It’s Time For South Korea To Embrace Bitcoin, Says KRX Chairman

Korea Exchange Chairman Son Byung-doo said the country needs to study embracing bitcoin and cryptocurrencies.

It’s time to explore ways to embrace Bitcoin and digital assets, Korea Exchange (KRX) Chairman Son Byung-doo said, according to a report by local outlet Chosun. Byung-doo drew parallels between Bitcoin and the traditional capital markets, calling for investor protection and transaction stability measures.

“We need to study ways to embrace virtual assets as ‘know-how’ in the capital market,” Byung-doo reportedly said.

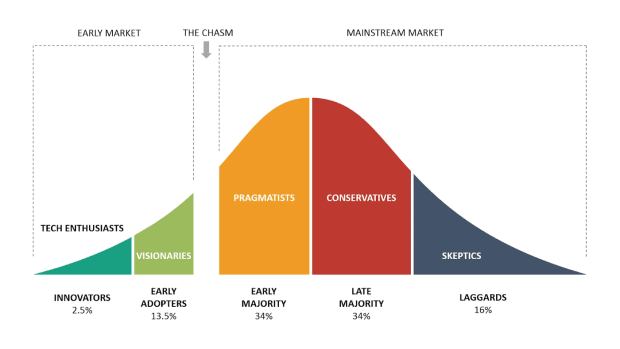

The number of domestic cryptocurrency exchange users in South Korea has increased despite local financial authorities maintaining a stance that Bitcoin is “outside the realm of finance.” According to the report, there are over 5 million users in domestic bitcoin exchanges. The daily trading volume of cryptocurrency has also increased and is close to reaching the trading value of South Korea’s stock exchange, KRX.

“Since virtual assets have become ‘major’ investment assets, it is time to prepare an institutional framework,” Byung-doo added. “Now is the time for exchanges to compete directly with overseas exchanges.”

The KRX chairman has noticed the increased investor appetite for bitcoin exposure in his country and is looking for ways to learn more about and “embrace” the asset class. Unsatiated thirst can lead to investors looking elsewhere.

The Securities and Exchange Commission (SEC) has led issuers to move up north by denying numerous applications for spot bitcoin exchange-traded funds (ETFs). Canada is home to plenty of “physical” bitcoin exposure offerings in stock markets, and today listed another product — by the now largest asset manager to offer a bitcoin ETF, Fidelity.

Fidelity Investments resorted to Canadian regulators and markets for listing its spot bitcoin ETF after seeing its similar filing stall at the SEC’s desk since March. The asset manager received regulatory approval last month to launch the first Industry Regulatory Organization of Canada (IIROC) to offer bitcoin trading and custodian services for institutional investors. The entity, Fidelity Clearing, now provides services to the asset manager’s ETF offering.