dog whistles, 4chan memes, as well as hidden Nazi imagery. While this narrative has resonated in certain circles of the internet, BAYC’s founders deny this entirely.

Yuga sued June 2022, alleging that Ripps and his associates were deliberately creating consumer confusion under the pretense of satire, generating millions in unjust profits while taking pride in the damage they caused to the BAYC with their allegations.

The U.S District Court for the Northern District of California found that Yuga Labs owns the BAYC trademarks, which are valid and enforceable, and that the defendants used the BAYC marks – referring to the images – to sell RR/BAYC NFTs without Yuga Labs’ consent and in a “manner likely to cause confusion”, with the similar product look confusing consumers intending to purchase an actual BAYC NFT or track their value with token tracking tools.

In addition, the court ruled that the defendants’ use of the BAYC marks was not a case of fair use, nor an artistic expression under something called the Rogers Test, because Yuga’s BAYC marks were strong in the marketplace and the RR/BAYC project was intended to mislead.

The court also determined that the domain names registered and utilized by the defendants – rrbayc.com and apemarket.com – have the potential to create confusion with the judge concluding that the defendant’s actions are driven by a malicious intent to profit and the two are engaging in cybersquatting.

Yuga Labs argued that it should receive $200,000 in statutory damages for the cybersquatting. However, the court dismissed this claim and declared that the determination of damages would be made during a pending trial.

Ripps and Cahen also attempted to argue that because NFTs are intangible, they aren’t protected under the Lanham Act, which governs trademarks, service marks, and unfair competition, providing protection against infringement and false advertising.

The judge disagreed, arguing that NFTs, as virtual goods, still qualify as goods under the Lanham Act due to their unique, traceable, and brand-associated characteristics.

In a separate case, Yuga Labs reached a settlement in February with the developer of the RR/BAYC websites and smart contracts, Thomas Lehman.

“It was never my intention to harm Yuga Labs’ brand, and I reject all disparaging statements made about Yuga Labs and its founders and appreciate their many positive contributions to the NFT space,” Lehman said at the time.

Edited by Nikhilesh De.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/7c0b0bd4-6cb4-4d93-8bc4-1db61149c9d1.png)