It’s Time to Buy Bitcoin But Also Prepare For One More Dip Below $20K: Analyst

On June 18th, Bitcoin’s price dropped to a low of $17,622 on Binance, and the community has been in deep discussions ever since if that was the bottom.

According to an analyst from the cryptocurrency resource CryptoQuant – the bottom may not yet be in, but we are about 1/3rd of the way to forming it.

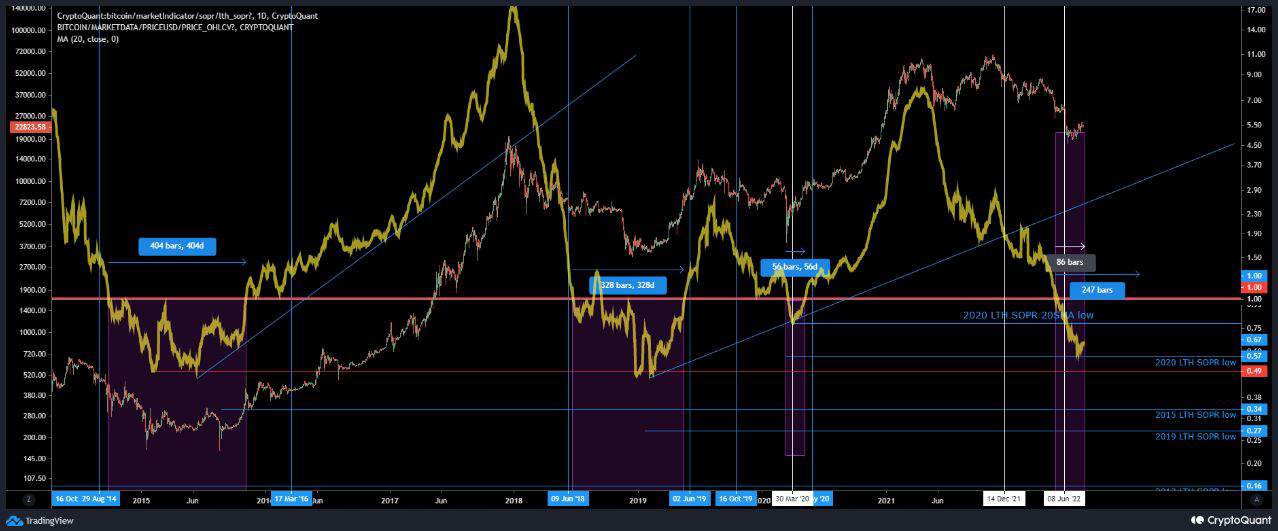

- Tomáš Hančar – analyst at CryptoQuant – revealed that the LTH SOPR 20-day SMA suggests that we are up to “1/3rd into a potential bottoming process.”

- The above indicator is short for the 20-day Simple Moving Average (SMA) of the Long-Term Holders’ Spent Output Profit Ratio (LTH SOPR).

- Data shows that this ratio has spent about three months under the neutral level value of “one,” which, according to the analyst, is 1/3rd of what a bottoming process usually takes.

I’ve roughly measured the historical bottoming processes/cyclical accumulations and ON AVERAGE (that includes the under two months period in March 2022) we should be looking at a ballpark of approximately 250 days of a bottoming process.

- The analyst goes further, involving the indicator’s 20-day moving average ‘smoothing’ line.

As far as the indicator’s 20-day MA smoothing line in technical terms is concerned, between 10th and 14th of July, we’ve seen what looks to be a bounce off of 2020 actual LTH SOPR low, coincidentally not too far off the 0.49 level, which represented the very lows of both 2015 as well as 2018/2019 cyclical bottoms.

- In conclusion, he believes that is time to start scaling in, but with caution, “just in case we get one more chance to buy sub-20k.”

- It has been about 47 days since the latest low, so he thinks it’s better to be sure to have a potential breakout scenario covered as well.