Japanese Tax Authorities Push for New Crypto Regulations

Crypto-related businesses and individuals have failed to report crypto gains valued at 10 billion yen ($93 million), according to Japanese Tax Authorities.

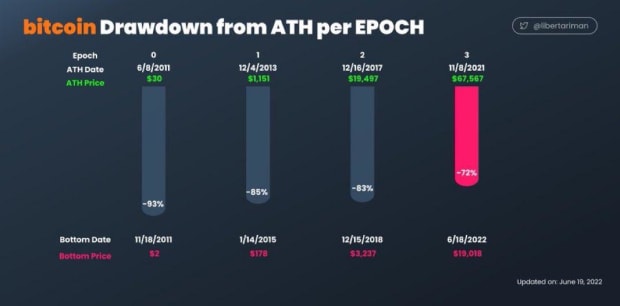

Asahi Shimbun reported that 30 companies and 50 individuals are being investigated for failure to account for astonishing profits made from cryptocurrency trading over a period of several years. This figure is linked to the sharp rise in value of virtual currencies in recent years.

One reason individuals avoid reporting their gains is due to concerns regarding the tax rate, which can exceed 50 percent on crypto earnings because they are considered miscellaneous income.

Authorities believe that holders of about 7 billion yen have made efforts to conceal their crypto transactions and are considering filing criminal complaints over tax evasion against those who have made large transactions or used methods to mask their identities.

The Japan Virtual Currency Exchange Association reported that transactions involving five major cryptocurrencies at member exchanges totaled 69.147 trillion yen in fiscal 2017, a 20-fold increase over fiscal 2016 and a 788-fold increase over fiscal 2015.

New measures are being planned to track transactions of cryptocurrency traders that deal in large amounts of money. The Tokyo Regional Taxation Bureau has asked for operators of several cryptocurrency exchanges to submit lists of their clients’ business transactions.

Because it would be impossible for tax authorities to track individuals who trade cryptocurrency on foreign exchanges or sell their holdings for other virtual currencies for higher levels of anonymity, a new system that will begin in January will allow authorities to ask private-sector exchange operators to provide names of clients under these conditions.

Operators who fail to provide such information will be penalized. These measures are designed to implement more regulations on cryptocurrency exchange operators that fail to be cooperative with tax investigators or do not properly register before starting operations.

According to the Asian Review, the National Tax Agency (NTA) will deploy about 200 specialists to detect undeclared income gained from cryptocurrency traders. They will be divided into teams and spread among 12 offices nationwide.

A senior National Tax Agency Official said “The fact that we are able to seek and confirm client data under the force of law will become a powerful weapon.”

The post Japanese Tax Authorities Push for New Crypto Regulations appeared first on Bitcoin Magazine.