It’s Possible You Shouldn’t Tell Journalists About Your Wash Trading Biz

Last week, the Department of Justice announced charges against over a dozen individuals and entities, arguing these market makers were actually wash trading funds and defrauding people.

PS: I’ll be at Flyover Fintech in Lincoln, Nebraska on Monday.

02:26

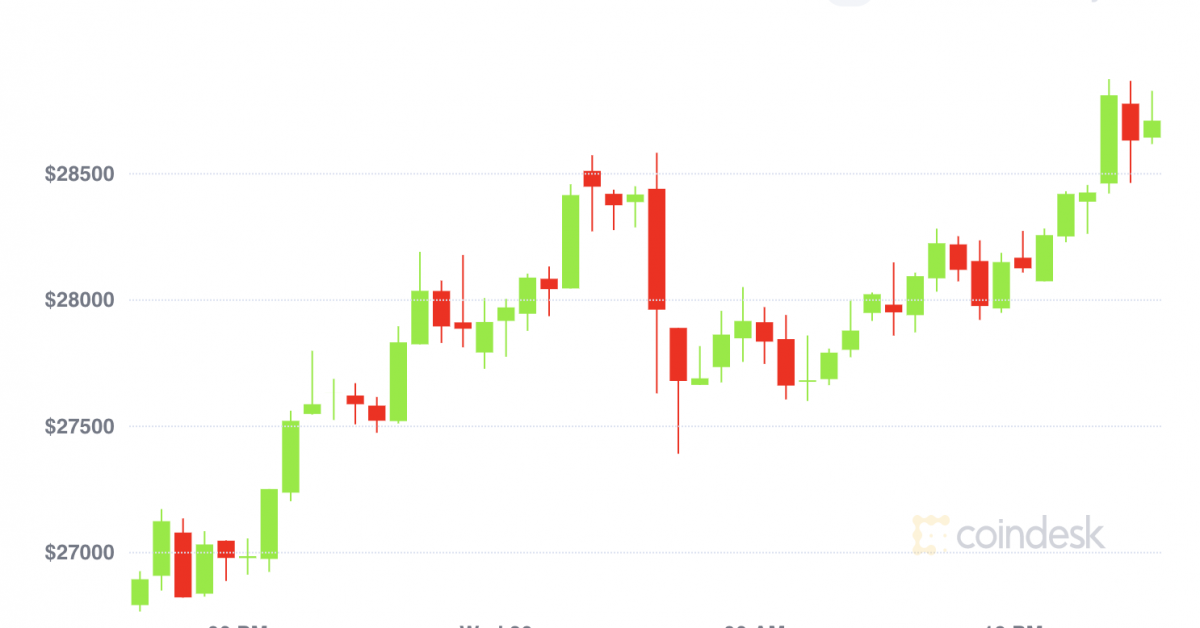

Bitcoin Price on the Rise Amid BTC ETPs’ Best Week Since July; Dogecoin Extends Its Rally

12:20

Dragonfly General Partner on Market Volatility: A Buenos Aires Special

01:00

Latin America’s Crypto Surge: A Battle Against Inflation

01:48

Nishad Singh’s Lawyers Ask Judge to Spare Him Prison; Italy to Raise Capital Gains Tax on Crypto

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

‘Not entirely ethical’

The narrative

Last week, the U.S. Department of Justice brought charges against a number of people and companies including Gotbit, CLS Global, MyTrade, and ZM Quant, alleging these companies were wash trading cryptos, and their operators and some token promoters were defrauding investors as a result.

Why it matters

Wash trading isn’t exactly a massive secret in this industry – as I’ll get to further down – but it’s still a market signal that can portend poorly.

Breaking it down

Alexey Andryunin told former CoinDesk reporter Anna Baydakova in 2019 that he co-founded a company designed to make it appear that random small-cap cryptocurrencies had real trading volume, with the express purpose of making these tokens appear active enough to secure a listing on CoinMarketCap and draw attention from larger companies.

At the time, Andryunin said, “The business is not entirely ethical.”

Five years later, prosecutors appear to agree. Andryunin was arrested in Portugal for extradition to the U.S.

You can read Anna’s 2019 report at this link.

The other interesting detail: The FBI worked on its own fake token, with a real contract you could track on-chain, called NexFundAI. Its website, which now features a massive “FBI” banner, looked remarkably legit – that is to say, like a lot of other AI-focused crypto tokens making vague promises but promising the moon.

Stories you may have missed

This week

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/ODEFGUPYGJDVBG2QJ5RSXXUAOY.png)

-

21:00 UTC (2:00 p.m. PDT) There was a brief hearing in SEC v. Payward (Kraken) but it seems to have been a short hearing and the trial appears to be scheduled for August 2026.

Elsewhere:

-

(The Wall Street Journal) Fairshake’s ads continue to not mention crypto despite the industry super PAC’s focus. “Crypto ‘is not an issue that moves the vast majority of voters,’” Ohio GOP Senate nominee Bernie Moreno told the Journal. Other reports by Politico and The Washington Post detail the same trend, and of course CoinDesk’s own Jesse Hamilton dug into Fairshake’s secretive practices this past June.

-

(The Washington Post) Climate change is becoming increasingly expensive by worsening droughts and helping lead to stronger hurricanes. Also worth reading: This piece on Florida’s insurance market.

-

(The New York Times) Meteorologists are getting death threats now, which is pretty insane. An individual was even arrested for threatening Federal Emergency Management Agency employees.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/N2UPXCUNIFDLHKKBDGTOW65Q74.png)

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

Disclosure

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

have been updated

.

CoinDesk is an

award-winning

media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of

editorial policies.

CoinDesk has adopted a set of principles aimed at ensuring the integrity, editorial independence and freedom from bias of its publications. CoinDesk is part of the Bullish group, which owns and invests in digital asset businesses and digital assets. CoinDesk employees, including journalists, may receive Bullish group equity-based compensation. Bullish was incubated by technology investor Block.one.

:format(jpg)/www.coindesk.com/resizer/BETd9o0r2OHtd2vT2ZqY9QPrJps=/arc-photo-coindesk/arc2-prod/public/ODFQHDRZFJG7XNVO7P6PUYMWS4.png)

Nikhilesh De is CoinDesk’s managing editor for global policy and regulation. He owns marginal amounts of bitcoin and ether.

Follow @nikhileshde on Twitter