JPMorgan: Young People Buy Bitcoin, Elderly Invest in Gold

The financial crisis prompted by the COVID-19 pandemic has highlighted the various investment approaches initiated across different age groups. According to a new JPMorgan analysis, elderly generations have turned to more traditional assets such as gold and bonds, while younger people have gone for Bitcoin.

Old For Gold, Young For Crypto

Bloomberg cited the latest JPMorgan research oriented at retail investors’ behavior during and after the COVID-19 crisis. The strategist team led by Nikolaos Panigirtzoglou concluded that baby boomers (born between 1946 and 1960) have decided to avert from keeping any stocks, particularly linked to the tech sector.

Instead, they focused on accumulating more traditionally regarded as “safe” and less volatile assets such as gold and government bonds. “The older cohorts continued to deploy their excess liquidity into bond funds, the buying of which remained strong during both June and July,” reads the study.

In contrast, and perhaps unsurprisingly, younger generations have allocated more funds into riskier assets – such as stocks and cryptocurrencies – particularly Bitcoin. Ultimately, the analysts outlined that both generations demonstrate serious divergence in their preferences and concluded that “the older cohorts prefer gold while the younger cohorts prefer Bitcoin.”

Interestingly, the JPMorgan conclusion coincides perfectly with Robert Kiyosaki’s opinion. While saying that gold, silver, and Bitcoin can make people richer and smarter, the Rich Dad Poor Dad author asserted that the precious metals are for the elderly, whereas Bitcoin is for the young.

YTD Asset Performances

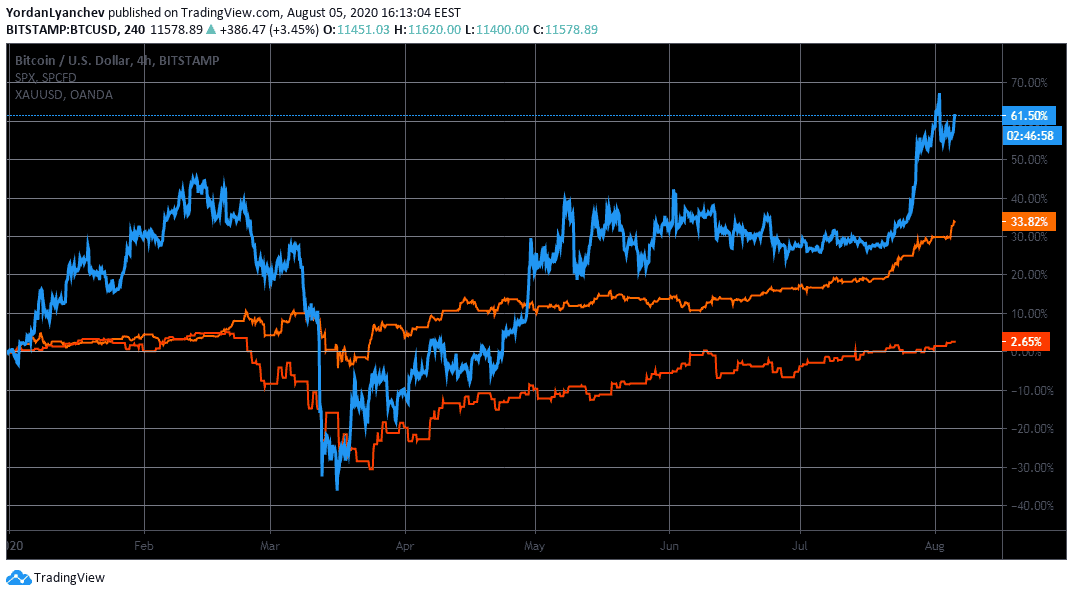

While commenting on the different asset classes, it’s perhaps logical to compare their performances during 2020 and especially after the COVID-19 pandemic.

Arguably the most popular stock market index – the S&P 500 – began the year with an increase and marked an all-time high in February. The pandemic, however, caused massive disruptions and brought it down by nearly 40% in a few weeks. Since then, the S&P has recovered and is slightly in the green YTD – by 2.6%.

As mentioned above, gold is typically considered a safe-haven asset that performs best during a financial crisis. The last such crisis in 2008 is a proper example as the bullion spiked in the years after. This time gold didn’t need years to surge in value. The precious metal, despite dropping in mid-March as well, is already at 34% up YTD. Just yesterday, it marked a new all-time high after exceeding $2,000/oz.

And then, there’s Bitcoin. The cryptocurrency entered 2020 at about $7,200, excelled during the first few months but fell agonizingly in mid-March to $4,000. Since then, though, BTC has been on a roll and is trading at about $11,600 at the time of this writing. On a yearly scale, this represents a 61.5% surge, making it the best-performing asset in 2020 – similarly to the previous decade.

The post JPMorgan: Young People Buy Bitcoin, Elderly Invest in Gold appeared first on CryptoPotato.