Janet Yellen Sounds Like She’s Scared Of Bitcoin

This week, CNBC published a headline that recently-appointed U.S. Secretary of the Treasury Janet “Yellen sounds warning about extremely inefficient bitcoin.” Ironically, two days later CNBC published another article because the Federal Reserve’s systems are down.

The article amplified her criticism of bitcoin’s value and energy consumption. The kicker is that it does so without actually comparing it to anything, which is absurd. So, here I am to address this one-sided journalism and lack of research.

”Treasury Secretary Janet Yellen issued a warning Monday about the dangers that bitcoin poses both to investors and the public,” CNBC reported.

It then noted that Elon Musk’s Tesla had purchased $1.5 billion worth of bitcoin before pivoting back to Yellen, reporting that she said “there remain important questions about legitimacy and stability.”

“I don’t think that bitcoin … is widely used as a transaction mechanism,” Yellen told CNBC.

To be able to report this statement, you might think CNBC would quantify Bitcoin’s total throughput, usually in comparison to something else, but perhaps that’s wishful thinking.

“I fear it’s often for illicit finance,” Yellen proceeded to tell CNBC. “It’s an extremely inefficient way of conducting transactions, and the amount of energy that’s consumed in processing those transactions is staggering.”

Let’s break this down…

“Illicit finance”: There is no comparison of bitcoin to another currency in regards to how often it is used for nefarious purposes. How much illicit financing is conducted with the USD? Or any other currency for that matter? How could you even begin to quantify that with the anonymity of cash?

“Extremely inefficient”: Once again, this lacks any comparison to even be deemed as so, and in reality is proven to be the opposite. Bitcoin is a bearer asset, not the echo of a paper IOU. It may take ten minutes and cost a little bit of money to settle on the base layer but that is for *final settlement.* What are the costs for sovereigns to do this? There are secondary layers to Bitcoin which enable global transactions instantly, in any currency or money, and cost a fraction of a cent. Comparing this to the costs and time requirements of traditional finance and remittances, it is clearly extremely more efficient.

“Staggering” energy consumption: Again, without any comparison, this point is just wrong. I thought Nic Carter had the last word when he wrote that, “The Bitcoin-energy worriers need not despair, however. There is a solution. All they must do is persuade Bitcoin fans to use and value an alternative settlement medium. Their best bet will be to devise a system that is even more secure, offers stronger assurances, settles faster, is more privacy preserving and is more censor resistant – all without using Proof-of-Work. Such a system would be miraculous. I’m waiting with bated breath.”

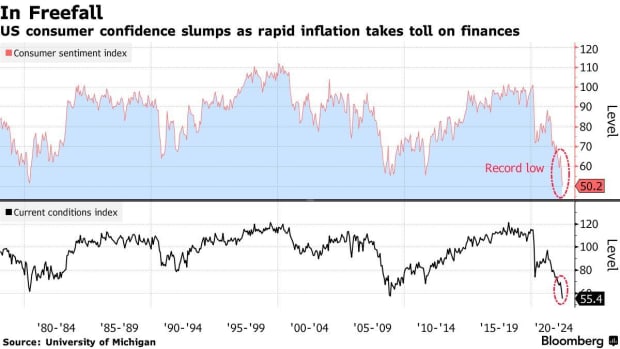

The article then moved on to bitcoin’s volatility. Yellen stated, “It is a highly speculative asset and you know I think people should be aware it can be extremely volatile and I do worry about potential losses that investors can suffer.”

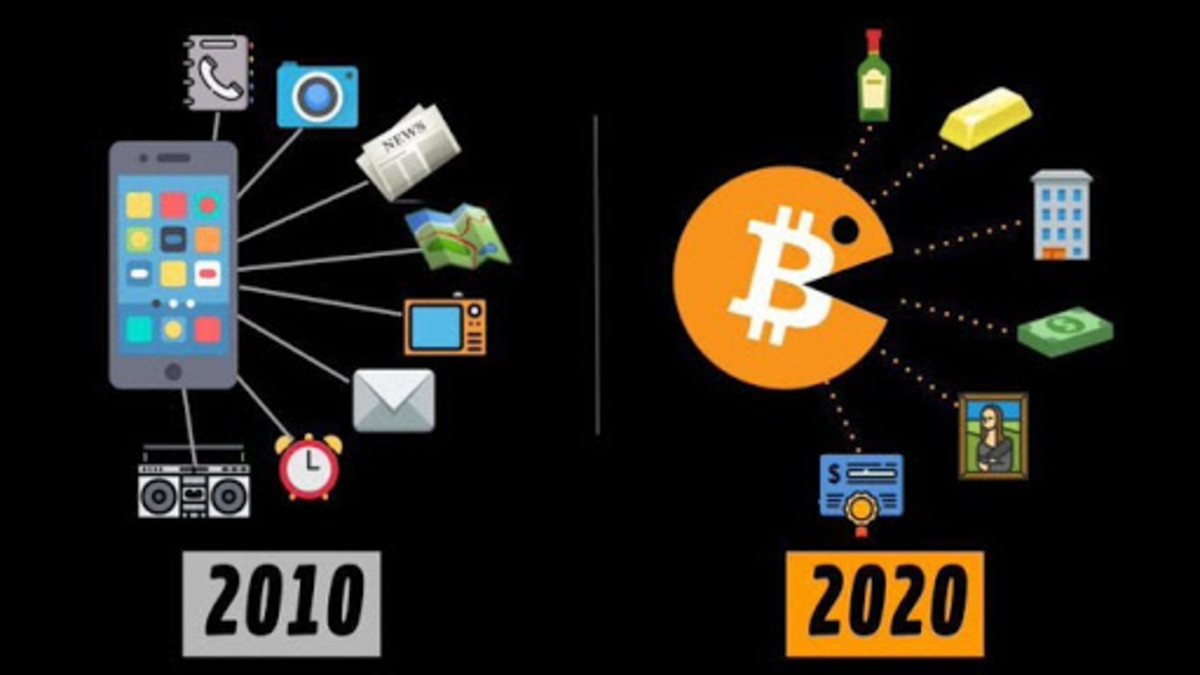

She is worried about the world’s best-performing asset over the last decade. It is a decentralized global monetary system and unit going through the monetization process with constant price identification 24/7. What did she expect? Instant smooth sailing to the moon with Saylor and Musk?

After giving Yellen a platform to bag on bitcoin with no comparisons and without any journalistic integrity, CNBC proceeded to bring up Central Bank Digital Currencies (CBDCs).

“The Federal Reserve, where Yellen once served as chair, has studied the issue and discussed the possibility of a new digital currency along with a payments system it expects to roll out over the next several years,” it reported. “‘I think it could result in faster, safer and cheaper payments, which I think are important goals,’ Yellen said.”

Why is it about faster, cheaper and “safer” payments when the printing press is killing our savings, supposedly in the name of full employment?

I’m just a guy with laser eyes and diamond hands, so make your own opinion but I think it’s ridiculous when financial regulators and the media try to criticize bitcoin, without actually comparing it to fiat, when the world’s central banks are trying to gauge if they can implement draconian, Chinese Communist Part (CCP)-like CBDCs.

It’s clear that bitcoin is money, the International Monetary Fund (IMF)’s latest poll reflects this.

Are CBDCs really money, though? The entire purpose of a blockchain data structure is to enable decentralized control. Therefore, it’s nonsensical when deployed by a central authority that continues to debase its currency.

Can governments stop Bitcoin?

“If no one wants a devaluation-proof, censorship-resistant, permissionless, borderless, non-discriminatory, teleporting financial asset, then no one will feed it energy, and it will die,” as Alex Gladstein wrote for Quillette.

The real question then, I’d say, is not can they stop it, but why in the world would they want to?

This is a guest post by Ben Jarvie. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

The post Janet Yellen Sounds Like She’s Scared Of Bitcoin appeared first on Bitcoin Magazine.