Is This The Fuel For The Next Bitcoin Price Pump? $60 Million Tether (USDT) Just Minted

Tether, the company behind the most widely-used stablecoin, has minted over $60 million worth of USDT. It’s interesting to see if this will have any positive impact on Bitcoin’s price, given the fact that the infusion comes right after BTC surged upwards of $700 in 24 hours.

60,000,000 New USDT Minted

Earlier today, the popular monitoring resource Whale Alert published the transaction. It states that 60 million new USDT were minted on the Ethereum blockchain. All of the new coins have been sent to the Tether Treasury.

Bitfinex CTO, Paolo Ardoino, commented on the matter. He said that “this is an authorized but not issued transaction.” He added that “this amount will be used as inventory for next period issuance.”

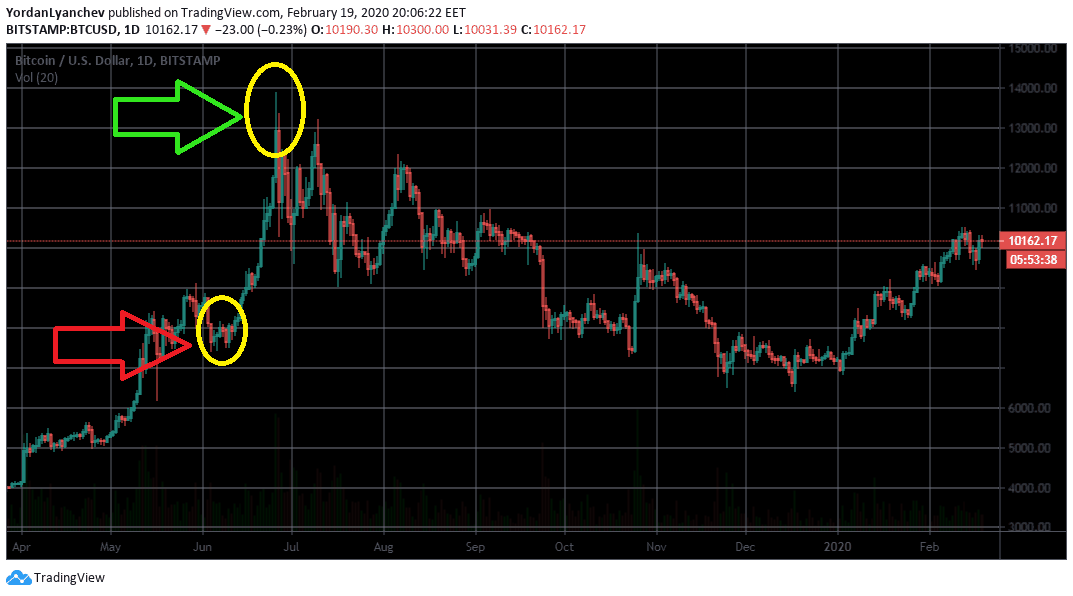

Interestingly enough, a similar scenario occurred in the middle of 2019. At that point, Tether printed over $150 million worth of USDT. Ardoino weighed in on the topic, saying once again that all of the coins are for “future issuance requests.”

Cryptocurrency Market To Spike?

As it happens regularly when new USDT is minted, the community starts anticipating a price move. Members speculate that the new stablecoins will have a positive impact on the whole market. Some previous events might support the excitement.

For instance, when the $150 worth of USDT were minted on June 11th, 2019, Bitcoin was at approximately $8,000. In the following days, it recorded some of its best yearly trading days. Ultimately, it reached its yearly high on June 26th at nearly $14,000.

Tether has been previously accused of possibly manipulating cryptocurrency prices. Two university academics said that one single whale caused the 2017 surge. They claimed that the whale used USDT to inflate the price of Bitcoin artificially.

Shortly after, Tether completely denied all accusations. The company behind USDT outlined that no single entity can cause such a massive price increase and that Tether tokens have never been used for market manipulations.

In any case, it’s still early to assume that the newly minted USDT could have a positive impact on the cryptocurrency market. Additionally, history is not a legitimate price indicator. However, with the recent price surges in the cryptocurrency market, it’s undoubtedly worth sparing a thought.

The post Is This The Fuel For The Next Bitcoin Price Pump? $60 Million Tether (USDT) Just Minted appeared first on CryptoPotato.