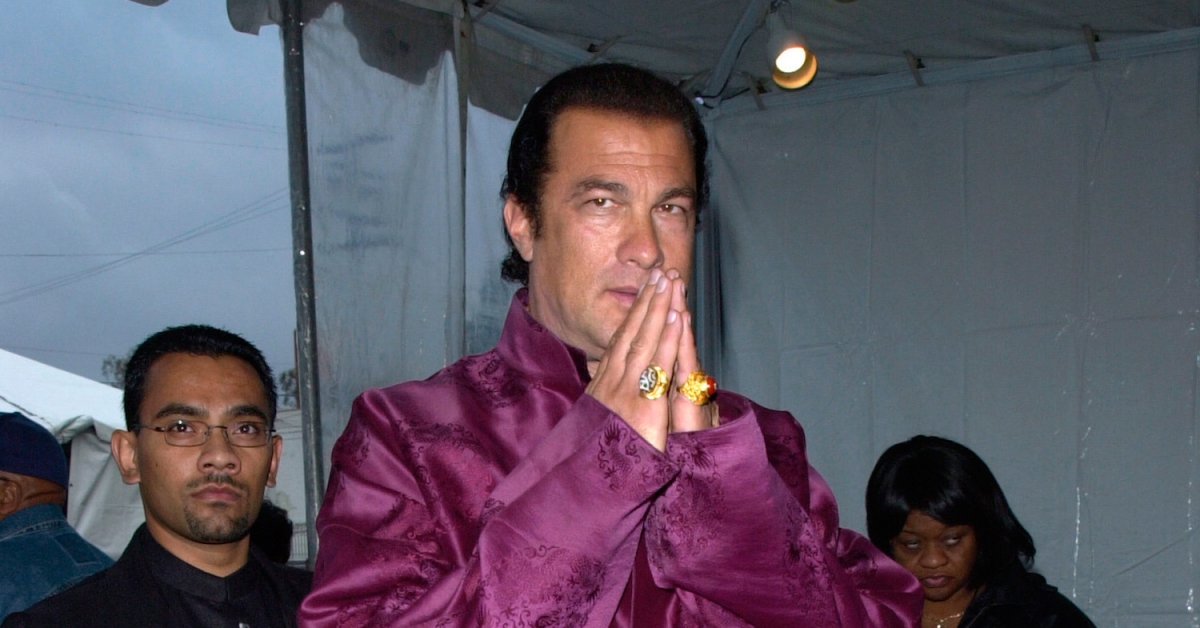

JPMorgan CEO Dimon Says Crypto Companies ‘Want to Eat Our Lunch’

JPMorgan Chase CEO Jamie Dimon indicated in a recent interview with Yahoo Finance that he had not spoken with Facebook about the development of Libra.

“But it’s very possible someone in the company did,” Dimon said.

“Blockchain is real,” he said, citing his company’s foray into the space with JPM Coin blockchain. “And I think competition is real.”

For Dimon, cryptocurrencies bring disruption to the banking industry because they provide similar services that banks traditionally provided like money transmission, clearinghouse activity, and real-time payments – though he adds, “It’s not an existential threat.”

“We’re going to have competitors, whether its a cryptocurrency competitor or another FinTech competitor. We’re going to have competitors.”

“I tell our people, don’t guess, you know they’re there, you know they’re coming, you know they want to eat our lunch. Assume it.”

Whether it’s a bank or a crypto service startup, Dimon said there are serious issues regarding the future of money. He believes some of these are caused by the government, specifically in determining whether they will be subject to banking regulations, KYC, the bank secrecy act, or anti-money laundering rules.

Sympathetic to the crypto industry’s desire to serve their clients, Dimon also said he’d “want to be able to serve their clients.”

“I always look at these [blockchain] systems like we’d like to do some of it too, ourselves.”

Jamie Dimon photo courtesy of flickr/Stefen Chow