Is This A Bitcoin Super Cycle?

Discussing whether we are currently experiencing a bitcoin super cycle.

On a recent Twitter Spaces, the Bitcoin Magazine discussed whether or not we are in a bitcoin “super cycle” with special guests. Check out the audio and unedited transcript from that chat below.

Listen To This Episode:

- Apple

- Spotify

- Libsyn

- Overcast

The general idea of this discussion is also to just get more clarity on where we are in the cycle. We’ll do that through this thread I put together, just now, of some charts and I’m sure we’ll get some interesting insights. I think it’s best that maybe I will just start with going through that thread with some charts to say, more or less, where we are in the cycle and then we’ll also get you some of the definitions also of the super cycle, maybe, also of lengthening cycles, diminishing returns, and so forth. I’ll try to give a short explanation of where we are more or less in the cycle, where we stand, and then I’ll let Dylan and Jordan speak and give their opinion about some of the things that I’ll say.

Just to get started, actually, I think it’s best to start with chart number 4 of that thread which is the bull market comparison. I have posted that chart a week ago or two weeks ago, thinking that we might bounce off this trend line. You can actually see a comparison between the different cycles and there is a trend line for each cycle, so the 2011, 2013, 2017, and 2021 cycle. That trend line is actually based on the previous all-time high and then it goes through the low of the cycle. That trend line gave relatively good support as you can see in 2011 and 2013 that we touched that line and we jumped off, we bounced off of that.

Now, my expectation, at first, was also that we might jump off that line. That didn’t happen. We fell through and that, for me, is kind of a sign to differentiate between a bull and a bear market. Now, I just want to maybe explain a little more about that. There are several ways to look at what is a bull and a bear market, right? In Bitcoin, there is a very important indicator, on-chain, which is the short-term holder cost basis. I’ll just give a short explanation of what that is. It’s basically the price that short-term holders, which are people that buy and sell Bitcoin within the last five months, the average price that they buy in. That’s their cost basis. You can generally see, in bull markets, that will tend to be above that line. So, a short-term holder cost basis, it’s a price and currently, we’re below it. We fell below that already some time ago. That was the first indicator that something was off.

After we fell through the short-term older cost basis, we also fell through some other moving averages like the 200-day moving average, the 21-weekly. Some important historical moving averages in Bitcoin – we fell below those. Now, it’s not the first time in a bull market that we fell below those indicators, but it is something to be cautious about. That kind of meant that we were in a gray area for some time.

Now, for me, the fact that we now fell through the support line, and also of the chart I’m talking about – the bull market comparison, really is a sign that, for me, we are currently in a bear market. I’ve been looking at some of the supply dynamics in the last weeks and I found some interesting insights. That’s why I also want to share those today and some of those are also the super cycle chart which is the first chart from the thread. We will get to that quickly, but I first want to show the last chart which is the relative strength index. Most people know what RSI is. It’s a traditional indicator that’s used a lot in the stock market. It shows the relative strength of price. For Bitcoin, the 12-month RSI has been quite a good indicator to look at the strength of the price for Bitcoin, at least among cycles. Also in that chart, you can see that the strength index is basically a value between 0 and 100. Above 90 is really when you can get like blow-off tops and stuff, and bear markets usually are in the 50s or even lower in the 40 range. I would say bull markets are generally above 70. And so, even above 90 is when you typically will get a blow-off top or a top.

We can see in each cycle that we were kind of above 90 for some time in the beginning, early on in the bull market. Because these indicators, the RSI indicator can be quite high above 90 for quite some time. It’s not really an indicator to guess the exact top, let’s say, but it still gives a good indication of where we are in the cycle. Usually early on in a bull market, we would go above 90 and then we would fall below it for some time and we would, again, get back above 90 and that would kind of cause a blow-off top. We have seen that in 2011, 2013 and 2017. And in 2021, in April, we also went above it. With the first peak, we went above RSI 90, and then we fell below. So, my expectation was also to get back above 90 again. We made a low there, below 70, which was also a bit of a warning sign. Then, that already made me a little more cautious because we fell deeper than in 2013, for example, where we also had a double top. Many people were expecting to get Bitcoin above 100k, this cycle. And so, when we started going back up again, after the drop in the summer or the end of July or so, we made that low from the first peak, we started going back up again.

My thinking there was also to get back again above 90 with the relative strength index to start going above 100k. But at the end of November and December, we got like, two months of downwards price action. That was actually against everyone’s expectations. Also, that was where plan B’s floor model, for example, started failing. That was against many expectations. The fact that we started dropping there was again another sign to be cautious. Now, we are in the 51, currently with the RSI, which was kind of showing that we’re in the bear market territory. So, unlike other cycles, we did not get above 90. Now, is it possible to still get above 90 in the next months? Sure it is. I actually even think it will happen but I think that the perspective kind of changes on how the cycle is defined. I wanted to say there is the theory of lengthening cycles within Bitcoin.

Basically, every cycle, the top starts getting later and later. For example, Ben Cohen is an advocate of this lengthening cycle. He’s been talking about that for years basically. That’s one theory. You could see the Bitcoin cycle as a lengthening cycle that we’re just now in a low and we’ll manage to get back up. But I would argue that we’re kind of in a bear market now and even though that bear market is a little shorter or not a typical one and a half year bear market. Although, we could argue that we’ve been in a bear since we had the top in April, because if you look at the RSI, for example, it has been kind of going down since April, and it hasn’t gotten back up even though we made a new high with the second top, and I will get into that in a little bit, we could still see this as a bear market if you look at some of the dynamics on-chain, and if you look at supply dynamics in particular. Maybe, we can quickly move to the second chart, the top comparison, which is the second chart in the thread, and then I’ll let Dylan and Jordan speak and give some comments on what I’ve said so far. Maybe I missed some things.

But just to still get over that chart, the top comparison, there you can see that the first stop is really caused by hype because you can see the supply of long-term holders. That’s very low and that is because long-term holders tend to sell off some of their supply when the price goes parabolic and they sell it to short-term holders. We got this first stop and that was purely based on hype. We could clearly see the hype then. It was Tesla, it was Michael Saylor who made many announcements and stuff. So, we had a lot of hype in that market and we made the 64k. Obviously, that’s not sustainable. A top based on hype, the parabolic move up is not sustainable, so we went back down. We started to make this low and at that point, started very similarly to the 2013 market, we also had a double top, right? So, my expectation was to kind of get this hype back for the second top, but the short-term holders stayed away so we never actually got short-term holders in the market during that second top. The supply of the long-term holders actually started rising. So, a lot of long-term holders were buying into the market again, but the short-term holders were never there. So, my expectation, even when we were at around 60k again for the second top was that, at some moment, the short term holder supply will start increasing and we will get short-term holders back in the cycle, so we can get to levels of 100k, but they never came. So, basically, that second top, even though we made a top new all-time high, that was only based on long-term holders in the market and that shows. I think it’s quite special because, in Bitcoin’s history, that has never happened. So, we just actually made an all-time high based on the conviction of long-term holders, this HODL army which is ever-growing basically. And that’s a very good sign in my opinion, for the next years to come, right? Because, this whole army keeps growing. There are several long-term holders that keep on buying no matter the price. There are some long-term holders that obviously still panic sell, especially when we start dropping below some critical levels like the short-term holder cost basis that I talked about. And also, the 40k in general that we dropped because it was a support level that made many long-term holders also panic a bit. With that said, I think I talked enough. I’ll let some of the other speakers hop in. So maybe, Dylan, if you have any comments on what I just said, please go ahead.

[14:06] Dylan LeClair: Root, man, you’re very well-spoken about explaining all these dynamics in a simple way. That’s really impressive. I think your analysis is head on on on-chain analysis, especially in reference to the price dynamics which has gotten a little bit of hate as of the last two months but on-chain can only quantify supply-side dynamics. And, going into November – it was kind of crazy because we were making all-time highs without really any of the typical distribution that you see, like long-term holders, smart money convicted Bitcoiners, accumulated through these drawdowns, and then, when price breaks all-time highs, you start to see some of that distribute. And actually, that long-term holder supply in relative terms and absolute terms was increasing through the whole move up from the summer, to new highs. But ultimately, there wasn’t that kind of demand-side, right?We had marginal macro buying from that new kind of investor cohort that came in 2020, 2021. But, we got to those new highs. Derivatives were a little bit overheated, not as much as April, but there just wasn’t that wall of money to continue to buy, and when that marginal kind of buying turned into marginal selling, you can look and say the GBTC discount going to thirty percent under net asset value and there’s 650,000 Bitcoin in that trust. So, just in terms of kind of the macro marginal sellers of the last couple months, even though the supply dynamics are looking really, really bullish. There wasn’t that kind of wall of demand to come in.

And so, that has me feeling really optimistic for the future because we kind of saw almost a bull market start with bear market dynamics that we’re currently witnessing, like this net accumulation happening. Ultimately, it’s just when that kind of tied-up capital comes in. The big ones are really going to surprise the upside.

[15:50] Root: Thanks for that, Dylan. Very good comments. And also, I’d just add on a little bit to that. So, we basically came out of this mid-cycle low because of shorts that got liquidated, right? So, we jumped from, I don’t know, was it 2019? Back then, we jumped several thousands up. So, that was also like a kickoff, basically, to get out of that, to start this long-term holder conviction. Everyone was thinking, “Oh, we’re going to get back in this bull cycle.” And so, I think that the derivative market is something we cannot underestimate and also, I think, it might be part of why, maybe, cycle dynamics are changing. So, Jordan, maybe you still have something to add to this. I’ll let you speak. [16:37] Jordan Lindsey: Yes. Really, really interesting analysis that you’re bringing up over here. Really important, some things that I want to adjust, just really confirm or affirm from my own point of view. And that is that really – what you just mentioned, it does appear that the structure of the market is changing. I think that’s very important. I now understand how difficult it is to kind of pick up in real-time especially when a lot of people had the four-year cycle ingrained in their psyche. No one was really looking for a top of the market in April. A lot of on-chain indicators are absolutely indicating that. Glad you also introduced the relative strength index in slide number five showing that the RSI also peaking above 90 in each cycle peak has also had that type of reading. And then, even though price made the higher high in November – this is the hard part for a lot of people to reconcile – how could Bitcoin be in a bear market and price make a higher high later on in that bear market? I think that is something that a lot of people are going to have to really just take an honest hard look at. I know that it’s counterintuitive. It does seem like it’s that cobbler army and that tightening up of the supply that did cause it almost real bad that to happen. But, you never saw that hype come into the market at that time to carry it further. It does seem that what has happened is because of the macro headwinds, that’s around the time it became very apparent in the middle of October, that the Fed was intent on actually initiating the taper and then if able to unwind that by the end of March, even move towards a rate-hiking cycle that could, for sure, have an effect of putting massive headwinds in the white over here.But, I think that really part of the introduction of this space was talking or relating this to the super cycle. One would think that people would be talking about a super cycle, Bitcoin was actually in the hype phase going parabolic, Bitcoin upwards of 150,000, 200,000 dollars, and people are like, “This is a super cycle, Bitcoin’s going to a million dollars. This time is different.” I think it’s really worthy to know that it’s actually not under those circumstances, but looking at the possible potential changing of the structure of the market at Bitcoin that is being related to being a super cycle. One of the definitions of a super cycle could be a bear market that only has like a 60% drawdown. Maybe, a bear market lasting instead of like 12 months traditionally in Bitcoin with an 85% drawdown lasting with less of a drawdown and then price, prior to the next have been going on to make a new all-time high. I think that that very much fits the definition of the super cycle. It seems to me that we are a little bit, right now, at the mercy of Fed policy. Risk is not in the market. If we get any type of inflows into Bitcoin, it seems that the dynamics could change very quickly and because of what we saw in between July and November, even when that demand was not really there because of that tight supply you saw the price rise quickly. That can happen again but we do need that catalyst to come into the market.

Now, in the long run, that want to be because stocks wound up like actually going range-bound, right? And maybe, people like a lot of those flows start moving into the Bitcoin Market. That could be one thing. Obviously, we’re looking at the continued adoption on the sovereign level. Those dominoes could continue to fall. If we start seeing a super state, whether it’s Russia or U.S, between the Bitcoin. Obviously, these things could hasten the pace, but I think, until we see the Fed pivot and whether or not that comes like before March, because the market kind of forces the Fed to say we’re not there yet or even close to that. I think that we have much further downside before any type of Fed put would come into question. But if the markets became disorderly, that could happen sooner. Otherwise, we might be looking at the Fed moving towards actually getting off to liftoff, moving towards raising rates, and then just kind of the countdown until the economy actually moves into recession, and then they need to unwind that lowering rates and coming in with the next injection of QE potentially into 2023 before we really start seeing the catalyst into the market that’s going to really take it to that next stage. Price-wise, I think that what we’re seeing over here, price consolidating, we’re referring to as a bear market, even making a higher high in that bear market is incredibly bullish long-term.

[ads] [23:56] Root: Thank you so much, Jordan. Lots of insights there. Also, I just wanted to add for this second run-up that we had, basically, the long-term holder one, because, really, short-term holders were out of the market then but still, we had that run-up. It was also a bit initiated by the future-based ETF that was accepted. So, that helped. It was a catalyst also to get us back up further and maybe, had a big influence on causing that new all-time high there. I don’t know if any of the other speakers, Alex, I see you’re up here as well. Do you still have any comments before I go on? [24:39] Alex: Go ahead. Continue on, Root. Thank you. [24:41] Root: Thank you. So, then I’ll head into the super cycle dynamic. If anyone knows how to get Dan on, would be great as well. I try to ping him but I think I don’t think he saw my message, so it would be cool. He actually came up with the definition of the super cycle. The super cycle basically just means that the current cycle pattern of the four-year cycle of Bitcoin that we deviate from that. So, it could be any deviation, basically. We could have a bull market that extends to 1 million, and then start dropping, or it could be like several small bull, bears, basically. But truly, a deviation from the original four-year cycle so for the ones that don’t know, but I think most of us that are listening know that Bitcoin had historically a four-year cycle caused by the halving. So, the halving of the newly initiated supply that’s coming in in Bitcoin that caused the supply shock and that initially, traditionally has been the catalyst basically for a bull market within Bitcoin. And obviously, we know that the supply of Bitcoin that gets halved is decreasing. So, the influence of the impact of a halving will also become less over time. So, it’s obvious that at some point, we will not get a four-year cycle and we will start deviating from it. I would argue now that we have kind of the first signs that we are really deviating from the four-year cycle and that is the super cycle dynamic that I put on there. That’s chart one of the thread that I put out.What can we see here? We can see that the profit that long-term holders have, you can see that in the beginning, the first short-term holder top is the 2017 top and the last top, the 2021 top that we made. I zoom in on the last six years or so of Bitcoin and you can see that at the beginning, once we start this parabolic move up, you can see those blue dots, that means that price makes a new all-time high during that first phase. You can see that many long-term holders are starting to take some profit. So, there’s a lot of new demand coming in in the Bitcoin cycle. Long-term holder sell-off. Their profit is short-term and therefore, you can see that the profit of long-term holders, not profit held by long-term holders, is declining. So, basically, that moves into the hands of the short-term holders and we get the short-term holder top, that obviously is not sustainable and we get a crash. In 2017, we also had an 85% drop or so, eventually, made a low from 20k all the way to 3k, or so. So, you can see that profit of long-term holders declines obviously quite far in down in that bottom of the bear market. And then, you can see in 2019, we had this run up again – the 2019 long-term holder run. There was some demand from short-term holders, but it was not near the level of the first peak that we had in 2017. Basically, in that run, we got to 14k almost and that was also not sustainable. I would argue that that run-up is very similar to the situation we are now in. So, we had the halving, the third halving, which you can see in the chart as well. We started this parabolic move up. Again, long-term holders started to sell some of their profits to short-term holders and we had this hype top, based on short-term holders – we started dropping. And then, we had this long-term holder run-up. Basically, in this run, there were almost no short-term holders and yet, we still made that new all-time high which is quite impressive.

Now obviously, that was also not sustainable because the run without the month will end, and we started coming down. We kind of find ourselves now in that orange circle that is in the chart. And so, I would argue that that orange circle is similar to the drop we had. Well, either with Corona or maybe the one drop earlier, we could still go a little lower. I’m not saying that exactly, but what I wanted to show in this dynamic is that even though we are only midway the halving, because you know that the next halving is in March of 2024. A typical halving takes four years. We’re not even two years within the halving, but we had already this same dynamic that we had during the whole halving of the 2017 cycle and that is truly impressive to me and that’s also an indication. For me, that’s an indication of a super cycle. Maybe this dynamic can keep on repeating from now on. We have less severe drops, less severe bear markets and that will continue to get these type of dynamics because I cannot imagine that we now have two years of bear market basically left. I need to wait for the catalyst of the next halving to make a new all-time high.

I would argue that there’s a lot of room, especially if you think that since April we have been in a bear market, that we’re already almost a year in the bear market, right? So, that would indicate that there’s a lot of room to make new all-time highs before the next halving. And if we do that, then we would truly have a different dynamic than previous cycles. And so, I would argue that is kind of what the super cycle would be about. So, I don’t know if any of you guys have any comments, but please feel free to hop in now.

[30:51] Jordan: I just want to build off a little of slide 3, the market hype. You were showing those red circles at the bottom when the short-term holders become really, really, let’s call it oversold, and you circle them at the bottom and you pointed to two areas that we could potentially be in. One of them might be somewhere before we had the March 2020 COVID crisis towards the later part of 2019. The other one potentially is more towards that end of that bear market in 2018. Just one interesting dynamic that’s taking place right now regarding the DXY, the US Dollar Index, and Bitcoin.Now, at the top of Bitcoin bull markets, we see deviations where we see usually the DXY trade down and Bitcoin trade-up breaking a correlation that they normally have. However, right now in real-time, we’re seeing a different type of break of correlation. We’re seeing the DXY trade up strongly and Bitcoin trade down. It’s not often that you see that type of break of the correlation with a DXY trades strong and Bitcoin trades weak. It happened to few other times. One of the times that it did happen was where you have that circle right around the end of the 2018 Bitcoin bull market. Before that capitulation occurred, you started seeing the DXY trade up strong and you started seeing Bitcoin trade-off. It happened also in the 2014 bear market. And the only other times that it has happened, has been briefly during the March 2020 crisis, specifically when the BitMEX liquidation loop happened until BitMEX went offline. It was the largest exchange at the time. That was very brief. The other time it happened was going all the way back to 2013 during what we called the mid-cycle dip between the two wave highs. And then also, again, just now, we saw that it occurred this summer. That points to potentially either that we are in the latter end of a bear market and why there’s still potential further downside risk in price. We’re getting towards the later and seeing the DXY move up against Bitcoin like that. Soon, we’re going to see that Bitcoin snap back towards that direction or potentially, like we just saw in the summer, in July, Bitcoin is potentially even bottoming around here or close to it.

Now, I don’t think that anyone should be looking to kind of time price and look for like to call whether or not we take out. And this is coming from someone who’s pretty strongly, technically, analysis-based. I think right now what we’re seeing in the markets is a lot more psychological. We’re seeing a lot of headwinds out there. Anything could happen. But at the same time, you guys want to affirm that it’s coming from many different areas, the changing structure that you’re seeing, even the dollar index being another one of them. Bill Miller, he was in the news recently and he was talking about or relating to Bitcoin actually being in the adoption of the life cycle of new technology, relating that to Amazon, relating that to electricity, relating that to any type of technology that has actually gone through this initial hype phase and then moved into reality phase, and then into that ultimate market opportunity phase which is like a sustained, upward-sloping behavior. When you’re talking about, perhaps, we’re seeing that changing structure, where the volatility is decreasing to the upside and on the downside, we’re breaking away from that four-year cycle behavior, defining as a super cycle breaking away from that behavior. That also fits very well with what a lot of other people who have looked at technology that’s actually been able to go ahead and reach that place where it moves into that ultimate market opportunity. And Bitcoin, it’s almost as if at the right time, we’re starting to all of a sudden see these dynamics appear. I know that it’s very hard to get in real-time. Most people were not looking for that peak in April but nevertheless, it’s just a question of how quickly you can pick you up and how quickly you could adapt and get in front of what is actually happening.

[35:11] Root: Thanks, Jordan, for your insights there. Now, surely there’s a lot going on with the whole macroeconomic environment which has a big impact on Bitcoin. Dylan, do you still have anything to add? [35:24] Dylan: Yes. I think, I mean, you guys are echoing a lot of my current thoughts as well. I think just with, you know if you think about Bitcoin as a macroeconomic asset, obviously, there’s that kind of core hollow base that doesn’t even know what the DXY is. And they don’t give a shit about the dollar’s relative strength to other fiat currencies, and they’re stacking with 100% of their disposable income regardless. The number of people around the world like that, at an institutional level with guys like, Michael Saylor and Bill Miller saying half my portfolio, he’s a billionaire, Bill Miller, that shouldn’t go under the surface. But at the same time, when Bitcoin is kind of this risk-off or like a risk-on asset for a lot of these new alligators. When the dollar’s bidding, the Feds expected a hike, even if it’s 50 basis points. There’s some funds or some alligators that will just sell their big one. And obviously, I think that will be a short-sighted decision later on but it’s more of an opportunity for everyone else. But yes, I think that’s plain playing effect in the market. [36:27] Root: Thank you. Thank you, Dylan. I think it’s funny actually. Bitcoin is supposed to be the solution for these kind of problems yet Bitcoin gets seen as a risk-only asset which is obviously because of the volatility that Bitcoin has. Do you have any ideas on, maybe like, are we close to a bottom? What is your opinion on that? [36:50] Dylan: I’m like seeing derivatives, little bears, and we haven’t seen anything too crazy. Hasn’t been in the summer and open interest while relatively high especially perps open interest, it wasn’t skyrocketing with funding going deeper as it was the summer. But in general, just seeing we kind of have some cool charts on the deep dive where you know it’s funding candles or it’s like the Bitcoin chart overlaid with funding. You can kind of see the bull and bear cycles almost in derivative markets as well, kind of pushed price a little bit higher in the upside during bulls and during bear markets. Everyone’s short sentiments in the gutter and people short the bottom with the reds. And so, it’s nice seeing the funding these past couple of days. We got some negative, basically like net shorting. Not net shorting because there’s forever short, there’s a long, but drips are driving the price lower. So, in terms of like, bullish leverage speculation, it’s not there. It’s not what it was compared to much of 2021, which is healthy, which is good to see. And so, hopefully, more of that environment will rise in price so we can get a nice short squeeze here, but we’ll have to see that play out. [37:56] Root: So it’s interesting that Bitcoin from fundamental analysis, it’s so strong. We have countries using Bitcoin as legal tender and there’s the rumor, I guess even for Max Keiser that, that there might be another country coming in 2022 to accept Bitcoin as legal tender. Something like that would be for sure, a catalyst to get back in a bull market, in my opinion. Obviously, we have to get back above several levels. We talked about the short-term holder cost basis for a little bit. We need to get back above these levels and we need some kind of catalyst. I would argue to get back new demand because that is lacking. That’s what is lacking now. And so, I have some opinions on the bottom as well.I actually think we are relatively close to a bottom. I think we could still drop a little further. If we look at the realized price which is the price that people buy their Bitcoins at. Unlike market cap, which is just the amount of Bitcoin that is in circulation times the price, you can also look at the realized price and we can do that because of on-chain. We can see every transaction so we know at what price people buy Bitcoin at. So, that gives us realized price. That has been a relatively okay bottom indicator. In the bottom of a bear, we would basically drop a little below the realized price. For example, with the Corona crash, we just dropped below it and we had a week below it and we got back above it right away. And so, that price is now a 24k. That would be, in my opinion, the worst-case scenario we could lie at. Who knows we could drop a little further, but to be honest, I think there’s quite some support at 30k and maybe, we’ll go for this 24K, but that would also need some kind of Black Swan event maybe to get there, or just time that we keep on being in fear. But, I could honestly not see how much longer this fear can keep up. We have been, if you look at the fear-greed index, we’ve been in fear for over two months now. So, at some point, we’re going to make a bottom and we’re going to go back up. Jordan, do you still have something to add here?

[40:25] Jordan: It’s kind of compliment what you’re talking about now. Well, it does appear that we are getting close to the bottom, especially if you view April as the top of the cycle and that we’ve been in a bear market since. We are relatively much closer to that bottom. I kind of caution everyone out there. I know that people, we’re all extraordinarily bullish on Bitcoin, but at the same time, right now, just cause for more of a tone of caution and why you always want to have that foundational plan in place of just dollar-cost averaging in regularly.Right now, I feel looking out for the entire community and feel like the stronger we are together, the stronger that we’re able to kind of lean in to accumulate and hold. Right now, might call specifically for just dollar-cost averaging right now into a cash position, keeping it on the sidelines. Keeping yourself just in a greater position of power. And then, regardless of whether or not we see that buying return to the market at that point, even if you’re buying in a little bit higher, it makes a lot more sense. I agree with your levels that you’re talking about, somewhere around $25,000 potentially being below. That’s outside of disorderly behavior in the markets. It seems like a much stronger place, and we’re talking potentially only a few months away, maybe less, maybe more. It’s very difficult to time those types of things. But at this particular time, I would really feel better if people were just a little bit more cautious building up those cash positions, and then just keeping themselves mentally, psychologically in a stronger position and then be there to be able to take advantage when those inflows begin, even if that means technically waiting for Bitcoin to break above maybe something like $44,000. Or, if we see that – because from where we are right now, there is more downside risk and if people are there at that point to just kind of dollar-cost average in a little bit stronger at lower levels – that puts everyone, that puts the entire community just in a stronger position, and I just wanted to see that.

So, in one sense, I don’t want to rain on the parade. I do think we’re getting very close to the bottom. But I think that right now, for sure, risk potentially is to the outside.

[43:07] Root: Okay. Thank you. Jordan. There’s still one chart that we didn’t discuss. So, I’ll quickly go into chart number 3 from the thread and that is the supply held by short-term holders market hype. I gave the name number 3 from the thread. There, you can see the supply held by short-term holders. You can basically see for every top that we make, this supply by short-term holders makes like a parabolic move up. You can see also in the 2019 long-term holder run that there was some demand coming in from short-term holders, but it still remained relatively low. And if you look in 2021, in April, we had this huge peak there but in the November top, short-term holders were in the lows. So, there was really almost no short-term holders in the market. But one interesting thing is that when short-term holder demand is this low, we tend to make also a global low or a macro low in the market, let’s say. So, those are the green circles in that chart. Basically, they are the bottom of the bears and I think we’re close to that. But, I have to mention there that also, I’m not a day-trader. My time preference is very low. If I say like, we’re close to a bottom, I mean we can still be some weeks out and we can drop several hundred dollars or several thousand dollars even. But I think still, the entry now between 30 and 40, if you think about that, if you look at this chart, for example, it can go to 24k but we can also not expect it to go to 24k for sure, right? So it’s difficult to time the exact bottom. So, my advice would still be to DCA and into Bitcoin, in this range, and I think you will be very happy in a few years. I should say not financial advice. Of course, everyone is responsible for their own decisions but that’s still the last chart that I wanted to mention. [ads] [47:04] Root: Is there still any comments from you guys, or should we move to some questions, maybe. [47:09] Dan: Yes, just one last thing. It’s the one-year [inaudible] and a lot of people are familiar with this on-chain metric. And what’s interesting about that is that normally peaks out. Again, when we see that ratio of coming off, you saw that behavior occur in April and pointing to us getting close to the bottom right now. You’ve been seeing out of a rounding bottom that ratio rise and climb. The only one thing I want to caution about is as it’s rising upwards, in the past, it doesn’t mean we’re going to see it now as Root just really, really just… everyone, it’s really hard to time these things where the price comes off. We’re getting close to the bottom time-wise, price-wise, but there is still just going off of that one major cologne, it points to us getting very close to the bottom. But, there could be a little bit bumps ahead so… [48:02] Root: Thank you very much, Dan. Dylan, if you don’t have anything to add, I’ll do some requests. I think we can have, maybe some people have some questions. We can let some of the people on with questions… [48:15] Dylan: Yes, go for it. [48:16] Root: Just check. So, I see here Random Alerts, I’ll let you on. Random Alerts, the stage is yours. If you have a question or anything to add. [48:28] Random Alerts: Hey, thanks, guys. I’m Richard. I go by Random Alerts on Twitter. Thank you for allowing me to speak. Just one thing I wanted to touch on is of all the new investors or new traders out there, I know there’s a lot of things that go out and people either buy narratives or buy views and there’s a lot of buy and hold. The only thing I would say is you should really just look at the price. The price will tell you everything that you need to know. All indicators. Don’t matter what people tell you, all technical indicators are determined by the price. And so, if you’re a long-term holder, you have to have a process. If you’re a trader, you have to have a process.I just tweeted out some charts. If you guys want to look at them, I can walk through them if you guys like. But the only thing I’ll say is there’s a lot of uncertainty in markets. There are these events that we’re going through right now where it’s a sell everything of it. It doesn’t matter if it’s gold, energy, or whatever. When somebody mentioned the dollar index, when I look at the weeklies for the S&P, Russell, NASDAQ, copper, gold, natural gas, oil, and the dollar. The dollar weekly candle is huge and the natural gas weekly candle is huge. So, that is just telling you that something is about to go down. We don’t know what it is. But something negative is brewing, and it’s going to affect everything. That’s my only comment. I just want to say thank you guys for allowing me to be here. And the other thing is always look at the technicals. Always look at the price action and it will tell you what you need to know. Thank you.

[50:02] Root: Thank you, Random Alerts. I think, technical indicators prices, for sure, gives a lot of insight but in Bitcoin, the cool thing is that we have also on-chain analysis so we can actually look at supply dynamics. And so, I think they’re very useful also, not to give an immediate like we cannot tell where the price is going over the next few days or so, but we can see a general trend, which is impossible with the stock market. Just wanted to add on to that. [50:38] Random: Can I give a last comment? [50:41] Root: Sure. [50:42] Random: Okay, so when it comes to like the on-chain analysis and things like that, they are great. They give you information but just like, correlation with a dollar and the S&P. There are times when the dollar goes up and the S&P goes down. And there are other times when the dollar’s going up and so is the stock market. Correlations are great, but sometimes they break down. With great knowledge, there’s a lot of indicators. There’s a lot of correlations, but there are times which, to me, I think we’re in event where this is going to be like a sell everything. It doesn’t matter. I think the reason that we get these volatile times where we can’t really make what’s going on is because our correlations, our indicators aren’t really working. The way I just look at it, I told family and friends is you got to think no matter what country you’re in, no matter what currencies your home country uses, at the end of the day, when things are correcting to the downside, you need to sell it so that you can pay your bills. Now, maybe when the day comes that Bitcoin is being used globally, that’s going to be different. I do see that at the beginning like El Salvador or all these other countries. I think Arizona is passing a bill today making Bitcoin legal tender. In the beginning, I think that’s a negative for Bitcoin, only because people are escaping like we say, in Turkey or Venezuela, things like that. They’re escaping shit currency already. And so, they’re getting into Bitcoin, but they’re not going to hold it. They’re going to be trading in and out of it to buy regular life essentials, and so that’s going to add volatility.But yes, the on-chain things like that, it’s great. Keep them in your radar. And when you see those correlations breakdown, just kind of put those to the side and just look at the price . And then, if you feel uncertain, if you think there’s a lot of questions out there, it is better for you just to kind of stay out or if you add to your position, don’t buy the dips, buy on the schedule. All right, I’m done. Thank you.

[52:37] Root: Thank you, Random Alerts. I don’t know if I agree with it 100% but there were definitely some good insights there. I think we got Luke on as a speaker. Luke, do you have anything to say? [52:50] Luke: Yo, I actually had a question for Random Alerts, just first before I popped off. Look, I agree. We probably are going to see something really big in the coming, 2-3 years. I didn’t know this little correction. Now, is that big event or not? But when you say sell everything, what exactly do you mean? Just to the new people tune in now, you’re talking about that. You’re also referring to Cold Storage Bitcoin? Or when you say sell everything, what does that mean, man? [53:18] Random: Oh, I mean, like in all markets. There’s a lot of people who say, “Hey you need to be buying gold right now or you need to be selling the dollar because interest rates’ going up,” and some people say, “Well, if interests are going up, that’s good for the dollar.” There’s a lot of theories and ideas that people are going to try to push you towards. And like I said, if you pull up, and I know this is a conversation for Bitcoin, but Bitcoin, when the big players are coming in, especially the futures, the big institutional players, they’re going to make this just like every other asset that they trade. It’s unfortunate. I think Mark Yusko talked about that – that we do not want futures. We do not want the hedge funds in the space because they’re going to make it their playing field again.So, when I say sell everything, copper is going down, gold is selling off, the S&P 500 selling off, the Russell is selling off, the NASDAQ selling off, everything is being sold. And so, when people tell you, “Oh, well, Kathy Woods, this is a great time for disruptors’ growth.” No, it’s not. There was a narrative going out there at beginning of the year that people are rotating from growth to value. Yes, that happened basically the first week of January into the second week and then they sold everything. Growth, value, momentum, quality. It didn’t matter to people what the narrative was. Everything was being sold. And so, right now we’re in a situation where people are selling to raise cash, and once we see this bottom settle, then we’re going to start seeing the rotations into these things. Kind of reminded me of it. We talked about levels a little bit. There’s some charts up. Somebody commented a bunch of nonsense charts. So, there’s a lot of people that tell you, “Hey, I don’t know where this is going, this is probabilities.” Let me tell you where I see it going just based on the price. So, if you’re a long-term holder, trader, etc. Right now on the weekly chart, you’re at the 100-day weekly average. So, I agree with the views here that we are probably at a bottom. I wouldn’t call it a bottom or top. I would call it at support. You are at a major support at the 100-weekly moving average. And if you let go of this, some of the guys talk about too, the next level support on the weekly chart is the 200. And that’s at 24,000,842.

So, there’s a big range there. And then the last thing I’ll say, is when you look at the daily, which to me is more important, how the daily closes. Right now, you’re way below the 500 MA. Now, before I even got into trading crypto, looking at crypto. I never look past the 200. Since I started trading crypto a few years, I mean, there are some charts that I had to go down to 3,000. Bitcoin did touch, I believe the 700 MA sometime in the last week, but we are getting or we should be getting an oversold territory. But right now, on the daily, if you do not recover 48,000 and hold, we’re going to continue to go down. So, I know people don’t like to give you…

[56:30] Guest 1: If I can just hop in there for a little bit, Alerts? Some of those levels that you mentioned, they align a little bit, so 24K was what we just mentioned as well as the realized price. So, the difference a little bit as well, I mean, in Bitcoin, we have this HODL army. They are not selling, no matter the price really, you know. So, historically you can therefore see a bit of like these support levels that are very strong. So, realized prices, one of them which is currently at 24K. So, again, but I would argue that if you answer the market with current price and somewhere, you DCA over the next months, basically, and you get an average price, I don’t know, it can even be between 20 and 40. If we all think that Bitcoin at some point will go over 100K within the next two years, let’s say, then that’s a very good entry point, I would argue. Not for a day trader, but for the average person, that is more than they could wish for, basically. [57:36] Random: Yes. And the only thing about that is, for me, I post all this stuff online because it’s what I do for my friends. I manage my parents’ account. I made some friends, helping them with their 401k, so I’m not trying to sell you anything. I just look at the price. And so, to the HODLers, the only thing I would say is, it’s great. It’s great to buy and hold. There are some charts that I post out. It tells you if you’re a bottler, look at this chart this way and whenever you see a bear market, whenever you see these indicators trigger, you buy on the schedule, don’t buy the dips. And so, I’m not here to tell people, “Hey, sell your Bitcoin, or sell everything.” What I am saying is there is a different way to look at the market. As far as the HODLer army thinks like that, the only thing that comes to my mind as a warning is look at what happened to AMC. There were plenty of people posting about AMC. I’m not selling diamond hands and they got crushed. And so, for the people that are here that are not in the, I’ve been in some of these Spaces, some people save the fucking money… [58:36] Root: But I would argue that AMC was typically like a hype, it was like- [58:40] Random: Yes. [58:41] Root: Compared to a shit coin. I mean it’s nothing near. It’s not identical to Bitcoin in that sense. [58:47] Random: No. In fact, Bitcoin, just look at it and I’m not comparing it to, but Bitcoin to me, look at this Apple, Microsoft things like that. Whenever this all settles out, Bitcoin is going to survive. I have no doubt about that. Ethereum as well, but some of these shit coins, you’re right, they’re not going to exist anymore. So, if you buy and hold Bitcoin in the long run, you will be right. But the second part of this is that there area lot of traders today that are not trading with excess. They’re not trading out of abundance. They are trading with the rent money, their food money. There are plenty of people that I’ve seen online that cry, complained at Elon for Dogecoins. And so, just for these people, the people that are unfortunately risking money that they need today. You need to be looking at other things. Look at the price versus listening to the narrative because I agree with you. Let’s say within five years if Bitcoin goes to a million, everybody who held, you did an amazing thing. But how many can how many people can hold that way? That’s the problem. [59:51] Root: Yes. I think the more you understand about Bitcoin, the more likely you will have a stack for the long term and you will not sell. My long-term stack, I will probably never sell. I will pass it on to the next generation. But I see some people listening in. I see Will Clemente. If you want to come on. Please feel free to join. TXMC, I see you listening in, feel free to come on. If it’s not, we’re going to still do one more question or so and we’re going to round up the stock. We’ve been talking for an hour. Good discussion so far. So, I still see Brown Van. Maybe I’ll let you on. If you still have a question. [1:00:34] Guest 2: To the point the more that you understand Bitcoin the stronger your conviction. It relates to a position and then the discussion about the potential changing structure of the market that we’re witnessing in real-time would be great if we had any more insight to that, from anyone as well. That’s something that I think is very important here. Obviously, no one could or is looking to time the exact bottom, as Root was very clear. Looks like a fantastic time. There’s between that $20-40,000 range to be dollar-cost-averaging in and everyone seems to be really, really happy with that. But something that is really the topic here, the changing structure of the market, something really important to be hitting on right now. [1:01:24] Root: Brown Van, if you want to ask a question and now’s the time. [1:01:28] Brown Van: I don’t really want to ask any question, just to show you from Nigeria. I just want to appreciate you guys. You guys are doing amazing work. I also follow Bitcoin just for updates and just for me to know when exactly, when to buy, when to sell. You guys have been doing amazing. Thank you. All of you guys. Thank you very much. I don’t know the names to call, names are so plenty. I appreciate what you guys are doing. Thank you so much. That’s all. [1:01:57] Root: Thank you. Brown Van from Nigeria. We’ve been going on for an hour. I think it’s kind of time to round things up. I see TMXC, Traits, Sonya as well. I’ll just let him have a word still. You’ve been listening in for some time I think, please go ahead. [1:02:14] TXMC: Hey everyone. Hope you’re having a good day. Good presentation. I like your charts, Root. I like your visual style and your charts, I always find them pretty cool.I think that the sentiment that I’ve heard on the stage here today is one that I share which is generally, I think it’s obvious that we’re in a phase of caution for the market generally, it’s obvious, right? The amount of fear that’s out there. The kind of interesting thing to me about the second half of last year. I was excited as everyone else when we saw the rally out of the July lows that kind of catalyzed by the short squeeze. And then all of a sudden, we’re entering September and we’re in a strong rally off the bottom, and I was really encouraged by all that. Even after we saw the volatility on the day that El Salvador made Bitcoin legal tender in early September. We had that flush that day. Even after that, the Ever Grande Fud, I still felt confident and we got more of a rally.

But you know, what we can see, what the activity that occurs on-chain when you have a proper, like you fork interest in an asset in a bull run. The kind of thing that we had at the beginning of 2021 would just never show up. I think that myself, and I don’t speak for others, but I think a lot of us were maybe looking to see if retail or just some modicum of the volume of activity on-chain would return as we got back to the all-time high and sustain the rally and carry us into some crazy parabola that makes it look like 2013 all over again. I was hoping for that. I really wanted that. But, we never really saw that happen. And when you look at the active entities or just active individuals on the chain each day compared to where it was the beginning of the year to like October, November. It’s night and day. It’s nowhere near the same. It’s almost bear market conditions that we created a second all-time high in, which is really kind of remarkable to me. And as you mentioned, Root, in one of your charts that I saw, I might have missed part of the presentation, but I was looking at your thread, and it says, the second half of the year, that rally was based on conviction and I agree with you. Part of what puts it in a top is oversupply and that comes from spending and an incentive to spend, either from high profit or from fear. We didn’t have really much of that. Spending was very controlled. And most of what carried the rally was lack of spending and derivatives at this point. I think it’s pretty clear derivatives are huge part of this market.

When we’re seeing long-term holders actually growing their supply in these recent weeks, as price has been drawing down over 50%, that’s really encouraging because I think it’s important to note, usually the top is put in by people who’ve held their coins for a long time. It’s typically what happens. There’s actually a lot of distribution earlier in the year, which helped to create a climate where the rally just stalled out. We just didn’t have the blow-off top style of price chart. But, we haven’t had very much spending at all and long-term holders are just adding to their supply. There’s a lot of clear accumulation occurring on-chain. And so, my estimation is what’s really been driving a lot of this as some people have said, the macroclimate is really taking everything down with it, mostly risk-based assets, risk and growth-focused assets, and Bitcoin is the prime of all of those. So, it’s taking it on the nose. And, most of the supply that’s moving is short-term holder supply. Its newest coins that’s kind of churning around.

And so, I think that the sell-off is just kind of some macro D risking and just derivatives, people selling futures, may be buying spot a little bit, collecting that premium because we haven’t had negative funding for very much. It’s sell-off. I don’t know, man. It does feel like we’re close to a bottom. We bled a lot harder than I expected without a relief rally of any kind. I posted about something like that this morning. It just kind of surprised me how it just went straight down basically and it seems like we’re near the floor, people mention a realized price that’s on my mind, that’s around 24k, the low of the last year’s prices is like 29 and a half. That’s a good spot which is right at 30K. I think if we break 30, there’s almost a certainty that we will flash down and threaten the realized price because Bitcoin just likes to do those kinds of things. Even below the realized price, long-term holder cost base is like 17.5, 17.8. So, there are levels down below us that we could get to and the 200 week is in too. So, there’s a lot of things underneath. I do think we test 30k, I do think we flash below it before a new all-time high is created. That’s just my current base case. I’d love to be wrong. But I think that we’re down for some ranging for the next month or two at least because the rest of the world’s shit show guys. And no matter how great Bitcoin is, man, there are all the amazing bullish things going on. New countries taking it legal tender, just got a new all-time high on a hash rate, all these institutions talking about their customers are asking for it. They’re wanting to allocate to it. Great things are happening, but the world is a mess. And Bitcoin is the premier filet mignon of risk assets for the rest of the world that doesn’t understand its risk-off by nature. So, we just have to kind of ride the storm, DCA if you feel that this is a value area, which I absolutely do. Buying all the way down. If it applies, just kind of observe and wait for the market to show a trend because Bitcoin is a big trending beast. And right now the trend is ugly. So, just be patient and HODL. You can’t get liquidated out of Cold Storage. That’s all I had to say.

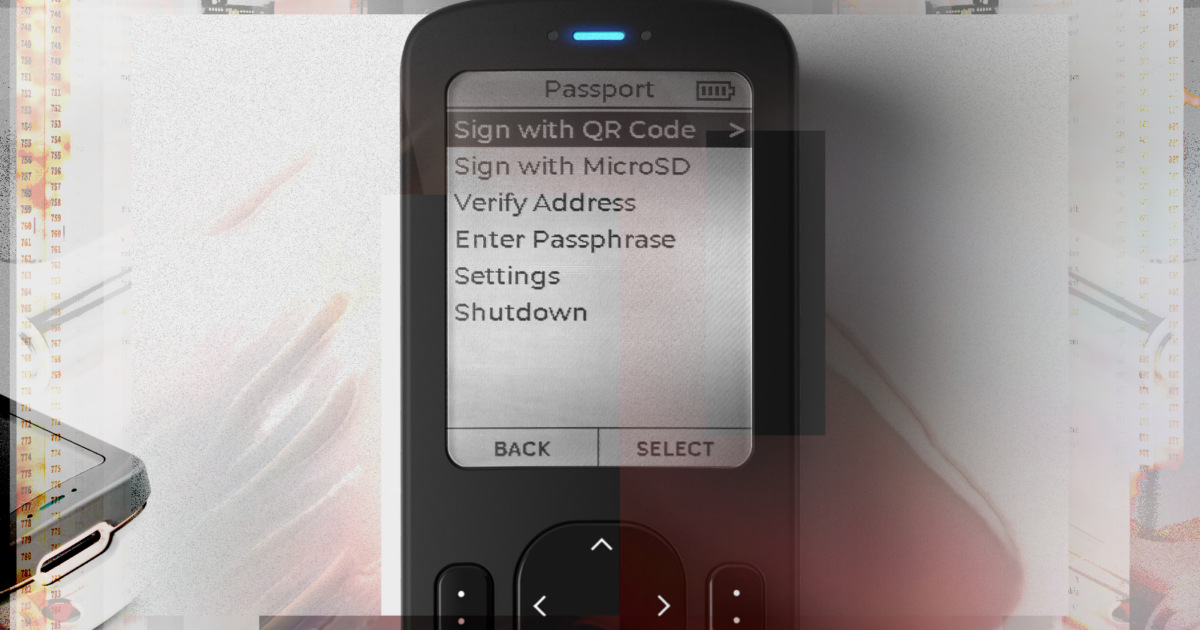

[1:07:55] Root: Thank you so much, TXMC. That was a fantastic summary of what’s going on in my opinion and just to end a little bit on a positive note. So, the fundamentals of Bitcoin, they haven’t changed, they’re actually stronger than ever, right? It’s just the understanding of people in the world is still narrow and the macro environment is also very hostile at the moment, as TXMC was just saying. In a way, in that sense, for me, it’s kind of similar to again, the rally of 2019 that we had, that we’ve been discussing for a bit. You know, because they’re also, when we started going down, it was relatively volatile there as well. And we had to grow in a crash that took us like below the realized price, right? So, that is some similar event that could definitely happen now as well and take us to that realized price. It will probably not be groaning crash again, but, for sure, other things, maybe the start of the war and Ukraine. It could be anything basically, just the general fear and all markets that will drag Bitcoin down to the realized price and I think certainly a retest of the 30s is possible. I would think it’s even highly likely as well that we still retested one more time before we truly move on. But that said, I still think DCing in this area for people that are in it for the long term. If we think about the next two years, that’s a long time. I think a lot of the mess that’s going on in the world will resolve itself within these two years. Maybe, not this year but next year. If not this year, next year probably. I think it’s quite likely that we will see still a new all-time high before the next halving which would definitely be an indication for a change in the structure of cycles and potentially the super cycle pattern that we just observe now in this talk. So, with that said, I think we’re going to round things up. I don’t know if you still have a final thought. Jordan, I’ll let you speak and then TXMC. [1:10:14] Jordan: I just enjoyed everything you had to present today, Root. Thanks for bringing everyone together. Thanks for all you’ve shared. TXMC exactly summed up so well. Thanks everyone for being here. [1:10:26] CK: I just wanted to echo what TXMC said which is you know, make your Bitcoin hard to get so that way you can’t capitulate easily. Multisig is great for that. Do a lot of research before you do that as well, but generally speaking, it should take a lot of work for you to unlock those Bitcoins if you make a decision to sell. I think it should require a lot of planning.I want to encourage everyone here, to go to Bitcoin 2022, b.tc/conference. It is the ultimate Bitcoin gathering, 30,000 Bitcoiners coming together, showing the world how real this technology is. I’m not saying there’s going to be a pump because it’s a conference, but it’s going to be really fucking bullish. So, you’re going to have to be there. You can use the promo code, ‘Satoshi’, to save 10% off. Pay with Bitcoin to save even more. Get your tickets now. Ticket prices would go up in mid-February. So, get your tickets now, don’t wait, get those savings.

Thank you so much, Root. We’re very, very honored and proud to sponsor your work. I really appreciate you letting us be associated with you and hosting the space with us. Excited to do more in the future.

[1:11:45] Root: Thank you so much. Thank you Bitcoin Magazine for hosting this. Thank you, Jordan, Dylan, TXMC for coming up and all the speakers that allowed for this great discussion within Bitcoin. [END]